Orient Electric FY-25 Financials: Revenue Jumps 10%, PAT Grows to Rs. 83.21 Cr.

Orient Electric Limited [NSE: ORIENTELEC, BOM: 541301], a major Indian Fast Moving Electric Goods (FMEG) manufacturer, has announced its financial results for Q4 of FY-25 and FY-25.

Orient Electric’s FY-25 Financial Performance

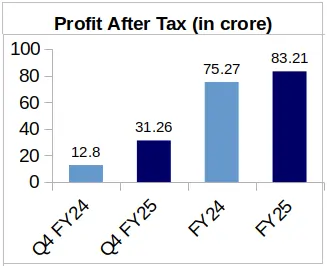

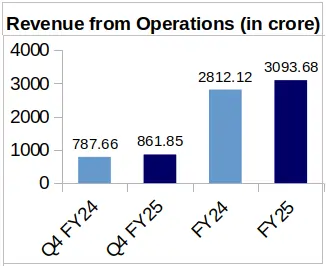

YoY Comparison of Orient Electric’s Financial Figures: Q4 FY-25 vs. Q4 FY-24 & FY-25 vs. FY-24

During Q4 of FY-25, Orient Electric reported a revenue of Rs. 861.85 crore, representing a Year-over-Year (YoY) increase of 9.42% from the company’s Q4 FY-24 revenue of Rs. 787.66 crore. The company reported Profit After Tax (PAT) of Rs. 31.26 crore during Q4 of FY-25 against Rs. 12.80 crore PAT for the corresponding quarter in FY-24. Therefore, Orient Electric’s Q4 FY-25 PAT grew to 2.44x of its Q4 FY-24 PAT.

For the entire financial year, the company’s revenue from operations grew by 10.01% YoY to Rs. 3,093.68 crore in FY-25 from Rs. 2,812.12 crore during FY-24. PAT of the company during FY-25 jumped to Rs. 83.21 crore which is up by 10.55% from the company’s FY-24 profit of Rs. 75.27 crore.

Earnings Per Share (EPS) of the company during Q4 of FY-25 stood at Rs. 1.46, and at Rs. 3.90 for the entire FY-25.

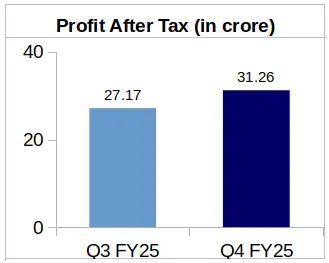

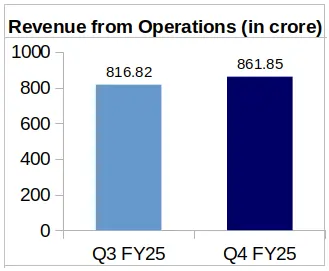

QoQ Analysis of Orient Electric’s Financials: Q4 FY-25 vs. Q3 FY-25

On Quarter-over-Quarter (QoQ) basis, the company’s revenue grew slightly by 5.51% from Rs. 816.82 crore reported for Q3 of FY-25.

Profit After Tax of the company echoed the same upward trend, increasing by 15.05% from Orient Electric’s Rs. 27.17 crore profit, which was logged during the third quarter of FY-25.

Further, Orient Electric’s EPS for Q3 of FY-25 were reported as Rs. 1.27.

Segment-Wise Revenue Comparison of Orient Electric

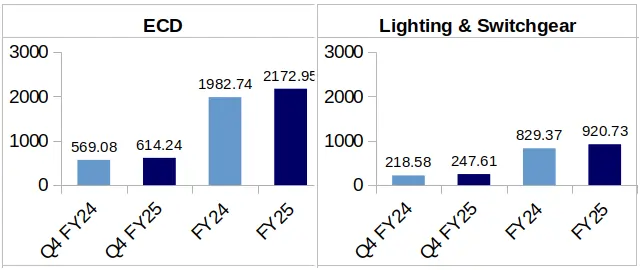

In Rs. Cr.

Electrical Consumer Durables (ECD): The company earned Rs. 614.24 crore as revenue during Q4 of FY-25 from its ECD segment against Rs. 569.08 crore clocked during Q4 of FY-24. This represents a YoY increase of 7.94% in quarterly segmental revenue.

Orient Electric’s revenue from its ECD’s business was Rs. 2,172.95 crore during FY-25, reflecting an YoY increase of 9.59% from its Rs. 1,982.75 crore segmental revenue during FY-24.

This segment usually contributes a major portion to the company’s gross revenue*. During Q4 of FY-25, Orient Electric’s ECD segment constituted 71.27% of the company’s gross revenue. Considering the entire FY-25, this segment accounted for 70.24% of Orient Electric’s gross revenue.

*Gross revenue refers to the sum of segmental revenues without deducting any inter-segmental revenue.

Lighting & Switchgear: During Q4 of FY-25, Orient Electric reported a revenue of Rs. 247.61 crore from its lighting & switchgear segment. This marks a YoY increase of 13.28% from the company’s Rs. 218.58 crore revenue from this segment during Q4 of FY-24.

For the entire FY-25, the company recorded Rs. 920.73 crore as revenue from its Lighting & Switchgear segment, showing an increase of 11.02% from Rs. 829.37 crore during FY-24.

The company mentioned in its investor presentation for its FY-25 financials that during Q4 of FY-25, consumer lighting registered high double-digit volume growth YoY. This growth was driven by addition of new products in the company’s portfolio and distributor partnerships. Some of the new products under this segment include Chip-On-Board (COB) Downlighters, Magnetic Track Lights and outdoor lights.

Orient Electric further mentioned that the company’s B2B lighting business exhibited “strong momentum” in Q4 of FY-25, registering mid-teens growth YoY. This included execution of major projects for street lighting & façade lighting.

About Orient Electric Limited: Orient Electric Ltd. is a part of the C.K. Birla Group, and is a manufacturer of lighting products, switchgear and FMEG products. The company has a presence in 35 countries.