RR Kabel Q1 FY26 Revenue Up 14%, Rs. 1,200 CapEx for Next 3 Years

RR Kabel Ltd. [NSE: RRKABEL, BSE: 543981], an Indian manufacturer of wires and cables and Fast Moving Electrical Goods (FMEG) has posted its financial results for the quarter ended 30th June 2025.

RR Kabel’s Standalone Financials for Q1 FY-26

During Q1 of FY-26, RR Kabel reported a standalone revenue of Rs. 2,058.59 crore and a Profit After Tax (PAT) of Rs. 88.76 crore.

RR Kabel’s Consolidated Financial Numbers for Q1 FY26

YoY Comparison of RR Kabel’s Financial Performance: Q1 FY26 vs Q1 FY25

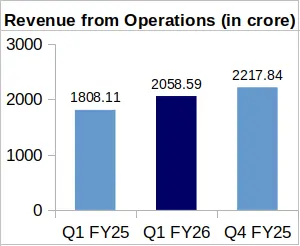

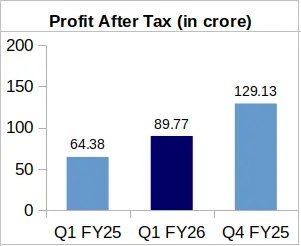

On Year-over-Year (YoY) basis, RR Kabel’s Q1 FY26 revenue jumped by 13.85% to Rs. 2,058.59 crore from Rs. 1,808.11 crore revenue reported for Q1 of FY25. The company’s PAT increased to Rs. 89.77 crore in Q1 of FY26 from RR Kabel’s Rs. 64.38 crore PAT for Q1 of FY25. This reflects a remarkable YoY increase of 39.44% in the company’s net profit.

Earning Per Share (EPS) of the company was Rs. 7.94 during Q1 of FY26 against Rs. 5.71 during Q1 of FY25.

QoQ Analysis of RR Kabel’s Financial Numbers: Q1 FY26 vs. Q1 FY25

On Quarter-over-Quarter (QoQ) basis, RR Kabel’s revenue dropped slightly by 7.18% from Rs. 2,217.84 crore, which was logged for Q4 of FY25. Following suit, the company’s PAT also fell by 30.48% from Rs. 129.13 crore reported by the company during Q4 of FY25.

Segment-Wise Revenue Comparison of RR Kabel

in Rs. Cr.

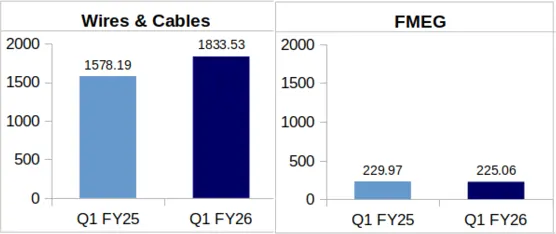

Wires & Cables: The company’s revenue from this segment stood at Rs. 1,833.53 crore in Q1 of FY26, representing a YoY increase of 16.18% from company’s Q1 FY25 revenue of Rs. 1,578.19 crore.

Commenting on the growth in this segment, Mr. Rajesh Jain, Chief Financial Officer of RR Kabel, said “This performance was supported by modest volume growth and better realization. Geographically, domestic revenue grew mainly due to wire business while cable remained subdued due to spill over impact”.

Fast Moving Electrical Goods: This segment of the company earned a revenue of Rs. 225.06 crore during Q1 of FY26 which is 2.14% lower YoY than Rs. 229.97 crore revenue during Q1 of FY25.

As per Mr. Rajesh Jain “Fan segment has underplayed due to early monsoon having a tad impact on overall revenue”.

RR Kabel Eyes Rs. 4,500 Cr. Wire & Cable Growth with Rs. 1,200 Crore CapEx

The company has outlined a Capital Expenditure (CapEx) plan of Rs. 1,200 crore over the next three years for its wires and cables vertical. This investment is a part of the company’s growth strategy for the FY26-FY28 period, which has been dubbed as Project RRise. For FY26, the company has earmarked Rs. 300 crore, of which Rs. 50–75 crore has already been invested during the first quarter.

During the company’s Q1 FY26 earnings call, Mr. Jain added that once the full Rs. 1,200 crore investment is operationalised, the company expects to grow its wire and cable segment annual revenue by approximately Rs. 4,500 crore.

About RR Kabel Ltd.: Mumbai-headquartered RR Kabel is a part of RR Global and is a manufacturer of wires, cables, and Fast Moving Electrical Goods (FMEG) in India. The company has manufacturing plants at Silvassa and Waghodia.