KEC International’s Q1 FY-25 Financials: PAT Soars 106% YoY

KEC International Limited [NSE: KEC, BOM: 532714] has released its financial results for Q1 FY-25.

KEC’s Standalone Financials for Q1 FY-25

KEC International’s standalone revenue from operations for Q1 FY-25 was Rs. 3,888.25 crore. The company reported Profit over Tax (PAT) of Rs. 32.15 crore for Q1 FY-25.

KEC’s Earnings per Share (EPS) for the quarter were Rs. 1.25.

KEC’s Consolidated Financial Results for Q1 FY-25

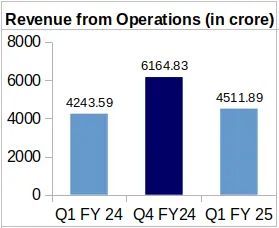

YoY Top Line grows by 6.32%; Falls QoQ by 26%

KEC’s Revenue from Operations for Q1 FY-25 and Q1 FY-24 stood at Rs. 4,511.89 crore and Rs. 4,243.59 crore, respectively, showing a YoY growth of 6.32%.

However, the top line saw a significant Quarter-on-Quarter (QoQ) dip of 26.78% in Q1 FY- 25 from its Q4 FY-24 revenue, which stood at Rs. 6,164.83 crore.

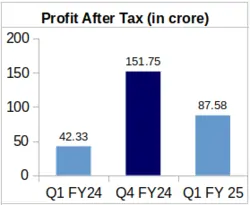

Q1 FY25 PAT Jumps by 106% YoY, Dips by 42% QoQ

YoY PAT increased by 106.9% to Rs. 87.58 crore in Q1 FY-25 from Rs. 42.33 crore in Q1 FY-24. However, the consecutive quarters demonstrated a significant dip in profit by 42.3% in Q1 FY-25 from Rs. 151.75 crore during Q4 FY-24.

KEC’s EPS for Q1 FY-25 was Rs. 3.41, whereas, EPS of Q1 FY-24 was Rs. 1.65.

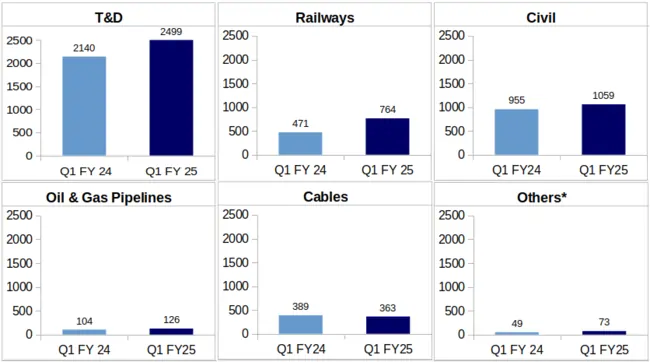

Segment-wise Revenue Comparison of KEC

Rs. in Cr.

KEC’s T&D Segment’s Share in Revenue Grows by 5% points, Segment Grows 17%

KEC’s T&D segmental revenue for Q1 FY-25 was Rs. 2,499 crore, which is 55.39% of the net sales for the quarter. The share of T&D segmental revenue for Q1 FY-24 at Rs. 2,140 crore, with the net sales as 50.43%, marking 5 percentage points increase in share of overall revenue. During the company’s earning’s call for its Q1 FY-25 results, Mr. Vimal Kejrwal, Managing Director and Chief Executive Officer, KEC International attributed this growth to “substantial investments being planned to enable the green energy transition agenda”.

KEC’s Non-T&D Segments

KEC’s segments apart from T&D comprise civil, railways, oil and gas pipelines, cables and its ‘Others’ segment, which includes the company’s solar/cabling business.

Civil segment: KEC’s civil segment had an overall YoY growth of 11%. The revenue of the civil segment was Rs. 1,059 crore for Q1 FY-25 and Rs. 955 crore for Q1 FY-24. Mr. Kejriwal mentioned that the civil order book of KEC is over Rs. 10,000 crores as on 30th June 2024. He also highlighted in the Earning’s Call that the growth in this segment was impacted by “severe labor shortage during the quarter due to elections”.

Railway Segment: KEC’s railway segment’s revenue dropped by 38% on YoY basis, to Rs. 471 crore in Q1 FY-25 from Rs. 764 crore during Q1 FY-24.

Oil and Gas Pipelines segment: Revenue from Oil and Gas Pipelines segment of KEC increased handsomely by 21% to Rs. 126 crore for Q1 FY-25 from Rs. 104 crore for Q1 FY-24.

Cable Segment: KEC’s Cable segment revenue had a YoY dip in revenue by 7% to Rs. 363 crore in Q1 FY-25 from Rs. 389 crore in Q1 FY-24.

Mr. Kejriwal added, “The [cables] business continues to maintain a sustained order book momentum across diverse segments, including T&D, railways, metro, solar and metals”. He also added that due to government investments, increasing demand in industrial sectors and real estate, and green energy initiatives, “the cable industry is set for significant growth projected to grow at a CAGR of 10% plus till FY ’28”.

Others: KEC’s ‘Others’ segment’s revenue which consists of the company’s ‘solar/cabling’ business, demonstrated an increase by 50% to Rs. 73 crore in Q1 FY-25 from Rs. 49 crore in Q1 FY-24.

KEC’s Future Plans for Upcoming Quarters

KEC to Start Aluminium Conductor Production by Q3 FY-25

KEC will start aluminium conductor production at its Aluminium Conductor Plant in Vadodara by Q3 FY25, according to Mr. Kejriwal. The foundation stone for this plant was laid in February 2024. He also stated “We are progressing well on setting up the fully integrated manufacturing line for aluminum conductors”.

KEC to Subsidiarise Cable Segment

KEC is also planning to subsidiarise its cable segment in order to “capitalize on the strong performance and the market potential and to bring out sharper focus to our cable business”. This branching of the cable segment will be done without affecting the economic aspect of stakeholders.

KEC’s YTD Order Intake at 7,600 crore

Mr. Kejriwal also mentioned that KEC’s order intake for Q1 FY-25 was “well-diversified” and the company has a “strong order book of INR 32,715 crores as on date. With this, our order book plus L1 position stands at a record level of over INR 42,000 crores”. The Year to Date (YTD) order intake was Rs. 7,600 crore for all segments, both T&D and Non-T&D segments. Mr. Kejriwal added, “…combined with a substantial tender pipeline exceeding INR 1,50,000 crores, we are well-positioned to deliver sustained growth in the coming quarters”.

About KEC Inernational Limited: Headquarted in Maharashtra, KEC International is an EPC player with a significant name and presence in around 100 countries. Its segments include Urban, Infrastructure, Solar, Smart Infrastructure, Civil, Cable sector, Power Transmission and Distribution, Railways, and Oil and Gas pipelines.