Polycab’s Q2 FY-25 Results: Top Line Jumps 30%, Cable & Wire Revenue Grows 24% YoY

Polycab India Ltd. (PIL) [NSE: POLYCAB, BOM: 542652], a major Indian manufacturer of wires and cables, has announced its financials for Q2 of FY-25.

Polycab India’s Q2 FY-25 Standalone Financials

During Q2 of FY-25, Polycab India earned a standalone revenue of Rs. 5,365.99 crore from operations and the company’s Profit After Tax (PAT) for the period stood at Rs. 430.65 crore.

Analysis of Polycab’s Q2 FY-25 Financial Figures

YoY Comparison of Polycab India’s Financials: Q2 FY-25 vs. Q2 FY-24

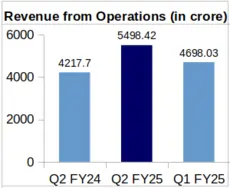

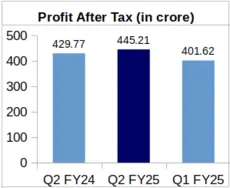

Polycab India’s revenue rose by 30.37% YoY to Rs. 5,498.42 crore during Q2 of FY-25 from Rs. 4,217.70 crore earned in Q2 of FY-24. Q2 PAT of the company also showed an increase of 3.59% to Rs. 445.21 crore during FY-25 from Rs. 429.77 crore in FY-24.

Correspondingly, the company’s Earnings Per Share (EPS) increased by 3.07% to Rs. 29.25 during Q2 of FY-25 from Rs. 28.38 reported for Q2 of FY-24.

QoQ Analysis of Polycab India’s Financial Figures: Q2 FY-25 vs. Q1 FY-25

Polycab India’s revenue increased Quarter-over-Quarter (QoQ) by 17.04% from Rs. 4,698.03 crore recorded for Q1 of FY-25. Polycab India’s PAT during Q1 of FY-25 stood at Rs. 401.62 crore, this reflects a QoQ increase of 10.85% in the company’s Q2 FY-25 PAT.

Polycab India’s Segment-Wise Revenue Analysis

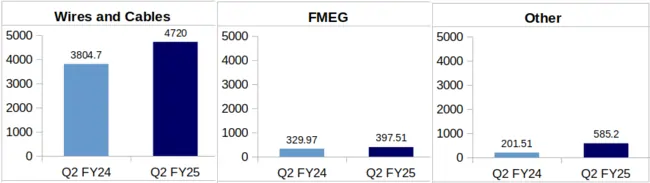

Wires and Cables: The company earned a revenue of Rs. 4,720 crore from its Wires & Cables segment during Q2 of FY-25 against Rs. 3,804.70 crore logged for Q2 of FY-24. This increase represents a YoY growth of 24.06% in the company’s quarterly Wires & Cables segment revenue.

According to the company’s press release dated 17th October 2024, growth in Wires & Cables segment is “…driven by favorable movement in commodity prices and continued strong demand environment”.

FMEG: Polycab India’s quarterly revenue from Fast Moving Electrical Goods (FMEG) segment jumped by 20.47% to Rs. 397.51 crore during Q2 of FY-25 against Rs. 329.97 crore during Q2 of FY-24.

Polycab India highlighted that growth in its FMEG segment during the quarter was primarily driven by the fans segment. Additionally, the contribution from online sales in the fans business saw a significant increase.

Others: Polycab’s ‘other’ segment mainly consists of its EPC business. The company’s revenue from this segment stood at Rs. 585.20 crore in Q2 of FY-25 which is 2.90 times the company’s Q2 FY-24 revenue of Rs. 201.51 crore.

Polycab India’s Rs. 1,100 Cr. CapEx Plan for Q2 FY-25

During the company’s earnings call for Q2 FY-25, Mr. Chirayu Upadhyaya, Head of Investor Relations at Polycab India, mentioned that the company will be investing Rs. 1,000 crore to Rs. 1,100 crore as capital expenditure (CapEx) during FY-25. Out of this, Rs. 570 crore has already been invested in the first half of FY-25. A significant portion of the CapEx will be allocated to Polycab India’s cables and wires business. About the areas in which this CapEx will be utilised, he added, “….it will be spread across the different types of cables that we have…domestic cables, which are generating very good demand, the cables that we export, the special purpose cables as well and the EHV facility which we are setting up”.

The under-progress EHV facility mentioned above by Mr. Upadhyaya is expected to be operational by the end of FY-26.

Mr. Upadhyaya further emphasized that the company plans to allocate Rs. 1,000 crore to Rs. 1,100 crore annually in CapEx over the next three years.

Polycab India Limited: Polycab India Limited was established in 1996. The company’s wire and cable portfolio includes power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, communication cables, and others including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables and green wires.