HFCL Q1 FY-25 Financial Results: Revenue up 16%, PAT Grows 46% YoY

Himachal Futuristic Communications Limited (HFCL) [NSE: HFCL, BOM: 500183], an Indian manufacturer of Optical Fibre Cables (OFCs), has announced its financial results for Q1 of FY-25.

HFCL’s Standalone Q1 FY-25 Financial Results

HFCL reported a revenue of Rs. 1,065.52 crore from operations during Q1 of FY-25. The company recorded a Profit After Tax (PAT) of Rs. 113.98 crore in initial quarter of FY-25.

HFCL’s Earnings Per Share (EPS) stood at Rs. 0.79 during Q1 of FY-25.

HFCL’s Q1 FY-25 Consolidated Financial Results

YoY Financial Numbers of Himachal Futuristic Communications: Q1 FY-25 vs. Q1 FY-24

On a Year-over-Year (YoY) basis, the company’s revenue from operations increased by 16.38% to Rs. 1,158.24 crore during Q1 of FY-25 from Rs. 995.19 crore earned during Q1 of FY-24.

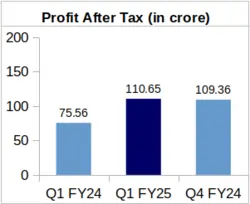

The company’s Q1 FY-25 PAT also showed an outstanding increase of 46.44% to Rs. 110.65 crore from Rs. 75.56 crore PAT during Q1 of FY-24.

HFCL’s EPS stood at Rs. 0.77 during Q1 of FY-25 against Rs. 0.49 during Q1 of FY-24.

QoQ Financial Figures of HFCL: Q1 FY-25 vs. Q4 FY-24

HFCL’s revenue from operations for Q1 of FY-25 was down by 12.66% from Rs. 1,326.06 crore revenue earned during last quarter of FY-24. The company’s Q1 FY-25 PAT remained almost same, increasing by a meagre 1.18% from its Rs. 109.36 crore PAT for Q4 of FY-24.

Segment-Wise Revenue Comparison of HFCL

Rs. in Cr.

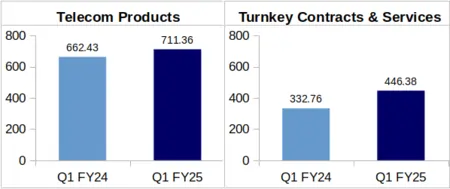

Telecom Products: This segment of the company brought in a revenue of Rs. 711.36 crore during Q1 of FY-25 against Rs. 662.43 crore during Q1 of FY-24. This showed a YoY growth of 7.39% in the company’s revenue from its Telecom Products segment.

Turnkey Contracts and Services: The company’s revenue from Turnkey Contracts and Services segment increased by 34.14% to Rs. 446.38 crore during Q1 of FY-25 from Rs. 332.76 crore in Q1 of FY-24.

HFCL Stock 6% Up After Announcing Q1 FY-25 Financials

On the day of announcement of HFCL’s Q1 FY-25 financial results, the company’s share price stood at Rs. 119.46 apiece, which is 6.16% higher as compared to HFCL’s share price of Rs. 112.53 apiece on the previous trading day. Volume of HFCL’s share trades peaked at 4,25,72,000 trades on the day HFCL announced its Q1 FY-25 financials against 2,56,44,000 trades on the trading day preceding the announcement of results.

Telecom Sector Contributes Most to HFCL’s Q1 FY-25 Revenue, Order Book at 6,776 Cr.

In its earnings presentation for Q1 of FY-25, HFCL reported that telecom sector contributed 96% of the company’s revenue, while the defense sector accounted for 2%. Further, works in the railways sector contributed the remaining 2%.

HFCL further mentioned that the company’s order book has reached Rs. 6,776 crore as on 30th June 2024. This includes Rs. 3,092 crore worth of Network Services orders, Rs. 2,011 crore of Operations & Maintenance orders, and Rs. 1,673 crore worth of orders for HFCL’s products.

Commenting on the company’s financial performance, Mr. Mahendra Nahata, Managing Director of HFCL said “HFCL’s investments in R&D for Telecom & Networking Products, Defence equipment and Optical fiber cables, capacity expansion and backward integration have positioned us to leverage these opportunities in the upcoming quarters”.

He further added that Indian defence sector is also experiencing growth because of the country’s prioritisation of local manufacturing. “We have developed a comprehensive portfolio of defence products which is gaining traction both in domestic and in select global markets”, he said.

About HFCL: HFCL was founded in 1987, and has its headquarters in Delhi. It caters primarily to the communication sector through optical fibre cables and transmission & access equipment manufacturing. HFCL has optical fibre cables manufacturing facilities in Goa and Hyderabad. HTL Limited, the company’s subsidiary, also has an optical fibre cables manufacturing plant in Chennai. The company has a Cable Reinforcement Solutions Plant in Hosur, Tamil Nadu.