Finolex Cables Q2 FY26 Revenue Jumps 5%, Profit Up 38% YoY

Finolex Cables Limited [NSE: FINCABLES, BOM: 500144], an Indian manufacturer of cables, Copper rods, switchgear, and Fast-Moving Electrical Goods (FMEG), has announced its financial results for Q2 FY26.

Finolex Industries Q2 FY26 Standalone Financials

Finolex Industries reported a standalone revenue of Rs. 1,375.79 crore and Profit After Tax (PAT) of Rs. 186.89 crore during Q2 of FY26.

Consolidated Q2 FY26 Financials Performance of Finolex Cables

YoY Comparison of Finolex Cables’ Numbers: Q2 FY26 vs. Q2 FY25

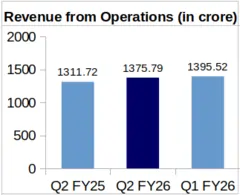

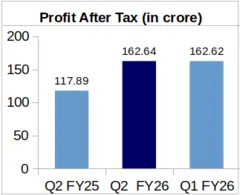

Finolex Cables’ consolidated revenue during Q2 FY26 was up slightly by 4.88% to Rs. 1,375.79 crore from its Rs. 1,311.72 crore revenue reported for Q2 FY25. Finolex Cables’ PAT jumped to Rs. 162.64 crore during Q2 FY26 from Rs. 117.89 crore in Q2 FY25. This represents a significant Year-over-Year (YoY) increase of 37.96% in the company’s PAT.

The company’s Earnings Per Share (EPS) stood at Rs. 10.63 during Q2 FY26 against Rs. 7.71 during Q2 FY25.

QoQ Analysis of Finolex Cables’ Financial Numbers: Q2 FY26 vs. Q1 FY26

On Quarter-over-Quarter basis (QoQ), Finolex Cables’ revenue was almost flat, decreasing by 1.41 % from Rs. 1,395.52 crore earned for Q1 FY26. The company’s PAT also remained practically the same QoQ, decreasing marginally by 0.01% from Rs. 162.62 crore in Q1 FY26.

Finolex Cables’ Segment Wise Revenue Analysis

Rs. in Cr.

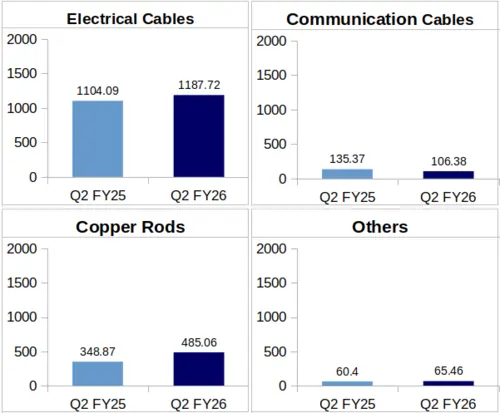

Electrical Cables: During Q2 of FY26, the company reported Rs. 1,187.72 crore as revenue from its Electrical Cables segment against Rs. 1,104.09 crore earned during Q2 of FY25. This shows a jump by 7.57% YoY.

The company mentioned in its Q2 FY26 investor presentation that Q2 building wire volumes stayed flat YoY. Demand from the real estate sector was low due to stagnation in affordable and mid-segment housing and new project launches. Monsoon also affected sales of wires used in agriculture. However, industrial wires and solar cables performed well, recording double-digit volume growth.

Communication Cables: Finolex Cables’ Communication Cables vertical brought in a segmental revenue of Rs. 106.38 crore during Q2 FY26, which is YoY 21.42% lower than the company’s Q2 FY25 Communication Cables revenue of Rs. 135.37 crore.

The company elaborated that its Communication Cables segment saw low volumes across all product lines during Q2 FY26.

Copper Rods: The company reported a revenue of Rs. 485.06 crore from this segment in Q2 FY26. This reflects a YoY increase of 39.04% from Rs. 348.87 crore, earned by the company from this vertical during Q2 of FY25.

Others: This segment comprises Finolex Cables’ switchgear, conduit pipes and Fast Moving Electrical Goods (FMEG). Finolex Cables’ ‘Others’ segment business revenue was reported as Rs. 65.46 crore for Q2 of FY26, which translates a 8.38% YoY growth from its Rs. 60.40 crore revenue from this segment for Q4 FY24.

Completion of Major Existing CAPEX Programs

The company’s management mentioned in its Q2 FY26 earnings call that Finolex Cables’ preform plant is ready and awaiting production trials, which are expected to start within the next couple of weeks. Finolex Cables is also developing a fibre draw plant. The building for this plant is nearing completion, and the necessary machines are expected to be added soon.

The management hopes that both of the aforementioned projects will be completed by March 2026.

About Finolex Cables Limited: Pune-based Finolex Cables is a major Indian cable manufacturer and the flagship company of the Finolex Group. Finolex offers a wide range of Electrical and Communication cables. The company has manufacturing facilities at Pimpri and Urse in Pune, Goa, and Roorkee, Uttarakhand.