KEC Q2 FY-25 Financials: Revenue Up 13%, PAT Jumps 53%

KEC International Limited [NSE: KEC, BOM: 532714], a major Indian EPC company, has published its financial results for Q2 of FY-25.

KEC’s Standalone Financial Results for Q2 of FY-25

KEC International reported a standalone revenue of Rs. 4,483.84 crore for Q2 of FY-25 and a Profit After Tax (PAT) of Rs. 58.15 crore for the same period.

KEC’s Q2 FY-25 Consolidated Financial Numbers

YoY Comparison of KEC International’s Financials: Q2 FY-25 vs. Q2 FY-24

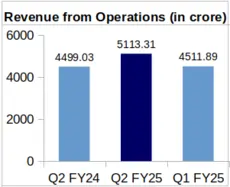

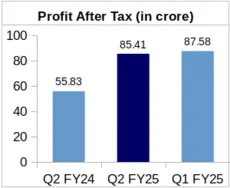

On an Year-over-Year (YoY) basis, the company’s top line grew by 13.65% to Rs. 5,113.31 crore during Q2 FY-25 from its Rs. 4,499.03 crore revenue for Q2 of FY-24. Following the same upward trend, KEC’s Q2 PAT was up by 52.98% YoY, growing to Rs. 85.41 crore in FY-25 from Rs. 55.83 crore in FY-24.

Correspondingly, the company’s Earnings Per Share (EPS) increased to Rs. 3.32 during Q2 of FY-25 from Rs. 2.17 during Q2 of FY-24.

QoQ Results Analysis for KEC International: Q2 FY-25 vs. Q1 FY-25

Quarter-over-Quarter (QoQ), KEC’s revenue from operations jumped by 13.33% from Rs. 4,511.89 crore, which was logged during Q1 of FY-25. However, the company’s PAT fell by 2.48% from Rs. 87.58 crore,which was earned during initial quarter of FY-25.

Segment-Wise Revenue Comparison of KEC International

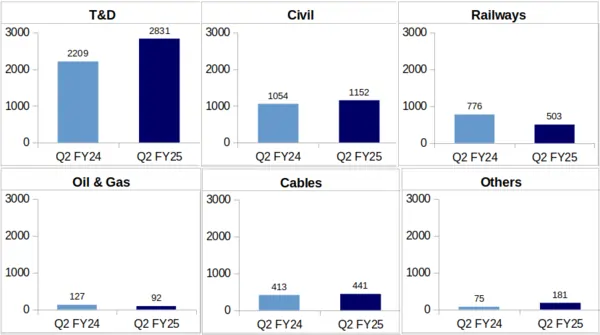

Transmission & Distribution (T&D): The company’s revenue from this segment jumped to Rs. 2,831 crore during Q2 of FY-25 against Rs. 2,209 crore in Q2 of FY-24. This increase in numbers showed a YoY growth of 28.16% in the company’s quarterly T&D revenue.

KEC International’ investor presentation for Q2 FY-25 financials mentioned that there has been a Year-to-Date (YTD) T&D order inflow of Rs. 9,000 crore. Furthermore, the company reported a Transmission & Distribution order book of Rs. 26,000 crore across India, Middle East, SAARC, Africa, Americas, East Asia Pacific, Commonwealth of Independent States (CIS) and Australia through its T&D business.

Civil: The civil segment of the company contributed Rs. 1,152 crore to the company’s total revenue during Q2 of FY-25 against Rs. 1,054 crore in Q2 of FY-24. This shows a growth of 9.30% on YoY basis.

Additionaly, KEC International reported an order book of about Rs. 10,000 crore from its Civil business. The company also highlighted that it has expanded its civil portfolio by securing a new client in the Metals & Mining segment. However, KEC has not specified the name of this client.

Railways: KEC International’s segmental revenue from Railways business dropped by 35.18% to Rs. 503 crore reported for Q2 FY-25 against Rs. 776 crore during Q2 of FY-24.

Oil & Gas: This segment of the company brought in a revenue of Rs. 92 crore during Q2 FY-25 against Rs. 127 crore during Q2 FY-24. This increase in revenue showed a fall of 27.56% in KEC’s quarterly Oil & Gas revenue.

As per the company’s Q2 FY-25 investor presentation, KEC International has begun executing its first Oil & Gas international project in Africa and is close to winning its second order, also in Africa.

Cables: KEC International reported a revenue of Rs. 441 crore from its Cables segment during Q2 of FY-25, representing an YoY increase of 6.78% from Rs. 413 crore logged for Q2 of FY-24.

KEC International mentioned that the company secured its maiden cable supply order in the United States. The company is also investing in setting up E-Beam (Electron beam) and Elastomeric cables production line.

Others: KEC’s ‘Others’ segment’s revenue, which consists of the company’s ‘solar/cabling’ business, showed an increase of 2.41 times to Rs. 181 crore in Q2 FY-25 from Rs. 75 crore in Q2 FY-24.

The company has begun work on its largest solar order for a 625 MWp Solar PV project in Rajasthan and has reported an order book exceeding Rs. 1,300 crore from this segment.

KEC International’s Share Prices Over 3% Down After Announcing Q2 FY-25 Financials

KEC International’s share price fell by 3.33% on the day of announcement of its Q2 FY-25 financials as compared to the share price on previous trading day.

Further, volume of share trades of the company stood at 5,06,000 trades on the day KEC announced its financials and at 82,000 trades on the trading day before the announcement of its Q2 FY-25 financials.

KEC International Outlays Rs. 400 Cr. CapEx for FY-26

During the earnings call for Q2 FY25, Mr. Vimal Kejriwal, MD & CEO, KEC International Ltd., shared plans for the company’s capital expenditure (CapEx) for FY26, which is set at Rs. 400 crore. This marks an increase from the typical CapEx range of Rs. 300 crore to Rs. 350 crore in previous years.

Out of KEC’s total CapEx, Rs. 90 crore will be allocated to the cables business. This investment will fund the development of an e-beam facility and elastomeric cables, which is slated to be commissioned in Q4 of FY-26. The company expects to generate revenue of Rs. 600 to Rs. 650 crore from this new facility.

KEC International’s Total Order Inflow and Order Book

In its press release dated 4th November 2024, KEC International mentioned a total order inflow of Rs. 13,482 crore during the second quarter of FY25. The company’s order book stood at Rs. 34,088 crore for the same period.

Commenting on the company’s financial results, Mr. Vimal Kejriwal said, “The uptick in order intake has resulted in our order book + L1 being at a record high of over Rs. 42,500 crore. With this formidable order book and a promising pipeline of tenders, we have a clear visibility of growth in the balance quarters of this year and next year as well”.

KEC International Limited: Headquarted in Maharashtra, KEC International is an EPC player with a significant name and presence in around 100 countries. Its segments include Urban, Infrastructure, Solar, Smart Infrastructure, Civil, Cable sector, Power Transmission and Distribution, Railways, and Oil and Gas pipelines.