KEC’s Q1 FY26 Profit Grows 42% YoY, Q1 Revenue 11% Up

KEC International Limited [NSE: KEC, BOM: 532714], an Indian EPC major, has announced its financial results for Q1 of FY26.

KEC International’s Q1 FY26 Standalone Financials

KEC International reported a standalone revenue of Rs. 4,029.94 crore and Profit After Tax (PAT) of Rs. 36.83 crore during Q1 of FY26.

KEC’s Consolidated Q1 FY26 Financial Figures

YoY Comparison of KEC’s Numbers: Q1 FY26 vs. Q1 FY25

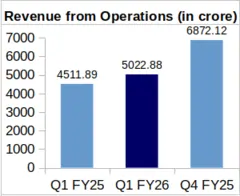

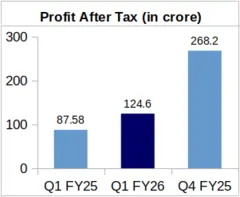

The company’s consolidated revenue during Q1 FY26 was up by 11.33% to Rs. 5,022.88 crore from its Rs. 4,511.89 crore revenue reported for Q1 FY25. KEC’s PAT jumped to Rs. 124.60 crore during Q1 FY26 from Rs. 87.58 crore in Q1 FY25. This represents a significant Year-over-Year (YoY) increase of 42.27% in the company’s PAT.

The company’s Earnings Per Share (EPS) stood at Rs. 4.68 during Q1 FY26 against Rs. 3.41 during Q1 FY25.

QoQ Analysis of KEC’s Financial Performance: Q1 FY26 vs. Q4 FY25

On Quarter-over-Quarter basis (QoQ), the company’s revenue was down by 26.91% from Rs. 6,872.12 crore earned for Q4 FY25. KEC’s PAT also followed a downward QoQ trend, plummeting by 53.54% from Rs. 268.20 crore clocked during Q4 FY25.

KEC’s Segment-Wise Revenue Comparison: Q1 FY26 vs. Q1 FY25

Rs. in Cr.

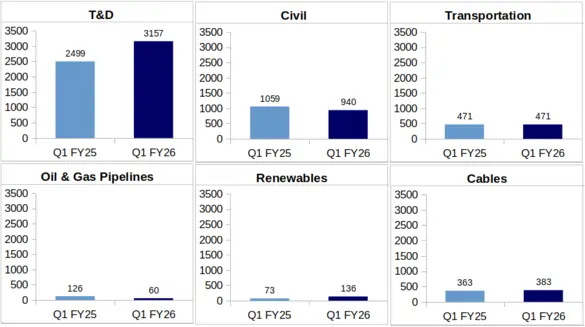

Transmission & Distribution: During Q1 of FY26, the company reported Rs. 3,157 crore as revenue from its Transmission and Distribution (T&D) segment against Rs. 2,499 crore earned during Q1 of FY25. This shows a jump by 26% YoY.

In this segment, the company reported an order intake of Rs. 3,200 crore during Q1 FY26 from India, Middle East and Americas.

Civil: KEC’s Civil vertical brought in a segmental revenue of Rs. 940 crore during Q1 FY26, which is YoY 11% lower than the company’s Q1 FY25 civil revenue of Rs. 1,059 crore. The company mentioned in its investor presentation that revenue in this segment was impacted by labor shortages and delayed payments in water projects.

Transportation: KEC reported a revenue of Rs. 471 crore from its Transportation segment in Q1 FY26, which is same as revenue reported by the company during Q1 FY25.

Oil & Gas Pipelines: The company reported a revenue of Rs. 60 crore from its Oil & Gas Pipelines business in first quarter of FY26. This reflects a YoY decrease of 52% from Rs. 126 crore, earned by the company from this vertical during Q1 of FY25.

Renewables: KEC’s Renewables segment quarterly revenue increased by 87% YoY to Rs. 136 crore during Q1 of FY26 from Rs. 73 crore in Q1 of FY25.

Cables: During Q1 of FY26, KEC generated Rs. 383 crore revenue from this segment, which is up by 5% YoY from Rs. 363 crore reported in Q1 FY25.

Further, the company is investing Rs. 90 crore towards installing requisite equipment for production of electron beam (e-beam) and elastomeric cables. The production of these cables is expected to begin in Q4 of FY-26.

KEC International Reports Strong Q1 FY26 Performance

The company reported an order book of Rs. 34,409 crore as of June 30, 2025, with an order inflow of Rs. 5,517 crore during Q1 FY26. Majority of these orders were secured in T&D and Civil segments.

Commenting on Q1 FY26 financial performance, Mr. Vimal Kejriwal, MD & CEO, KEC International Ltd., said, “We have started the year on a strong note by delivering a healthy revenue growth, substantial increase in profitability and a reduction in debt levels. Despite headwinds such as persistent manpower shortages and geopolitical uncertainties, we have continued to deliver consistent profitable revenue growth”.

About KEC International Limited: Headquartered in Maharashtra, KEC International is an EPC player with a significant name and presence in around 100 countries. Its segments include Urban, Infrastructure, Solar, Smart Infrastructure, Civil, Cable sector, Power Transmission and Distribution, Railways, and Oil and Gas pipelines.