Orient Electric Q1 FY-25 Financials: Revenue up 7%, PAT Slumps 27%

Orient Electric Limited [NSE: ORIENTELEC, BOM: 541301], a major Indian Fast Moving Electric Goods (FMEG) manufacturer and a part of the CK Birla Group, has announced its financial results for Q1 of FY-25.

Orient Electric’s Q1 FY-25 Financial Performance Analysis

YoY Comparison of Orient Electric’s Financial Numbers: Q1 FY-25 vs. Q1 FY-24

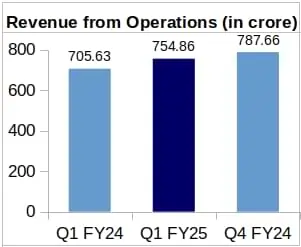

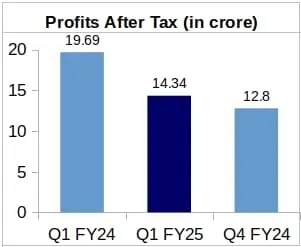

Orient Electric earned a revenue of Rs. 754.86 crore from its operations during Q1 of FY-25, representing an YoY increase of 6.98% from its Rs. 705.63 crore revenue logged by the company for Q1 of FY-24. However, Orient Electric’s Profit After Tax (PAT) fell by 27.17% to Rs. 14.34 crore during Q1 FY-25 from Rs. 19.69 crore earned by the company for Q1 of FY-24.

Orient Electric’s Earning Per Share (EPS) stood at Rs. 0.67 during Q1 of FY-25 against Rs. 0.92 during Q1 of FY-24.

QoQ Financial Results Comparison of Orient Electric: Q1 FY-25 vs. Q4 FY-24

On Quarter-over-Quarter (QoQ) basis, Orient Electric’s revenue decreased slightly by 4.16% from Rs. 787.66 crore logged by the company for Q4 of FY-24. Contrastingly, the company’s PAT increased by 12.03% QoQ from Rs. 12.80 crore PAT during last quarter of FY-24.

Orient Electric’s Segment-Wise Revenue Comparison

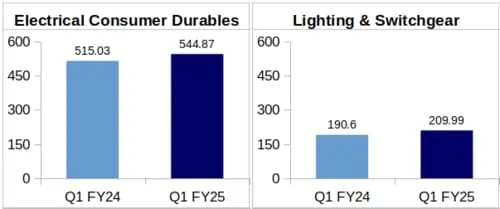

in Rs. Cr.

Electrical Consumer Durables (ECD): The company earned a revenue of Rs. 544.87 crore from its ECD segment during Q1 of FY-25 against Rs. 515.03 crore logged for Q1 of FY-24. This increase represents YoY growth of 5.79% in the company’s ECD segment revenue.

Orient Electric highlighted in its investor presentation for its Q1 FY-25 results that summer products, particularly ceiling fans and coolers, experienced robust demand due to heatwave affecting several parts of the country. This led to a “…strong season sell-out, indicating market share gains”.

Lighting & Switchgear: The company’s revenue from Lighting & Switchgear business jumped by 10.17% to Rs. 209.99 crore during Q1 of FY-25 from Rs. 190.60 crore clocked during Q1 of FY-24.

During the company’s earnings call for Q1 FY-25 financials, Mr. Ravindra Singh Negi, Managing Director and Chief Executive Officer (CEO) of Orient Electric, said “The consumer lighting segment continued to face price erosion, but showed high-teens volume growth, a steep increase in the B2B segment and improved distribution of switchgear and wires, leading to double-digit growth this quarter”.

Orient Electric’s Stock 2% Down Post Announcement of Q1 FY-25 Financials

Orient Electric’s share price dropped by 2.03% on the day the company announced its Q1 FY-25 financial results as compared to the share price on previous trading day. The company’s share price stood at Rs. 285 apiece on the day Orient Electric announced its financials against Rs. 290.90 apiece on the previous trading day.

The company’s volume of share trades stood at 10,21,000 trades on the day of the company’s Q1 FY-25 financials and at 11,86,000 trades on the trading day before the announcement of financials.

About Orient Electric Limited: Orient Electric Ltd. is a part of the C.K. Birla Group, and is a manufacturer of FMEG products, lighting products, and switchgear. The company has a presence in 35 countries. In India, the company is a major manufacturer and exporter of electric fans with about 60% share in the country’s fan exports.