Apar Industries Q3 FY25 PAT Down 19.6% YoY, Receives Stable Credit Ratings

Apar Industries Limited [NSE: APARINDS, BOM: 532259], a major Indian player in the conductors, cables, and speciality oils manufacturing space, has announced its financial results for Q3 of FY-25.

Apar Industries Receives Stable Credit Ratings from ICRA

Apar Industries has been rated ‘A+’ by Investment Information and Credit Rating Agency (ICRA) Ltd. on long-term and ‘A1’ on short-term basis.

The credit ratings, received by Apar Industries, indicate stability regarding fulfilment of financial obligations. Short-term ratings consider a period of one year or less while long-term ratings define a period of more than one year.

Apar Industries Q3 FY-25 Standalone Financials

On standalone basis, the company reported a revenue of Rs. 4,509.50 crore and a Profit After Tax (PAT) of Rs. 176.07 crore during Q3 of FY-25.

Apar Industries Consolidated Q3 FY-25 Results

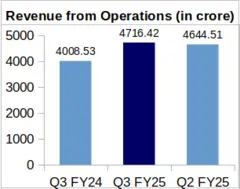

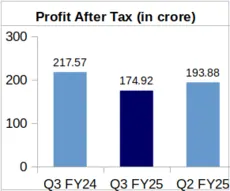

YoY Comparison of Apar Industries’ Numbers: Q3 FY-25 vs. Q3 FY-24

On Year-over-Year (YoY) basis, Apar Industries’ revenue jumped by 17.66% to Rs. 4,716.42 crore during Q3 of FY-25 against Rs. 4,008.53 crore in Q3 of FY-24. On the other hand, the company’s PAT was down by 19.60% YoY to Rs. 174.92 crore during Q3 of FY-25 as compared to Rs. 217.57 crore profit during Q3 of FY-24.

The company reported Earnings Per Share (EPS) of Rs. 43.55 during Q3 of FY-25 against Rs. 56.62 EPS during Q3 of FY-24.

QoQ Analysis of Apar Industries’ Financials: Q3 FY-25 vs. Q2 FY-25

On Quarter-over-Quarter (QoQ) basis, the company’s revenue was slightly up by 1.55% from Rs. 4,644.51 crore earned during Q2 of FY-25. Apar Industries’ PAT fell by 9.78% from Rs. 193.88 crore PAT for second quarter of FY-25.

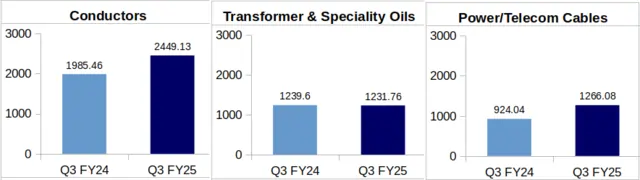

Segment-Wise Revenue Comparison of Apar Industries

Conductors: This segment of the company generated a revenue of Rs. 2,449.13 crore during Q3 of FY-25 against Rs. 1,985.46 crore during Q3 of FY-24. This reflects a YoY growth of 23.35% in the company’s quarterly revenue from this segment.

Transformer & Speciality Oils: Quarterly Revenue from Transformer & Speciality Oils segment of the company decreased slightly by 0.63% to Rs. 1,231.76 crore during Q3 of FY-25 against Rs. 1,239.60 crore during Q3 of FY-24.

Power/Telecom Cables: Apar Industries earned a revenue of Rs. 1,266.08 crore from this segment during Q3 of FY-25 as compared to Rs. 924.04 crore during Q3 of FY-24, representing a YoY increase of 37.02%.

Apar Industries’ Stock 20% down After Announcing Q3 FY-25 Financials

Apar Industries’ share price tumbled by 19.97% on the day of announcement of its Q3 FY-25 financial results as compared to the previous trading day. The company’s share price stood at Rs. 7,173.70 apiece on the day of result announcement against Rs. 8,963.80 on the previous trading day.

Further, volume of share trades of company peaked at 9,05,000 trades on the day company announced its Q3 FY-25 financials against 1,26,000 trades a day before company announced its results.

Apar Industries’ Order Book & Order Inflow During Q3 FY-25

The company mentioned in its investor presentation for Q3 FY-25 financial results that Apar Industries reported an order inflow of Rs. 3,077 crore during Q3 of FY-25.

Apar Industries’ pending order book stood at Rs. 7,600 crore as on 31st December 2024.

About Apar Industries Limited: Established in 1958, Apar Industries Ltd. has its presence in over 125 countries. Apar’s portfolio comprises manufacture and supply of conductors, transmission cables, specialty oils, polymers, and lubricants.