Polycab’s Q1 FY26 Financials: Revenue Jumps 26%, PAT up 49% YoY

Polycab India Ltd. (PIL) [NSE: POLYCAB, BOM: 542652], a leading Indian manufacturer of cables and wires, has announced its financial results for Q1 of FY26.

Polycab India’s Standalone Financials for Q1 FY-26

During Q1 of FY-26, Polycab India reported a standalone revenue of Rs. 5,704.38 crore and a Profit After Tax (PAT) of Rs. 567.83 crore.

Polycab India’s Consolidated Financial Numbers

YoY Comparison of Polycab India’s Financials: Q1 FY26 vs Q1 FY25

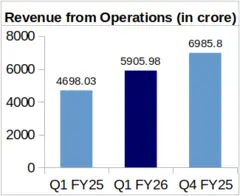

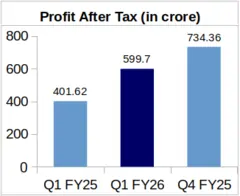

On Year-over-Year (YoY) basis, Polycab India’s Q1 FY26 revenue jumped by 25.71% to Rs. 5,905.98 crore from Rs. 4,698.03 crore revenue reported for Q1 of FY25. The company’s PAT increased to Rs. 599.70 crore in Q1 of FY-26 from Polycab’s Rs. 401.62 crore PAT for Q1 of FY-25. This reflects a significant YoY increase of 49.32% in the company’s net profit.

Earnings Per Share (EPS) of the company were Rs. 39.36 during Q1 of FY-26 against Rs. 26.35 during Q1 of FY-25.

Commenting on the company’s Q1 FY26 financials, Mr. Inder T. Jaisinghani, Chairman and Managing Director, Polycab India Limited, said, “We have started FY 2026 on a strong footing, delivering our highest-ever first-quarter revenue and profitability”.

QoQ Comparison of Polycab India’s Financial Performance: Q1 FY-26 vs. Q4 FY-25

On Quarter-over-Quarter (QoQ) basis, Polycab India’s revenue dropped by 15.46% from Rs. 6,985.80 crore, which was logged for Q4 of FY-25. Following suit, the company’s PAT also fell by 18.34% from Rs. 734.36 crore reported by the company during Q4 of FY-25.

Segment-wise Revenue Comparison of Polycab India

Rs. in Cr.

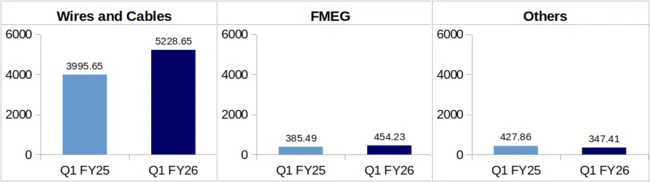

Wires and Cables: This segment of the company brought in a revenue of Rs. 5,228.65 crore during Q1 of FY26 against Rs. 3,995.65 crore during Q1 of FY25. This increase in revenue showed a growth of 30.86% YoY.

The company mentioned in its investor presentation for Q1 FY26 financials that this segment’s growth during Q1 FY26, which was driven by “…government expenditure, better project execution and rising commodity prices”. The company’s domestic Q1 wires and cables business grew by 32% YoY, whereas Polycab’s international Q1 wires and cables business exhibited a YoY growth of 24%. Wires and cables exports brought in 5.2% of the company’s Q1 FY26 revenue in this segment.

FMEG: The company’s revenue from FMEG segment increased by 17.83% to Rs. 454.23 crore during Q1 of FY26 from Rs. 385.49 crore in Q1 of FY25.

Solar products sub-segment performed the best in Polycab’s FMEG portfolio, and exhibited 2x YoY growth in Q1 of FY26. Polycab’s fans sub-segment was impacted adversely as the summer season was comparatively short this year. However, other sub-segments in the company’s FMEG vertical such as switchgear, lights, switches, conduits, and pipes & fittings exhibited growth on account of demand from the real estate sector.

EPC: The company’s revenue from this segment stood at Rs. 347.41 crore in Q1 of FY26, representing a YoY decrease of 18.80% from company’s Q1 FY25 revenue of Rs. 427.86 crore.

About Polycab India Limited: Polycab India Limited was established in 1996. The company’s wire and cable portfolio includes power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, communication cables, and others, including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables and green wires.