Havells India’s Q2 Revenue Growth at 5%, PAT Zooms 19% YoY

Havells India Ltd. [BSE: 517354, NSE: HAVELLS], a prominent Indian cables and Fast Moving electrical Goods (FMEG) manufacturer, has made its Q2 FY26 financial results public.

Havells India’s Q2 FY26 Standalone Financials

Havells’ standalone revenue for Q2 of FY26 was reported as Rs. 4,766.63 crore. The corresponding Profit After Tax (PAT) for the quarter was Rs. 317.48 crore.

Havells’ Consolidated Financial Performance During Q2 FY26

YoY Comparison of Havells’ Financials: Q2 FY26 vs. Q2 FY25

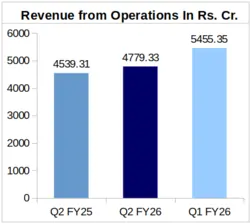

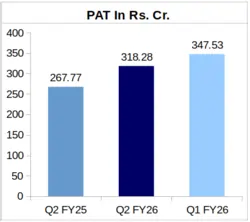

Considering Year-over-Year (YoY) financial performance, Havells’ Q2 revenue from operations grew by 5.29% to Rs. 4,779.33 crore in FY26, from Rs. 4,539.31 crore in FY25. The company’s PAT echoed this upward trend, soaring by 18.86% to Rs. 318.28 crore during Q2 of FY26 from Rs. 267.77 crore logged for Q2 of FY25.

Moreover, Havells India’s Earnings Per Share (EPS) were Rs. 5.09 during Q2 of FY26 against Rs. 4.28 in Q2 of FY25.

QoQ Comparison of Havells India’s Financial Results: Q2 FY26 vs. Q1 FY26

Compared to Q1 FY26, Havells’ Q2 FY26 revenue was down by 12.39%. In the opening quarter of FY26, the company had logged a revenue of Rs. 5,455.35 crore. The company’s Q2 FY26 PAT also took a Quarter-over-Quarter (QoQ) hit, slipping by 8.42% from Rs. 347.53 crore.

Havells’ Segment-Wise Quarterly Financial Performance for Q2 FY26

Rs. in Crore

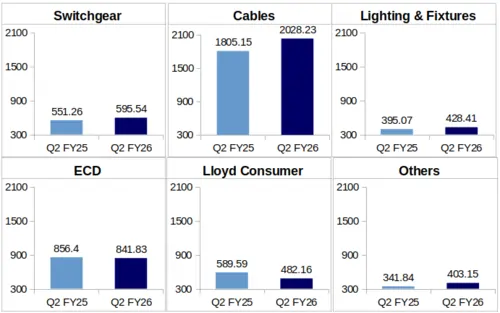

Switchgear: Havells’ Switchgear business vertical exhibited an 8.03% YoY growth, with quarterly revenue from this segment reported as Rs. 595.54 crore for Q2 FY26 against Rs. 551.26 crore in Q2 FY25.

Cables: Havells is largely a cable manufacturer, and in Q2 FY26 this segment accounted for 42.22% of the company’s gross revenue.

With Q2 revenue from this vertical reported as Rs. 2,028.23 crore during FY26, Havells’ cable segment has grown by 12.36% YoY, from a segmental topline of Rs. 1,805.15 crore in Q2 of FY25.

Commenting on the company’s cables segment, Mr. Anil Rai Gupta, Havells’ Chairman and Managing Director, said, “Cables maintained its steady growth momentum, driven mainly by strong growth in power cables during the quarter”. He also mentioned that Havells’ plans to expand cable production are progressing as planned. Notably, Havells’ is making Rs. 715 crore investment to expand production at its Alwar cables plant, and in September 2025, the company acquired additional land adjacent to its factory for expansion purposes.

Lighting & Fixtures: In Q2 of FY26, this business segment brought in Rs. 428.41 crore to Havells’ gross revenue, which is 8.44% higher YoY as compared to this vertical’s Rs. 395.07 crore revenue for Q2 FY25.

The company attributed revenue growth in this segment to LED pricing stabilization.

Electrical Consumer Durables: Havells’ ECD segment clocked a quarterly revenue of Rs. 841.83 crore in Q2 of FY26, which represents a slight drop of 1.70% YoY. In FY25, Havells earned a Q2 revenue of Rs. 856.40 crore from its ECD business. The company mentioned in its Q2 FY26 investor presentation that a comparatively milder summer impacted its fans and air cooler sub-segments.

Lloyd Consumer: Lloyd was acquired by Havells in May 2017. Post acquisition, it has been a sub-brand of Havells India.

Havells clocked Rs. 482.16 crore from its Lloyd vertical in Q2 of FY26, which is 18.22% lower YoY. In Q2 of FY25, Lloyd Consumer brought in Rs. 589.59 crore as segmental revenue.

During the company’s Q2 FY26 earnings call, Mr. Gupta said that Lloyd segment margins were impacted due to higher working capital levels, and the enforcement of the new GST norms. “…recent GST reduction by the government has been a welcome step towards uplifting consumer sentiment and strengthening the demand. Amongst the Havells category, air conditioners, TV and solar has seen GST rate reduction”, commented Mr. Gupta. It must be noted that Havells’ Lloyd vertical engages in ACs, LED televisions, refrigerators, and washing machines.

Others: This business segment comprises products such as industrial motors, water pumps, and purifiers. Q2 Revenue from this segment grew by 17.94% to Rs. 403.15 crore in FY26 from Rs. 341.84 crore in FY25.

About Havells India Limited: Havells India Limited is a Noida-based company which is one of the biggest players in the Indian FMEG market. Its product range includes Industrial and domestic Circuit Protection Switchgear, Modular Switches, Cables and wires, Fans, Power Capacitors, and Luminaires for Domestic, Commercial, and industrial applications, Water Heaters, Motors, and Domestic Appliances. During FY-25, the company reported a revenue of Rs. 21,778.06 crore.