KEI Industries’ FY-25 Results: Topline Zooms 20%, Cables & Wires Revenue Up 25%

KEI Industries, a key Indian cables and wire manufacturer, has posted its financial results for the quarter and year ended 31st March 2025.

KEI Industries’ Standalone Financial Figures

During Q4 of FY-25, KEI clocked a standalone revenue of Rs. 2,914.79 crore. The corresponding Profit After Tax (PAT) of the company was reported as Rs. 226.55 crore.

For the entire FY-25, KEI’s standalone topline was Rs. 9,735.88 crore. The company’s PAT stood at Rs. 696.41 crore considering the entire fiscal.

KEI’s Consolidated Financials: Q4 FY-25 & FY-25

YoY Comparison of KEI’s Results: Q4 FY-25 vs. Q4 FY-24 & FY-25 vs. FY-24

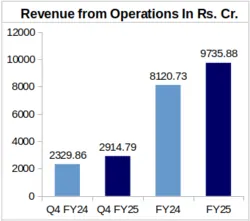

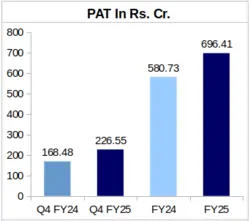

Year-over-Year (YoY) comparison of KEI’s financial figures shows a 25.11% leap in the company’s Q4 topline to Rs. 2,914.79 crore in FY-25 from Rs. 2,329.86 crore in FY-24. Moreover, KEI Industries’ PAT also echoed this upward trend, growing remarkably by 34.47% YoY to Rs. 226.55 crore in Q4 of FY-25 from Rs. 168.48 crore in Q4 of FY-24.

As for the entire year, KEI’s FY-25 topline stood at Rs. 9,735.88 crore, 19.89% higher than its FY-24 revenue of Rs. 8,120.73 crore. PAT for the entire FY-25 was Rs. 696.41 crore, which is 19.92% higher than its FY-24 PAT of Rs. 580.73 crore.

Earning Per Share (EPS) of the company was registered as Rs. 23.71 during Q4 of FY-25 and as Rs. 75.65 for the entire FY-25.

QoQ Analysis of KEI’s Financial Numbers: Q4 FY-25 vs. Q3 FY-25

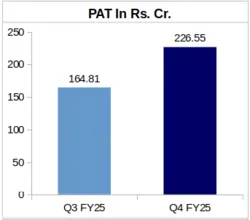

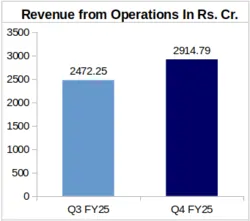

Quarter-over-Quarter analysis of KEI Industries Q4 FY-25 financials reveals a strong performance by the company. Its Q4 FY-25 revenue was 17.90% higher than its Q3 FY-25 revenue of Rs. 2,472.25 crore. KEI’s Q4 FY-25 PAT showed a 37.46% jump over its Q3 FY-25 PAT of Rs. 164.81 crore.

KEI’s Segment-Wise Revenue: Cables & Wire Segment Shines, Other Segments Shrink

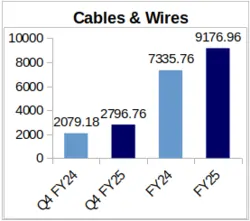

Cables and Wires: KEI industries’ Q4 FY-25 revenue from its cables and wires segment was Rs. 2,796.76 crores. Quarterly revenue from this segment rocketed by 34.51% YoY, from Rs. 2,079.18 crore reported for Q4 of FY-24.

As for the entire fiscal, KEI’s cables and wires segment topline grew by 25.10%, to Rs. 9,176.96 crore in FY-25 from Rs. 7,335.76 crore in FY-24. Being primarily a cables and wires manufacturer, it was no surprise that this segment formed over 91% of KEI’s gross revenue* in Q4 FY-25 as well as during the entire FY-25. Moreover, B2B cable and wire sales (domestic and exports) constituted 45.57% of the company’s Q4 FY-25 revenue, and 42.33% of its FY-25 revenue.

*Gross revenue referes to the sum of segmental revenues without deducting any inter-segmental revenue.

In its investor presentation for its FY-25 financials, KEI shared that in Q4 of FY-25, domestic B2B sales of cables and wires was Rs. 760 crore against Rs. 676 crore in Q4 of FY-24. Moreover, considering only EHV cable sales, KEI clocked Rs. 115 crore in Q4 of FY-25 against Rs. 220 crore in Q4 of FY-24. During the entire FY-25, KEI’s domestic B2B sales of cables and wires stood at Rs. 2,758 crore against Rs. 2,236 crore in FY-24. Further, KEI’s EHV cable sales (domestic B2B) were reported as Rs. 308 crore in FY-25, which is considerably lower than its FY-24 EHV cable domestic B2B sales of Rs. 622 crore.

Notably, KEI’s total B2B cable and wire sales (inclusive of exports) during Q4 of FY-25 was up by 28.36% YoY as compared to Q4 of FY-24. Moreover, this figure grew by 14.06% from FY-24 to FY-25.

Therefore, it can be said that despite KEI’s EHV cable sales falling YoY, the company’s total B2B sales showed impressive increase during Q4 of FY-25 and the entire FY-25.

Apart from this, quarterly cable and wire sales through KEI’s dealers grew by 41.85% YoY during Q4 of FY-25. As for the full FY-25, KEI’s cable and wire sales through its dealers was up by 34.94%.

Stainless Steel Wire: KEI’s Q4 revenue from this segment shrunk by 19.94% to Rs. 46.16 crore in FY-25 from Rs. 57.66 crore during FY-24. Considering the entire financial year, the drop in KEI’s SS wire revenue was slight, i-e by 2.83% to Rs. 215.93 crore in FY-25 from Rs. 222.23 crore earned during FY-24.

Moreover, SS wire exports accounted for Rs. 23 crore in Q4 of FY-25, and for Rs. 104 crore in FY-25. Thus, about half of the company’s Q4 FY-25 revenue in this segment was formed by export sales.

EPC Projects: The company’s revenue from this segment suffered the most on a YoY basis. KEI’s Q4 revenue from its EPC projects vertical was down by a sobering 34.38%, to Rs. 223.40 crore in FY-25 from Rs. 340.46 crore in FY-24. This drop was even more pronounced from FY-24 to FY-25. KEI’s revenue from this segment plummeted steeply by 45.99% to Rs. 656.24 crore in FY-25 from Rs. 1,215.11 crore logged for FY-24.

Revenue from export in this segment stood at Rs. 16 crore during Q4 of FY-25 and at Rs. 105 crore during the entire FY-25.

KEI’s Stock Gains 3%, Volume of Trades Up After Announcement of Results

KEI’s shares were trading at Rs. 3,295.30 apiece a day after the company made its FY-25 results public. This represents a 3.17% increase from KEI’s share price of Rs. 3,193.90 on the day its FY-25 financials were announced.

Volume of KEI’s share trades grew to 18,00,000 on the trading day after the company posted its FY-25 financials. This represents increase to 2.24 times of the share trades volume on the day of announcement of KEI’s results.

About KEI Industries Limited: KEI Industries was founded in 1968 as a partnership firm. It was converted into a Limited company in 1992. The company has manufacturing facilities in Bhiwadi, Chopanki & Pathredi in Rajasthan and Silvassa in Dadra & Nagar Haveli. KEI is primarily a cable and wire company, dealing in Low Tension (LT) cables, High Tension (HT) and Extra High Voltage (EHV), control and instrumentation cables, specialty cables, elastomeric / rubber cables, submersible cables, flexible & house wires.