Cords Cable Q3 FY25 Results: Highest Revenue, PAT Up 59% YoY

Cords Cable Industries Ltd., a Delhi-headquartered cable manufacturer, has posted its financial results for Q3 of FY-25.

“Highest Top-Line for Any Quarter so Far” – Cords CMD

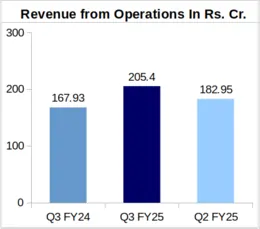

While speaking with CableCommunity, Mr. Naveen Sawhney, Managing Director of Cords Cable Industries, said, “[During] the quarter ended 31st December 2024, the company posted the highest top-line for any quarter so far, that is Rs. 205.40 crore”. He added that in comparison to Q3 of FY-24, other financial parameters were much better during Q3 of FY-25.

Analysis of Cords Cable’s Financial Performance during Q3 FY-25

YoY Comparison of Cords’ Financials: Q3 FY-25 vs. Q3 FY-24

Cords Cable’s top line during Q3 of FY-25 stood at Rs. 205.40 crore, which was 22.31% higher than the company’s Q3 FY-24 revenue of Rs. 167.93 crore.

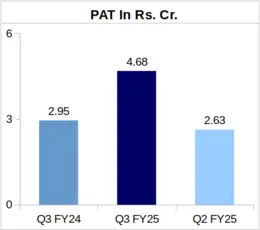

Q3 Profit After Tax (PAT) of the company also followed an upward trend, growing remarkably by 58.64% YoY, to Rs. 4.68 crore in FY-25 from Rs. 2.95 crore during FY-24.

The company’s Earnings Per Share (EPS) stood at Rs. 3.61 during Q3 of FY-25 against Rs. 2.27 in Q3 of FY-24.

QoQ Comparison of Cords’ Financial Numbers: Q3 FY-25 vs. Q2 of FY-25

Cords’ top line grew by 12.27% Quarter-over-Quarter (QoQ) from Rs. 182.95 crore clocked during Q2 of FY-25. The company’s PAT exhibited a positive trend as well, growing by 77.95% from Rs. 2.63 crore earned during Q2 of FY-25.

Growth Majorly Attributed to LT Power Cable Portfolio – Cords CFO

While speaking about the company’s Q3 FY-25 financial performance, Mr. Sandeep Kumar, CFO of Cords Cable Industries, said, “The growth in turnover is majorly attributed to increase in LT power cable products portfolio”. Mr. Kumar added that Cords is focusing on removing bottlenecks and putting new machinery for critical processes to increase production efficiency. “The company is leveraging its brand value and long track record of timely delivery for getting orders in new market segments like Renewable Energy”, he shared.

As for the company’s future outlook, Mr. Naveen Sawhney said, “Going forward, outlook seems to be better for our company’s products in domestic as well as in overseas markets”. Mr. Sawhney shared that the company expects high double-digit growth in Q4 of FY-25.

Company Stock Gains 20% After Results Announcement

Cords Cable’s shares were trading at Rs. 196.63 apiece on the day of announcement of its financials, that is on 10th February 2025. This represents a 20% gain from its share price of Rs. 163.86 apiece on the previous trading day.

This trend suggests an increase in shareholder’s confidence in the company’s performance.

About Cords Cable: Cords Cable Industries was established in 1987, and has two manufacturing facilities, one at Chopanki and the other at Kahrani in Rajasthan. The company’s portfolio comprises Instrumentation cables, Thermocouple cables, Power cables, Control cables, and other Special cables to provide solutions for industrial connectivity requirements such as Railway Signalling, SCADA, DCS, and other plant instrumentation requirements. The company’s turnover for FY-24 stood at Rs. 627.74 crore.