UltraTech Announces Foray into Cables: Cable Stocks take Substantial Hit

Stocks of major Indian cable manufacturers suffered massive fall on the stock market on 27th February 2025. These included industry majors such as Polycab India, KEI Industries, Havells India, RR Kabel, and Finolex Cables. The former three out of this list lost over Rs. 30,000 crore of market cap collectively in merely one day.

Drop Follows UltraTech Cement’s Entry in the Cables & Wires Segment

Several media reports have cited UltraTech Cement’s unexpected entry into the cables & wire industry as the reason for this drop. This unprecedented move by the Indian cement major reportedly triggered a massive sell-off amongst shareholders of major cable companies, thereby causing their stocks to slide.

KEI’s Stock Takes the Worse Hit, Polycab Loses the Most Market Cap in a Single Day

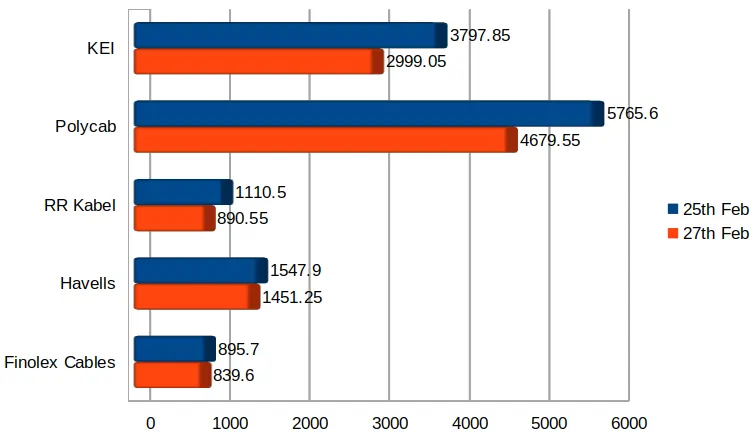

Share Price in Rs.

On 27th February, KEI Industries’ stock suffered the most, with its share price tumbling by 21.03%. Further, about Rs. 7,632.70 crore of the company’s total market capitalisation was lost on 27th February.

Polycab India, the country’s biggest cable and wire player in terms of revenue, lost Rs. 16,334.50 crore of its market cap on 27th February 2025. The company’s stock was down by 18.84% on 27th February.

RR Kabel, another wire & cable industry major with sizeable B2C operations, had its stock slip by 19.81% on 27th February 2025. The company lost Rs. 2,487 crore of its market cap on the same day.

Havells India and Finolex Cables’ stocks were down by over 6% each, which is milder as compared to the aforementioned companies. However in terms of market cap, Havells lost Rs. 6,059.30 crore, whereas Finolex Cables lost Rs. 858 crore on 27th February 2025.

UltraTech’s Entry into Cables and Wire Industry: Details & Significance

Company to Invest Rs. 1,800 Cr. in Gujarat

UltraTech Cement, part of the Aditya Birla Group and one of India’s largest cement players, announced on 26th February 2025 that it will be investing around Rs. 1,800 crore to enter the wire and cable industry. This investment will be directed to build a greenfield plant in Jhagadia, Gujarat, which will manufacture 30 to 40 lakh Km of wires and cables. In case of cables, UltraTech plans to manufacture LT, control, instrumentation, flexible cables and rubber cables at its upcoming plant.

UltraTech Cement expects this plant to be live by December 2026.

Direct Access to Hindalco & Birla Copper Expected to give UltraTech an Edge

UltraTech Cement, Hindalco and Birla Copper are all parts of the Aditya Birla Group. Owing to this fact, UltraTech Cement will have direct access to Copper and Aluminium through these companies.

It is well-known that Copper and Aluminium are the main raw materials for the cable and wire industry, and up to 70% of the cable/wire cost is due to the cost of the conductor. Therefore, UltraTech Cement is expected to benefit from supply and cost advantage for Aluminium and Copper. This would enable UltraTech to provide its wire and cable products at competitive prices in the market.

UltraTech Likely to Focus on Wires & Power Cables Initially

Media portals have reported the possibility of UltraTech Cement focusing on wires and power cables. As per Mumbai-based Nuvama Institutional Equities, “Cables need approvals from several customers across different user industries such as railways, oil & gas, solar, along with agencies that may take 6-24 months, depending on SKUs, post-commissioning of the plant”. Mostly, these time-taking approvals are required for instrumentation and control cables, which usually are sold to institutional buyers. However, wires and cables with simpler construction do not need such approvals. For this reason, it is likely that UltraTech Cement will be focusing on wire products and LT cable products since they do not require rigorous approvals.