Polycab India Q1 FY-25 Financials: Revenue up 21% YoY

Polycab India Limited (PIL) [NSE: POLYCAB, BOM: 542652], a prominent player in electrical cables and wires industry, has released its financial results for the first quarter of fiscal year 2025.

Polycab India’s Q1 FY-25 Standalone Revenue

Polycab India reported a standalone revenue of Rs. 4,601.48 crore from operations during Q1 of FY-25 and a Profit after Tax (PAT) of Rs. 387.67 crore during Q1 of FY-25.

Earnings Per Share (EPS) of the company stood at Rs. 25.80 during initial quarter of FY-25.

Consolidated Revenue & PAT Analysis of Polycab India for Q1 FY-25

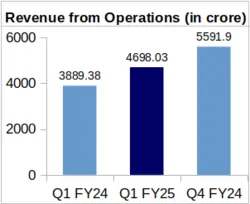

YoY Comparison of Polycab India Financial Numbers: Q1 FY-25 vs. Q1 FY-24

Polycab’s Q1 FY-25 revenue from operations stood at Rs. 4,698.03 crore, marking an YoY increase of 20.79% from Rs. 3,889.38 crore, earned during initial quarter of FY-24.

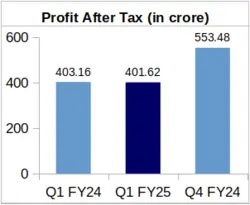

However, the company’s PAT remained almost flat YoY, with a decrease of 0.38% YoY to Rs. 401.62 crore during Q1 of FY-25 from Rs. 403.16 crore in Q1 of FY-24.

EPS of the company was marginally down to Rs. 26.35 in Q1 of FY-25 against Rs. 26.68 in Q1 of FY-24.

QoQ Result Comparison of Polycab India: Q1 FY-25 vs. Q4 FY-24

The company’s revenue from operations was down by 16% from its Q4 FY-24 revenue of Rs. 5,591.90 crore. Polycab India’s PAT also showed a decrease of 27.44% from Rs. 553.48 crore PAT earned during Q4 of FY-24.

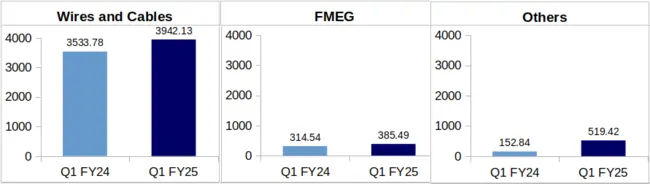

Segment-Wise Revenue Comparison of Polycab India

Rs. in Cr.

Wires and Cables: This segment of the company bought in a revenue of Rs. 3,942.13 crore during Q1 of FY-25 against Rs. 3,533.78 crore during Q1 of FY-24. This increase in revenue showed a growth of 11.56% YoY.

The company mentioned in its investor presentation for Q1 FY-25 financials that fluctuations in commodity prices led to fall in channel demand during the quarter. This impacted Polycab’s Wires and Cables segment revenue, resulting in lower than expected revenue growth for Q1 FY-25.

FMEG: The company’s revenue from FMEG segment increased by 22.56% to Rs. 385.49 crore during Q1 of FY-25 from Rs. 314.54 crore in Q1 of FY-24. The company recorded a robust demand of fans because of intense summer in various parts of the country.

Others: This segment mostly consists of Polycab’s EPC portfolio. The company’s revenue from this segment stood at Rs. 519.42 crore in Q1 of FY-25 which is 3.40 times the company’s Q1 FY-24 revenue of Rs. 152.84 crore. This growth was driven by execution of EPC orders.

Polycab Outlays Rs. 1,100 Cr. CapEx for FY-25, Rs. 280 Cr. Already Invested in Q1 FY-25

Mentioning the company’s CapEx plans, Mr. Chirayu Upadhyaya, Head of Investor Relations in Polycab India Ltd. said that the company will invest about Rs. 1,000 crore to Rs. 1,100 crore during FY-25. He mentioned that out of this, Polycab India had already invested about Rs. 280 crore as CapEx during first quarter of FY-25.

Describing the demand in cables & wires sector, Mr. Upadhyaya added “We believe the demand momentum in the domestic cables & wires business is very strong and believe will continue to be the case for many years to come”.

Polycab India Stock Over 3% Down After Announcing Q1 FY-25 Financials

Polycab India’s share price has decreased by 3.09% after the announcement of its Q1 FY-25 financial results. Additionally, the company’s volume of share trades peaked at 15,46,000 trades on the day Polycab announced its Q1 FY-25 financials against 11,00,000 trades after the announcement of results.

Polycab Receives ‘Positive’ Credit Ratings from Ind-Ra

Polycab India has been rated IND AA by India Ratings and Research (Ind-Ra) on long term basis and IND A1+ on short term basis. These ratings of the company indicate that the company has strong financial credibility and low credit risk.

About Polycab India Limited: Polycab India Limited was established in 1996. The company’s wire and cable portfolio includes power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, communication cables, and others including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables and green wires.