KEC Posts Healthy Q2 FY26 Financial Results: Revenue Jumps 19%, PAT up 88%

KEC International Limited [NSE: KEC, BOM: 532714], an Indian EPC major, has announced its financial results for Q2 of FY26.

KEC International Q2 FY26 Standalone Financials

KEC International reported a standalone revenue of Rs. 4,948.53 crore and Profit After Tax (PAT) of Rs. 105.72 crore during Q2 of FY26.

KEC’s Consolidated Q2 FY26 Financials

YoY Comparison of KEC’s Numbers: Q2 FY26 vs. Q2 FY25

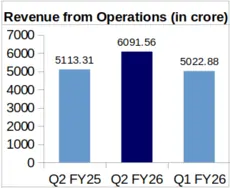

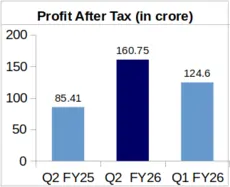

KEC’s consolidated revenue during Q2 FY26 was up by 19.13% to Rs. 6,091.56 crore from its Rs. 5,113.31 crore revenue reported for Q2 FY25. KEC’s PAT jumped to Rs. 160.75 crore during Q2 FY26 from Rs. 85.41 crore in Q2 FY25. This represents a significant Year-over-Year (YoY) increase of 88.21% in the company’s PAT.

The company’s Earnings Per Share (EPS) stood at Rs. 6.04 during Q2 FY26 against Rs. 3.32 during Q2 FY25.

QoQ Analysis of KEC International’s Financial Performance: Q2 FY26 vs. Q1 FY26

On Quarter-over-Quarter basis (QoQ), the company’s revenue was up by 21.28% from Rs. 5,022.88 crore earned for Q1 FY26. KEC’s PAT also followed an upward QoQ trend, increasing by 29.01% from Rs. 124.60 crore clocked during Q1 FY26.

KEC’s Segment-Wise Revenue Comparison

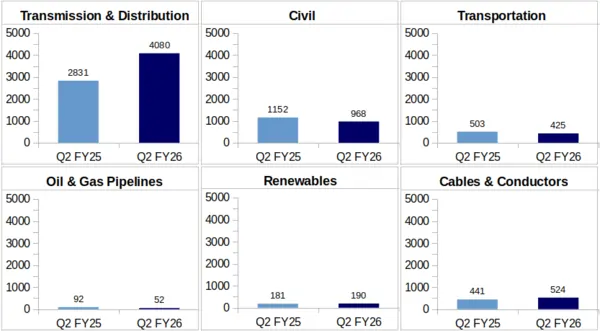

Transmission & Distribution: During Q2 of FY26, the company reported Rs. 4,080 crore as revenue from its Transmission & Distribution segment against Rs. 2,831 crore earned during Q2 of FY25. This shows a jump by 44% YoY.

The company mentioned in its Q2 FY26 investor presentation that KEC’s T&D order intake during the quarter stood at Rs. 12,000 crore. The company received these orders from India, Middle East, Commonwealth of Independent States (CIS) and Americas. KEC is also expanding its tower manufacturing facility in Butibori, Nagpur, with the project expected to be completed by the end of 2025.

Civil: KEC’s Civil vertical brought in a segmental revenue of Rs. 968 crore during Q2 FY26, which is YoY 16% lower than the company’s Q2 FY25 Civil revenue of Rs. 1,152 crore.

Explaining the reason behind the decline in KEC’s civil segment revenue, the company cited prolonged monsoons, labour shortages, and delayed payments in the Water segment. However the company added that its civil order book and value of civil orders for which it is currently at L1 bidder, add up to Rs. 10,000 crore.

Transportation: The company reported a revenue of Rs. 425 crore from this segment in Q2 FY26. This reflects a YoY decrease of 15% from Rs. 503 crore, earned by the company from this vertical during Q2 of FY25.

Oil & Gas Pipelines: In Q2 of FY26, the company clocked Rs. 52 crore as its quarterly revenue from its Oil & Gas pipelines vertical, 44% lower than KEC’s Oil & Gas pipelines segment revenue for Q2 of FY25, which stood at 92 crore.

Renewables: Revenue from Renewables segment of the company grew by 5% YoY to Rs. 190 crore in second quarter of FY26 from Rs. 181 crore during Q2 of FY25.

During the company’s Q2 FY26 earnings call, Mr. Vimal Kejriwal, MD & CEO, of KEC International, said “We are currently executing two large solar projects in Karnataka and Rajasthan. The 500 megawatts solar project to Karnataka is scheduled for completion this quarter and the 500 megawatts solar in Rajasthan is expected to be complete early next year”.

Cables & Conductors: The company’s Cable & Conductors business brought in Rs. 524 crore during Q2 of FY26, which represents an increase of 19% YoY. In Q2 of FY25, KEC registered Rs. 441 crore as quarterly revenue from this segment.

Mentioning the expansion in this segment, KEC International highlighted in its investor presentation that the company is expanding its e-beam facility to increase its cable product portfolio. Commissioning of this enhanced e-beam facility is expected by 2025-end.

KEC Posts Q2 Order Inflow, Management Insights on Healthy Q2 FY26 Performance

KEC International mentioned in its press release that the company reported a Year-to-Date (YTD) order inflow of Rs. 16,050 crore and order book of Rs. 39,325 crore. Further, the company is currently Lowest (L1) bidder for about Rs. 5,000 crore worth of orders.

Commenting on the company’s Q2 FY26 financial results, Mr. Vimal Kejriwal said, “We have delivered another quarter of strong performance, marked by robust revenue growth, significant improvement in profitability and healthy order intake…. With a strong focus on execution, robust order book and a substantial tender pipeline, we are well positioned to drive sustained and profitable growth in the coming quarters”.

About KEC International Limited: Headquartered in Maharashtra, KEC International is an EPC player with a significant name and presence in around 100 countries. Its segments include Urban, Infrastructure, Solar, Smart Infrastructure, Civil, Cable sector, Power Transmission and Distribution, Railways, and Oil and Gas pipelines.