Universal Cables’ Q3 FY26 Financials; Revenue Up 26.40%, PAT Soars 71.76% YoY

Universal Cables [NSE: UNIVCABLES, BSE: 504212], a subsidiary of M.P. Birla Group and a cable manufacturer in India, has recently shared its financial results for Q3 FY26.

Universal Cables’ Standalone Financial Results for Q3 FY26

In Q3 FY26, Universal Cables reported a standalone revenue of Rs. 767.92 crore from operations and a Profit After Tax (PAT) of Rs. 18.74 crore.

Universal Cables’ Consolidated Financials for Q3 FY26

YoY Comparison of Consolidated Financials; Q3 FY26 vs. Q3 FY25

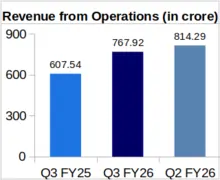

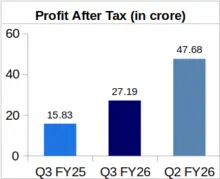

Universal Cables reported a consolidated revenue of Rs. 767.92 crore, which is a 26.40% increase Year-over-Year (YoY) against Q3 FY25’s revenue of Rs. 607.54 crore. As for the company’s PAT, a robust increase of 71.76% was observed on comparing Q3 FY26’s profit of Rs. 27.19 crore from Q3 FY25’s revenue of Rs. 15.83 crore.

Meanwhile, company’s Earnings Per Share (EPS) stood at Rs. 7.84 in Q3 FY26, a healthy YoY increase of 71.93% against EPS of Rs. 4.56 in Q3 FY25.

QoQ Analysis of Consolidated Financials; Q3 FY26 vs. Q2 FY26

Converse to the growth shown in YoY comparison, a Quarter-over-Quarter (QoQ) analysis highlights a decrease in revenue and PAT from Q2 FY26. QoQ analysis of consolidated financial revenue highlights a decrease of 5.69% from Q2 FY26’s earnings of Rs. 814.29 crore. Also, the PAT went down 42.97% against Q2 FY26’s PAT of Rs. 47.68 crore.

Universal Cables: Management Insights and Key Takeaways

For the period of 9 months ended 31st December 2025 Universal Cables’ revenue from operations stood at Rs. 2182.40 Cr. against Rs. 1724.35 Cr. for 9 months ended 31st December 2024, showing a growth of 25.83%. As per the company this was largely due to strong order execution and healthy volumes.

Universal Cables’ Boasts of a Robust Order Book

The company’s pending order book stood at INR 2950 Cr. as on 31st December 2025. Based on the steady order book and additional expected orders in the pipeline, Universal Cables expects to close the year FY 2026 with a 25%+ revenue growth.

Exports Expected to show Steady Growth

Regarding exports, the company mentioned that despite the ongoing geo-political uncertainties and changing global policy and trade landscape it expects to show steady growth in its revenue from exports to not only its current markets such as Europe, the Middle East and Australia, but also from additional countries and regions. The company has based this on its strong present order book and further attributes growth to certain expected flow of new business.

Universal Cables’ Share Price Down 3.03%

On the day of company’s financials announcement, its share price was at Rs. 758.15 apiece. When compared with the share of next trading day, which was Rs. 735.15 apiece, a decline of 3.03% can be observed.

About Universal Cables Limited: Established in 1962, Universal Cables Limited is a major Indian manufacturer of Electrical Cables. These include Low Voltage, Medium Voltage, and Extra High Voltage XLPE Power Cables up to 500 KV grade, PVC and Rubber Insulated Power Cables up to 11 KV grade, Control and Instrumentation Cables, and more. The company also deals in the manufacturing of Power Capacitors in Low Tension / Low Voltage and high Tension / High Voltage ranges. The company also has an EPC division to execute turnkey contracts.