Havells’ Q3 FY26 Results: Revenue Up 14.3%; 400% Dividend Announced

Havells India Limited’s [NSE: HAVELLS, BOM: 517354] has announced its financial results for Q3 FY26. The Board of Directors of Havell’s has also recommended a 400% dividend to its shareholders.

Havells India Q3 FY26 Standalone Financial Numbers

Havells India reported a standalone revenue of Rs. 5,573.44 crore and a Profit After Tax (PAT) of Rs. 301.36 crore during Q3 FY26.

Havells India Consolidated Financial Results for Q3 FY26

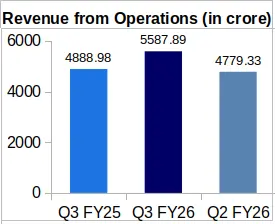

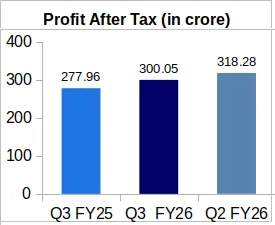

YoY Comparison of Havells’ Financial Numbers: Q3 FY26 vs. Q3 FY25

On Year-over-Year (YoY) basis, the company’s consolidated revenue from operations jumped by 14.30% to Rs. 5,587.89 crore during Q3 FY26 from Rs. 4,888.98 crore revenue reported for Q3 FY25. Profit After Tax (PAT) of the company increased to Rs. 300.05 crore in Q3 FY26 from Rs. 277.96 crore during Q3 FY25. This represents YoY increase of 7.95% in the company’s profit.

Earnings Per Share (EPS) of the company stood at Rs. 4.80 during Q3 FY26 against Rs. 4.43 during Q3 FY25. This shows a jump of 8.35% in the company’s EPS.

Quarterly Comparison of Havells’ Financial Figures: Q3 FY26 vs. Q2 FY25

On Quarter-over-Quarter (QoQ) basis, the company’s topline was up by 16.92% from its Rs. 4,779.33 crore revenue clocked during Q2 of FY26. Havells’ PAT decreased by 5.73% QoQ from Rs. 318.28 crore during Q2 of FY26.

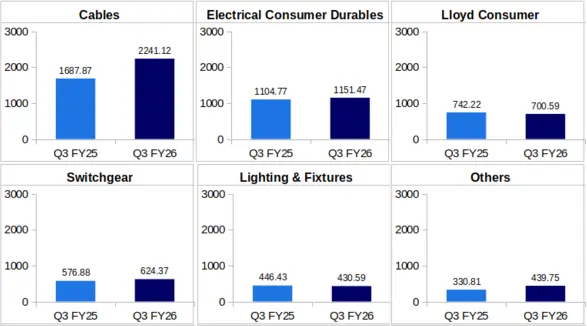

Analysis of Havells India’s Segment-Wise Revenue

Rs. in Cr.

Cables: This segment of the company clocked in a revenue of Rs. 2,241.12 crore during Q3 FY26 against Rs. 1,687.87 crore during Q3 FY25, representing a substantial YoY increase of 32.78%.

Havells India mentioned in its investor presentation for Q3 FY26 that the company’s cables business segment ‘delivered accelerated growth, driven by volume expansion and commodity price inflation’. The company also mentioned that growth in Q3 FY26 revenue was aided by Cable and Wire business.

Electrical Consumer Durables: Havells India reported a revenue of Rs. 1,151.47 crore from its ECD business in Q3 of FY26. This reflects a YoY increase of 4.23% from this vertical’s Rs. 1,104.77 crore revenue logged during Q3 of FY25.

Lloyd Consumer: The company earned Rs. 700.59 crore from its Lloyd Consumer business vertical during Q3 FY26 against Rs. 742.22 crore during Q3 FY25. This showed a YoY slump of 5.61% in the company’s revenue from its Lloyd Consumer business.

According to the company, Lloyd’s performance has been subdued by the impact of a weak summer.

Switchgear: During Q3 of FY26, the company reported Rs. 624.37 crore as revenue from its switchgear segment against Rs. 576.88 crore earned during Q3 of FY25. This shows a jump by 8.23% YoY.

Lighting & Fixtures: Havells India reported a revenue of Rs. 430.59 crore from its Lighting & Fixtures segment in Q3 FY26 and Rs. 446.43 crore during Q3 FY25. This reflects a slight decrease by 3.55%.

Others: This segment comprises some of Havells India’s other products, such as motors, water pumps, and purifiers.

During the Q3 of FY26, Havells generated Rs. 439.75 crore revenue from this segment against Rs. 330.81 crore generated during Q3 FY25. Revenue from this vertical increased by 32.93 % YoY.

Board of Directors Recommends Q3 FY26 Dividend to Shareholders

Havells India’s Board of Directors has recommended paying a 400% dividend on the face value of each share, which is Re. 1. This equates to Rs. 4 per equity share. This dividend will be paid to shareholders in upto 30 days of its declaration i.e 17th February 2026.

Havells India Share Price 7% Down After Announcing Q3 FY26 Financials

Havells India’s share price slumped by 6.96% after the announcement of its Q3 FY26 financial results. The company’s share price stood at Rs. 1,447.10 apiece on the day of announcement of its financial results, which decreased to Rs. 1,346.30 apiece on the next trading day.

About Havells India Limited: Havells India Limited is a Noida-based company, which is one of the biggest players in the Indian FMEG market. Its product range includes Industrial and domestic Circuit Protection Switchgear, Modular Switches, Cables and wires, Fans, Power Capacitors, and Luminaires for Domestic, Commercial, and industrial applications, Water Heaters, Motors, and Domestic Appliances.