RR Kabel’s Q2 FY26 Financials: Revenue Up 20%, PAT Grows to 2.35x YoY

RR Kabel Ltd. [NSE: RRKABEL, BSE: 543981], an Indian manufacturer of cables, wires, and Fast Moving Electrical Goods (FMEG) products, has made its Q2 FY26 financials public.

Highest-ever Half Yearly Revenue & PAT – RR Kabel COO

During the company’s earnings call for Q2 FY26, Mr. Rajesh Jain, RR Kabel’s Chief Operating Officer, said that the company recorded its highest-ever revenue and Profit After Tax (PAT) during H1 of FY26. During H1 of FY26, RR Kabel clocked a consolidated revenue of Rs. 4,222.36 crore, marking a 16.70% jump from its H1 FY25 revenue. Further, RR Kabel’s H1 FY26 PAT stood at Rs. 206.02 crore, which is 80.86% higher than its H1 FY25 PAT.

RR Kabel’s Standalone Q2 FY26 Financial Figures

RR Kabel reported a revenue of Rs. 2,163.77 crore during Q2 of FY26, and a corresponding Profit After Tax (PAT) of Rs. 38.62 crore on a standalone basis.

RR Kabel’s Consolidated Financial Performance for Q2 of FY26

YoY Comparison of RR Kabel’s Numbers: Q2 FY26 vs. Q2 FY25

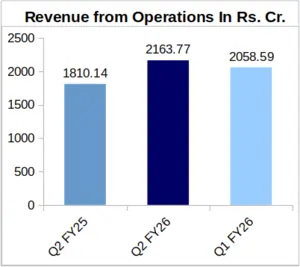

RR Kabel generated a consolidated topline of Rs. 2,163.77 crore from its operations during Q2 of FY26, which marks a remarkable 19.54% Year-over-Year (YoY) jump. During Q2 of FY25, RR Kabel’s revenue was reported as Rs. 1,810.14 crore. Out of the revenue generated in Q2 of FY26, exports accounted for 27% whereas domestic sales brought in the remaining 73% revenue.

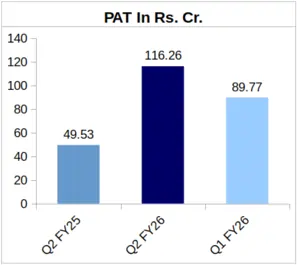

Correspondingly, the company’s Q2 FY26 PAT was 2.35 times its Q2 FY25 PAT. For the quarter ended 30th September 2025, RR Kabel’s PAT was Rs. 116.26 crore against Rs. 49.53 crore for the corresponding quarter in the previous fiscal.

Additionally, Earning Per Share (EPS) of the company was reported as Rs. 10.28 in Q2 of FY26, up from Rs. 4.39 logged for Q2 of FY25.

QoQ Analysis of RR Kabel’s Financials: Q2 FY25 vs. Q1 FY26

On a Quarter-over-Quarter (QoQ) basis, RR Kabel’s revenue rose by 5.11% from Rs. 2,058.59 crore logged for Q1 of FY26. PAT of the company also showed an upward trend QoQ, growing by 29.51% from Rs. 89.77 crore which was reported as quarterly profit for Q1 of FY26.

RR Kabel’s Segment-Wise Revenue Performance: Q2 FY26 vs. Q2 FY25

Rs. in Cr.

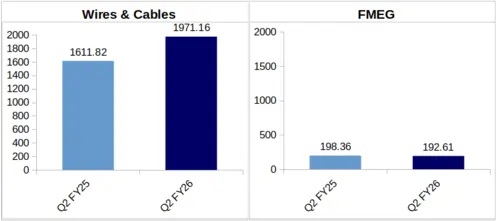

Wires & Cables: This business vertical usually constitutes the bulk of RR Kabel’s revenue, and in Q2 of FY26 this segment brought in 91.10% of the company’s quarterly revenue. In Q2 of FY26, RR Kabel’s revenue from this segment amounted to Rs. 1,971.16 crore, which is 22.29% higher YoY. In Q2 of FY25, the company’s wires and cables segment revenue stood at Rs. 1,611.82 crore. The company’s investor presentation mentioned that Q2 volume in this segment was up by 16% YoY.

Fast Moving Electrical Goods: RR Kabel has a sizeable FMEG portfolio, and in Q2 of FY26, FMEG sales brought in Rs. 192.61 crore of segmental revenue, against Rs. 198.36 crore in Q2 of FY25. Therefore, there has been a slight YoY dip by 2.90% in the company’s Q2 FMEG revenue.

Speaking about the company’s FMEG segment’s Q2 FY26 performance, Mr. Mahendrakumar Kabra, RR Kabel’s MD, said, “Market conditions remained challenging, particularly in fans and appliances, while switches and lighting products have performed better. Despite softer demand and seasonal headwinds, we have maintained steady performance, reflecting operational discipline and the strength of our diversified portfolio”.

Rs. 1,200 Cr. Expansion Plan On Track

During the company’s Q2 FY26 earnings call Mr. Rajesh Jain shared that its Rs. 1,200 crore expansion plan is progressing as planned. The company has earmarked this investment for the next 3 years, that is from FY26 to FY28 specifically for its wires and cables vertical. Out of this amount, 80% will be invested specifically for RR Kabel’s cable segment, whereas the rest will be used to expand the production of wires.

About RR Kabel Ltd.: Mumbai-headquartered RR Kabel is a part of RR Global and is a manufacturer of wires, cables, and Fast Moving Electrical Goods (FMEG) in India. The company has manufacturing plants at Silvassa and Waghodia.