Havells’ Announces 400% Dividend, Company Posts Q3 FY-25 Financial Results

Havells India Ltd’s. [NSE: HAVELLS, BOM: 517354], Board of Directors has recommended dividend to its shareholders for Q3 of FY-25. The company also announced its financial results for third quarter of FY-25.

Board of Directors Recommends Q3 FY-25 Dividend to Shareholders

Havells India’s Board of Directors has recommended paying a 400% dividend on the face value of each share, which is Re. 1. This equates to Rs. 4 per equity share. This dividend will be paid out to the shareholders on or before 30 days of its declaration i.e 14th February 2025.

Havells India’s Q3 FY-25 Standalone Financial Results

During Q3 of FY-25, Havells India reported a standalone revenue of Rs. 4,882.50 crore and a Profit After Tax (PAT) of Rs. 282.81 crore.

Havells India’s Q3 FY-25 Consolidated Financial Numbers

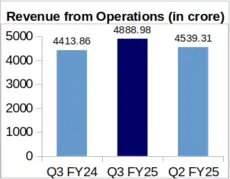

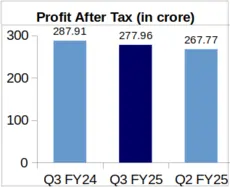

YoY Analysis of Havells’ Financials: Q3 FY-25 vs. Q3 FY-24

On Year-over-Year (YoY) basis, the company’s revenue jumped by 10.76% to Rs. 4,888.98 crore during Q3 of FY-25 from Rs. 4,413.86 crore during Q3 of FY-24. On the other hand, Havells India’s Q3 FY-25 PAT decreased by 3.46% YoY to Rs. 277.96 crore from Rs. 287.91 crore PAT earned during Q3 of FY-24.

The company’s Earnings Per Share (EPS) stood at Rs. 4.43 during Q3 of FY-25 against Rs. 4.59 during Q3 of FY-24.

Havells India’s QoQ Financial Numbers: Q3 FY-25 vs. Q2 FY-25

Havells India’s Quarter-over-Quarter (QoQ) revenue increased by 7.70% from Rs. 4,539.31 crore recorded for Q2 of FY-25. Havells India’s PAT during Q2 FY-25 stood at Rs. 267.77 crore, this reflects a QoQ increase of 3.81% in the company’s PAT during Q3 FY-25.

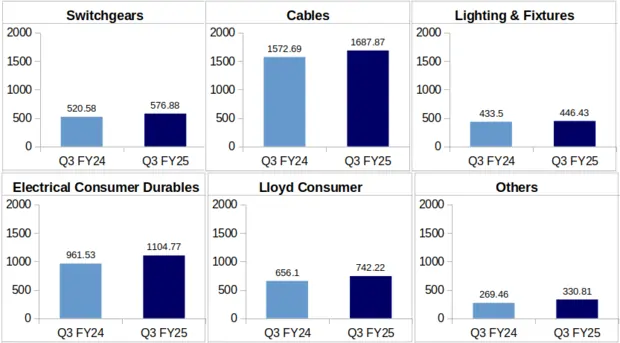

Havells India’s Segment-Wise Revenue Comparison

Switchgear: The company’s quarterly revenue from its Switchgear segment increased by 10.81% YoY to Rs. 576.88 crore during Q3 of FY-25 from Rs. 520.58 crore in Q3 of FY-24.

The company mentioned in its investor presentation for Q3 of FY-25 that growth in domestic switchgear was driven by demand from real estate sector, whereas growth in industrial switchgear remained subdued during the quarter.

Cables: Havells India earned a revenue of Rs. 1,687.87 crore from its Cables business during Q3 FY-25 against Rs. 1,572.69 crore logged for Q3 of FY-24. This increase represents a YoY growth of 7.32% in the company’s quarterly cable segment revenue.

The company mentioned in its investor presentation “Copper price softness during the quarter led to channel destocking in wires, thus impacting revenue”.

Havells India mentioned that the company observed strong growth in power cables. The company’s Tumkur plant which is still in ramp-up stage has contributed to this growth. The development of this facility was announced by the company during Q3 of FY-24 with a capex of Rs. 300 crore.

Lighting & Fixtures: The company reported a revenue of Rs. 446.43 crore from its Lighting & Fixtures business during Q3 FY-25, representing a minor YoY increase of 2.98% from Rs. 433.50 crore clocked for Q3 of FY-24.

The company mentioned that there was an increase in volume of sales in the Lighting segment during Q3 of FY-25 but revenue was impacted by LED price deflation.

Electrical Consumer Durables: This segment of the company contributed an amount of Rs. 1,104.77 crore in Havells India’s total revenue during Q3 of FY-25 against Rs. 961.53 crore contributed during Q3 of FY-24. This growth in numbers showed an increase of 14.90% in the company’s revenue YoY from its Electrical Consumer Durables segment.

Lloyd Consumer: Havells India reported a revenue of Rs. 742.22 crore from its Lloyd Consumer segment during Q3 of FY-25, representing a YoY increase of 13.13 % from Rs. 656.10 crore logged from this segment during Q3 of FY-24.

Others: This segment consists of Havells India’s other products such as motors, water pumps and purifiers. Q3 revenue from this segment grew by 22.77% YoY, increasing to Rs. 330.81 crore in FY-25 from Rs. 269.46 crore in FY-24.

Havells India’s Share Price 2% Up After Announcing Q3 FY-25 Financials

Havells India’s share price increased by 2.05% on the day of announcement of its Q3 FY-25 financials as compared to the share prices on the previous trading day. The company’s shares were trading at Rs. 1,526.95 apiece before the announcement of results and at Rs. 1,558.25 apiece on the day of announcement of its Q3 FY-25 financials.

Havells India’s Upcoming Refrigerator Manufacturing Plant in Rajasthan

Havells India will be investing Rs. 480 crore for setting up a refrigerator manufacturing plant in Ghiloth, Rajasthan. This upcoming plant is expected to manufacture about 14 lakh units of refrigerator every year and will be funded through the company’s internal accruals.

Havells India is expected to commence operations at this plant by Q2 of FY-27.

About Havells India Limited: Havells India Limited is a Noida-based company, which is one of the biggest players in the Indian FMEG market. Its product range includes Industrial and domestic Circuit Protection Switchgear, Modular Switches, Cables and wires, Fans, Power Capacitors, and Luminaires for Domestic, Commercial, and industrial applications, Water Heaters, Motors, and Domestic Appliances.