Apar Industries Q1 FY-25 Financials: Revenue Jumps 6%, PAT up 3% YoY

Apar Industries Limited [NSE: APARINDS, BOM: 532259], a major Indian player in the conductors, cables, and speciality oils manufacturing space, has announced its financial results for Q1 of FY-25.

Apar Industries’ Q1 FY-25 Standalone Financial Figures

During Q1 of FY-25, Apar Industries reported a standalone revenue of Rs. 3,746.54 crore from operations and Profit After Tax (PAT) of Rs. 195.56 crore.

The company’s Earnings Per Share (EPS) stood at Rs. 48.69 during Q1 of FY-25.

Consolidated Financial Results of Apar Industries

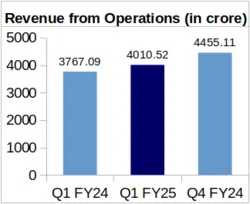

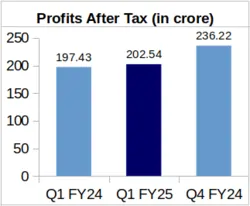

YoY Result Comparison of Apar’s Q1 FY-25 Financial Numbers: Q1 FY-25 vs. Q1 FY-24

On a Year-over-Year (YoY) basis, Apar Industries’ Q1 FY-25 revenue grew by 6.46% to Rs. 4,010.52 crore from Rs. 3,767.09 crore earned during Q1 of FY-24. Following the similar trend, the company’s PAT during Q1 FY-25 also increased to Rs. 202.54 crore from Rs. 197.43 crore in Q1 of FY-24. Therefore, there has been a growth of 2.59% YoY in the company’s Q1 PAT.

The company’s consolidated EPS stood at Rs. 50.42 during Q1 of FY-25.

QoQ Comparison of Apar Industries’ Financial Figures: Q1 FY-25 vs. Q3 FY-24

Apar Industries’ revenue from operations during Q1 of FY-25 was down by 9.98% from Rs. 4,455.11 crore clocked during Q4 of FY-24. The company’s Q1 FY-25 PAT also slumped by 14.26% from Rs. 236.22 crore PAT which was logged for the last quarter of FY-24.

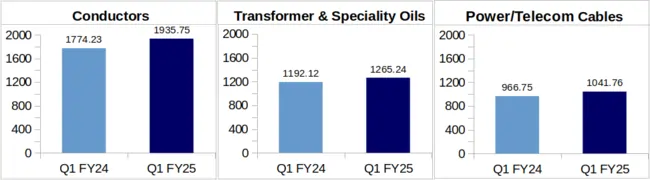

Segment-Wise Revenue Comparison of Apar Industries

Conductors: The company earned Rs. 1,935.75 crore as revenue during Q1 of FY-25 from its Conductors segment against Rs. 1,774.23 crore clocked from this segment during Q1 of FY-24. This represents an increase of 9.10% on a YoY basis.

The company mentioned in its investor presentation that exports of conductors contributed 29.5% to the company’s conductor segment revenue during Q1 of FY-25 as compared to 52.4% in Q1 of FY-24. Apar mentioned that the contribution of exports was lower on a YoY basis because demand from US and Europe was down due to ‘regulatory delays and competition’.

Further, the company’s order inflow for conductors stood at Rs. 1,794 crore during first quarter of FY-25.

Transformer and Speciality Oils: Apar Industries reported a revenue of Rs. 1,265.24 crore from its Transformer and Speciality Oils segment for Q1 of FY-25. This reflects a YoY increase of 6.13% from the company’s Rs. 1,192.12 crore revenue clocked during Q1 of FY-24.

Apar Industries stated that exports of transformer and specialty oils accounted for 45% of the company’s revenue from transformer and specialty oils segment during Q1 of FY-25, compared to 48.6% in Q1 of FY-24.

Power/Telecom Cables: Apar Industries’ Power/Telecom Cables segment saw an increase in revenue to Rs. 1,041.76 crore in Q1 of FY-25 from Q1 of FY-24’s Rs. 966.75 crore, marking a growth of 7.76%.

Exports of Power/Telecom Cables cables decreased to 33.2% during Q1 of FY-25 from 51.5% in Q1 of FY-24. The company highlighted ‘Export is lower in Q1 FY25 due to strong base of US sales in Q1 FY24’. According to Apar Industries “US business has shown a gradual recovery in the current quarter as compared to previous quarter with further acceleration expected to come in second half of the year”.

As on 30th June 2024, the company’s cable business order book stood at Rs. 1,571 crore.

Insights of Apar Industries on its Q1 FY-25 Financial Performance

Commenting on the company’s financial performance, Mr. Kushal Desai ,Chairman & MD of Apar Industries said “We had a good start to FY2025 with all time high Q1 revenue led by strong performance in domestic business across the segments. We expect demand from Western nations to accelerate by second half of FY25. We are confident to deliver long-term sustainable growth by leveraging on our robust growth drivers, strategic priorities and our value proposition”.

Mentioning the CapEx during the company’s Q1 FY-25 earnings call, Mr. Ramesh Iyer, Chief Financial Officer of Apar Industries Ltd., said that the company will invest about Rs. 300 to Rs. 350 crore during FY-25. He added that this CapEx will be directed towards Apar’s cable and conductor divisions.

About Apar Industries Limited: Established in 1958, Apar Industries Ltd. has its presence in over 125 countries. Apar’s portfolio comprises manufacture and supply of conductors, transmission cables, specialty oils, polymers, and lubricants.