Havells’ Q1 FY26 Financials: Revenue Down 6%, PAT Slumps 14% YoY

Havells India Limited [NSE: HAVELLS, BOM: 517354], a major Indian cable, wire and FMEG manufacturer, has announced its financial results for Q1 of FY26.

Havells’ Q1 FY26 Standalone Financial Numbers

Havells India reported a standalone revenue of Rs. 5,437.81 crore and Profit After Tax (PAT) of Rs. 352.34 crore during Q1 of FY26.

Havells India’s Q1 FY26 Consolidated Financial Figures

YoY Comparison of Havells India’s Numbers: Q1 FY26 vs. Q1 FY25

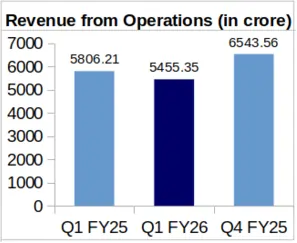

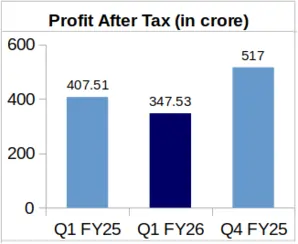

The company’s consolidated revenue during Q1 FY26 was down by 6.04% to Rs. 5,455.35 crore from its Rs. 5,806.21 crore revenue reported for Q1 FY25. Havells India’s PAT also fell to Rs. 347.53 crore during Q1 FY26 from Rs. 407.51 crore in Q1 FY25. This represents a significant Year-over-Year (YoY) decrease of 14.72% in the company’s PAT.

Havells India’s Earnings Per Share (EPS) stood at Rs. 5.55 during Q1 FY26 against Rs. 6.49 during Q1 FY25.

QoQ Analysis of Havells’ Financial Figures: Q1 FY26 vs. Q4 FY25

On Quarter-over-Quarter basis (QoQ), the company’s revenue was down by 16.63% from Rs. 6,543.56 crore earned for Q4 FY25. Havells India’s PAT also followed a downward QoQ trend, plummeting by 32.78% from Rs. 517 crore clocked during Q4 FY25.

Havells’ Segment-Wise Revenue Comparison: Q1 FY26 vs. Q1 FY25

Rs. in Cr.

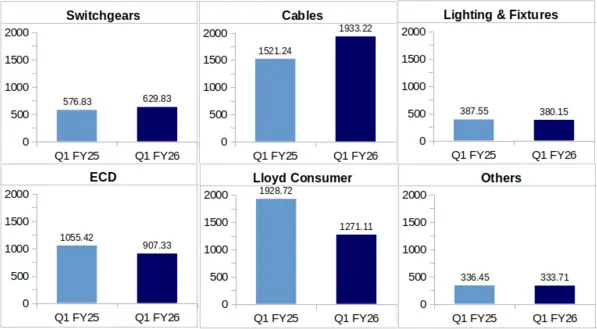

Switchgear: During Q1 of FY26, the company reported Rs. 629.83 crore as revenue from its switchgear segment against Rs. 576.83 crore earned during Q1 of FY25. This shows a jump by 9.19% YoY.

Cables: This segment of Havells India brought in a revenue of Rs. 1,933.22 crore during Q1 FY26, which is YoY 27.08% higher than the company’s Q1 FY25 cable revenue of Rs. 1,521.24 crore.

In its investor presentation for Q1 FY26, the company stated that Havells India recorded volume growth in its cables and wires segment, which was driven by capacity expansion and strong demand from various industries and the infrastructure sector.

Currently, the company is in process of expanding its cable manufacturing at its Tumakuru and Alwar plants, which will be completed in September 2026. While the company’s total investment at its Alwar facility will be Rs. 715 crore, Havells will infuse Rs. 450 crore at Tumakuru for increasing cable production.

Lighting & Fixtures: Havells India reported a revenue of Rs. 380.15 crore from its lighting & fixtures segment in Q1 FY26 and Rs. 387.55 crore during Q1 FY25. This reflects a slight decrease by 1.91%.

Electrical Consumer Durables (ECD): Havells India reported a revenue of Rs. 907.33 crore from its ECD business in first quarter of FY26. This reflects a YoY decrease of 14.03% from Rs. 1,055.42 crore, earned by the company from its ECD vertical during Q1 of FY25.

According to the company, unseasonal rains and a shorter summer season negatively impacted demand for fans and air coolers in this segment.

Lloyd Consumer: Havells India’s Lloyd segment quarterly revenue decreased by 34.10% YoY to Rs. 1,271.11 crore during Q1 of FY26 from Rs. 1,928.72 crore in Q1 of FY25.

Others: This segment comprises some of Havells India’s other products, such as motors, water pumps, and purifiers.

During the Q1 of FY26, Havells generated Rs. 333.71 crore revenue from this segment, which was almost the same as Q1 of FY25. The company’s Q1 topline from this vertical slipped by 0.81% YoY from Rs. 336.45 crore reported in FY25.

Havells India Gains 3% Up After Announcing Q1 FY26 Financials

Havells India’s share price jumped by 3.07% after the announcement of its Q1 FY26 financial results. The company’s share price stood at Rs. 1,531.60 apiece on the day of announcement of its financial results, which increased to Rs. 1,578.60 apiece on the next trading day.

About Havells India Limited: Havells India Limited is a Noida-based company, which is one of the biggest players in the Indian FMEG market. Its product range includes Industrial and domestic Circuit Protection Switchgear, Modular Switches, Cables and wires, Fans, Power Capacitors, and Luminaires for Domestic, Commercial, and industrial applications, Water Heaters, Motors, and Domestic Appliances. During FY-25, the company reported a revenue of Rs. 21,778.06 crore.