KEI Industries FY26 Results: Revenue Up 19%, PAT Jumps 42%

KEI Industries Limited [NSE: KEI, BOM: 517569], a major player in the Indian wire and cable industry, has announced its financial results of third quarter of FY26.

KEI Industries’ Standalone Q3 FY26 Performance

KEI Industries delivered a strong standalone performance in Q3 FY26, with revenue from operations reaching Rs. 2,954.70 crore and Profit After Tax amounting to Rs. 234.86 crore.

KEI Industries Posts Double-Digit Consolidated Growth in Q3 FY26

YoY Comparison of KEI’s Financial Results: Q3 FY26 vs. Q3 FY25

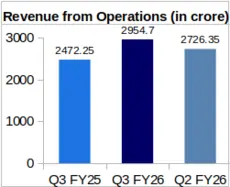

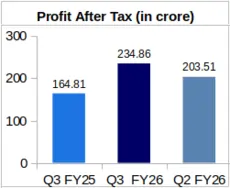

In Q3 FY26, KEI Industries posted consolidated revenue of Rs. 2,954.70 crore, up 19.51% from Rs. 2,472.25 crore recorded in Q3 FY25. The company also delivered a strong improvement in profitability, with Profit After Tax (PAT) rising 42.50% Year-over-Year (YoY) to Rs. 234.86 crore in Q3 FY26 from Rs. 164.81 crore in Q3 FY25.

The company’s Earnings Per Share (EPS) stood at Rs. 24.57 during Q3 FY26 against Rs. 17.87 during Q3 FY25, representing an increase of 37.49% YoY.

QoQ Analysis of KEI Industries’ Financial Numbers: Q3 FY26 vs. Q2 FY26

On a Quarter-Over-Quarter (QoQ) basis, KEI Industries’ revenue increased by 8.38% in Q3 FY26 from Rs. 2,726.35 crore in Q2 FY26. The company’s profit after tax (PAT) for Q3 FY26 rose by 15.40% from Rs. 203.51 crore in Q2 FY26.

KEI Industries’ Segment-Wise Revenue Comparison

Rs. in Cr.

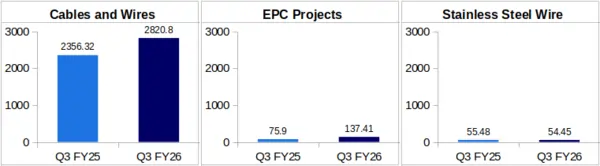

Cables and Wires: KEI Industries’ Cables and Wires business vertical exhibited a 19.71% YoY growth, with quarterly revenue from this segment reported as Rs. 2,820.80 crore for Q3 FY26 against Rs. 2,356.32 crore in Q3 FY25.

In its investor presentation, the company reported that KEI Industries earned Rs. 592 crore from domestic B2B sales during Q3 of FY26 compared to Rs. 809 crore in Q3 of FY25, thereby exhibiting a YoY decrease of 26.82%. Out of this, Extra High Voltage (EHV) cables accounted for Rs. 127 crore in Q3 of FY26, up from Rs. 41 crore in Q2 of FY25.

EPC Projects: KEI’s EPC Projects vertical brought in a segmental revenue of Rs. 137.41 crore during Q3 FY26, which is YoY 81.04%% higher than the company’s Q3 FY25 EPC Projects revenue of Rs. 75.90 crore.

Stainless Steel Wire: In Q3 of FY26, this business segment brought in Rs. 54.45 crore to KEI’s gross revenue, which is 1.86% lower YoY as compared to this vertical’s Rs. 55.48 crore revenue for Q3 FY25.

Product-wise Revenue Breakdown and Order Book Status

Mentioning its product category-wise revenue breakup, the company stated that during Q3 FY26, KEI Industries generated revenue of Rs. 1,217 crore from the sale of Low Tension (LT) cables. Sales of House Wires (HW) and Winding Wires (WW) contributed Rs. 1,043 crore during the quarter. High Tension (HT) cables accounted for revenue of Rs. 418 crore, Extra High Voltage (EHV) cables contributed Rs. 153 Cr. The remaining revenue was derived from sale of SS wires, and the execution of EPC projects (mentioned above).

Additionally, the company reported a pending order book of Rs. 3,928 crore as of 31st December 2025.

Board of Directors Recommends FY26 Dividend to Shareholders

KEI Industries’ Board of Directors has recommended paying a 225% dividend on the face value of each share, which is Rs. 2. This equates to Rs. 4.50 per equity share. This dividend will be paid out to the shareholders after the approval of the company.

About KEI Industries Limited: KEI Industries was founded in 1968 as a partnership firm. It was converted into a Limited company in 1992. The company has manufacturing facilities in Bhiwadi, Chopanki & Pathredi in Rajasthan and Silvassa in Dadra & Nagar Haveli. KEI is primarily a cable and wire company, dealing in Low Tension (LT) cables, High Tension (HT) and Extra High Voltage (EHV), control and instrumentation cables, specialty cables, elastomeric / rubber cables, submersible cables, flexible & house wires.