Cords Cable’s Q2 FY-25 Results: Revenue Zooms 26% YoY

Cords Cable Industries Ltd., a leading Speciality and LV cables manufacturer, has announced its financials for Q2 of FY-25.

Analysis of Cords’ Q2 FY-25 Financial Numbers

YoY Comparison of Cords Cable’s Financials: Q2 FY-25 vs. Q2 FY-24

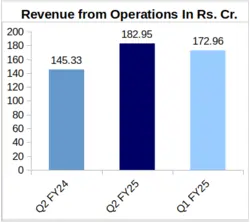

For Q2 of FY-25, Cords’ top line stood at Rs. 182.95 crore against Rs. 145.33 crore which was recorded for Q2 of FY-24. Therefore the company has exhibited a robust 25.89% Year-over-Year (YoY) growth in its Q2 revenue.

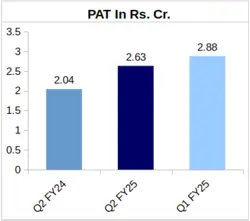

This upward trend was echoed by the company’s Q2 profit. Cords’ Q2 Profit After Tax (PAT) rose by 28.92% YoY, to Rs. 2.63 crore in FY-25 from Rs. 2.04 crore in FY-24.

Cords Cable Ind.’s Earnings Per Share (EPS) witnessed a proportional increase, to Rs. 2.02 in Q2 of FY-25 from Rs. 1.57 in Q2 of FY-24.

QoQ Comparison of Cords’ Financial Figures: Q2 FY-25 vs. Q1 FY-25

Quarter-over-Quarter (QoQ), Cords’ revenue exhibited a slight growth of 5.78% from its Q1 FY-25 top line of Rs. 172.96 crore.

However, the company’s profit slipped by 8.68% QoQ, from the Rs. 2.88 crore PAT reported for Q1 of FY-25.

“Regular Flow of Big Orders from Existing Sectors” – Cords’ Management

While speaking to CableCommunity, Mr. Sandeep Kumar, Cords Cable Industries’ CFO, said, “During the half-year ended 30th September 2024, the company’s performance has been good an on growth trajectory. Due to buoyancy in demand, the company has a regular flow of big orders from all the existing as well as new sectors”. Mr. Kumar also expressed that erratic trends in raw material prices are putting some pressure on the company’s profit in percentage terms. However, Cords is improving its bottom-line in absolute numbers with economies of scale.

Cords Rated ‘Stable’ on Long-Term & Short-Term by CareEdge Ratings

Cords Cable Industries has received ‘CARE BBB (Outlook: Stable)’ long-term credit rating, and ‘CARE A3; Stable’ short-term credit rating from CareEdge Ratings. As per CareEdge Ratings, “The ‘Stable’ outlook reflects that entity [Cords] shall sustain its growth in operational performance over the medium term on the back of company’s established position in the control and instrumentation cables market along with sustainable financial risk profile”.

CareEdge Ratings has highlighted the company’s positive factors such as Cords’ total operating income of over Rs. 650 crore and a Return on Capital Employed (ROCE) of 13%.

About Cords Cable: Delhi-headquartered Cords Cable Industries was established in 1987, and has manufacturing facilities at Chopanki and Kahrani in Rajasthan. The company’s portfolio comprises Instrumentation cables, Thermocouple cables, Power cables, Control cables, and other Special cables to provide solutions for industrial connectivity requirements such as Railway Signalling, SCADA, DCS, and other plant instrumentation requirements. The company’s turnover for FY-24 stood at Rs. 627.74 crore.