Havells India’s FY-25 financials: Revenue up 17.2%, PAT Jumps 15.7%

Havells India Limited [NSE: HAVELLS, BOM: 517354], a major Indian manufacturer in the cable & wire and Fast Moving Electric Goods (FMEG) space, has announced its financials for Q4 FY-25 and the entire FY-25.

Havells’ Standalone Financial Figures: Q4 FY-25 & FY-25

Havells India reported a standalone revenue of Rs. 6,532.21 crore from operations during Q4 of FY-25. The company’s Profit After Tax (PAT) during this period stood at Rs. 522.26 crore.

For the entire FY-25, Havells reported a standalone topline of Rs. 21,745.81 crore and a PAT of Rs. 1,488.84 crore.

Earning Per Share (EPS) of the company for Q4 of FY-25 stood at Rs. 8.33, and at Rs. 23.75 for entire FY-25.

Havells India’s Consolidated Financial Results: Q4 FY-25 & FY-25

YoY Comparison of Havells’ Financial Numbers: Q4 FY-25 vs. Q4 FY-24 & FY-25 vs. FY-24

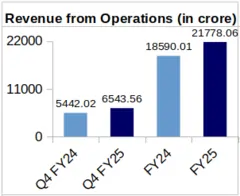

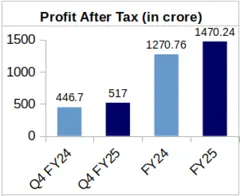

The company recorded a consolidated revenue of Rs. 6,543.56 crore during Q4 of FY-25, showing an increase of 20.24% YoY from its Rs. 5,442.02 crore revenue logged in Q4 of FY-24. Havells earned a Profit After Tax (PAT) of Rs. 517 crore for Q4 of FY-25, which is up by 15.74% YoY from the company’s profit of Rs. 446.70 crore for Q4 of FY-24.

Considering the entire FY-25, the company’s revenue jumped by 17.15% to Rs. 21,778.06 crore from its Rs. 18,590.01 crore revenue which was clocked during FY-24. The company reported a PAT of Rs. 1,470.24 crore during FY-25 as compared to its FY-24 PAT of Rs. 1,270.76 crore. This represents a jump of 15.70% in the company’s profit YoY.

Havells India’s Earning Per Share (EPS) was Rs. 8.26 for Q4 of FY-25 and Rs. 23.49 for entire FY-25.

QoQ Comparison of Havells Financials: Q3 of FY-25 vs. Q4 of FY-25

On a Quarter-over-Quarter (QoQ) basis, Havells India’s revenue increased remarkably by 33.84% from its Q3 FY-25 revenue of Rs. 4,888.98 crore. Echoing this upward trend, the company’s PAT also soared by 86% QoQ from its Rs. 277.96 crore PAT earned during Q3 of FY-25.

YoY Segment-Wise Revenue Comparison of Havells India

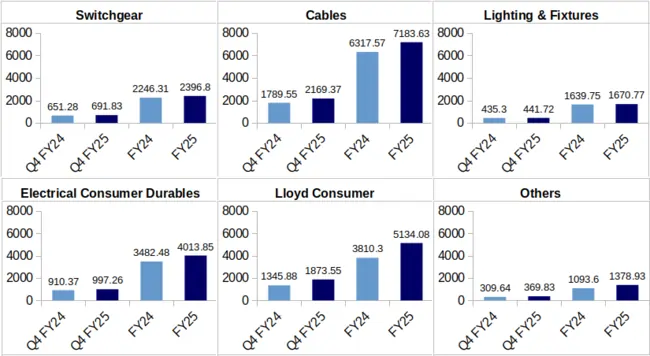

Switchgear: Revenue from Switchgear segment of the company grew by 6.23% to Rs. 691.83 crore during Q4 FY-25 from Rs. 651.28 crore in Q4 of FY-24.

For FY-25, Havells’ revenue from its switchgear vertical stood at Rs. 2,396.80 crore, up by 6.70% from Rs. 2,246.31 crore in FY-24.

The company mentioned in its investor presentation for Q4 FY-25 financials that this growth in Switchgear business was driven by expansion of its switchgear products range and supply orders for various projects.

Cables: The company earned Rs. 2,169.37 crore as revenue during Q4 FY-25 from its cable segment against Rs. 1,789.55 crore clocked during Q4 FY-24. This represents an increase of 21.22%% on a YoY basis.

For the entire financial year, Havells’ revenue from its cable business was Rs. 7,183.63 crore during FY-25, which reflects a 13.71% increase from its Rs. 6,317.57 crore revenue for FY-24.

Lighting & Fixtures: Havells India earned a revenue of Rs. 441.72 crore from its Lighting & Fixtures segment during Q4 of FY-25. This reflects a marginal YoY increase of 1.47% from the company’s 435.30 crore revenue from this segment reported for Q4 of FY-24.

For the entire FY-25, the company reported Rs. 1,670.77 crore as revenue from this segment, showing a slight increase of 1.89% from Rs. 1,639.75 crore in FY-24.

Electrical Consumer Durables: Havells’ revenue from this segment surged YoY by 9.54% to Rs. 997.26 crore in Q4 of FY-25 from Rs. 910.37 crore in Q4 of FY-24.

Over the entire FY-25, revenue from this segment represented a growth of 15.26% to Rs. 4,013.85 crore against Rs. 3,482.48 crore logged for FY-24.

Lloyd Consumer: In Q4 of FY-25, Havells’ Lloyd segment generated Rs. 1,873.55 crore revenue, marking a 39.21% increase from Rs. 1,345.88 crore in Q4 of FY-24.

Over the full financial year 2024-25, Lloyd’s revenue grew by 34.74% to Rs. 5,134.08 crore from Rs. 3,810.30 crore in FY-24.

Commenting on the growth in the company’s Lloyd business, Mr. Anil Rai Gupta, Chairman and Managing Director of Havells India, said “Lloyd has delivered a robust performance with strong revenue growth and margin improvement. The focus now remains on consistent revenue growth, along with improving profitability”.

Till Q3 of FY-25, Havells’ Lloyd vertical was not profitable despite growth in Lloyd segment revenue. During an interview in January 2025, Mr. Gupta said that the company’s Lloyd business is expected to be profitable by FY-26. “FY26 looks promising for both growth and profitability”, he said.

Others: This segment comprises some of Havells India’s other products, such as motors, water pumps, and purifiers.

During the fourth quarter of FY-25, Havells generated Rs. 369.83 crore revenue from this segment, marking a 19.44% increase from Rs. 309.64 crore reported in Q4 FY-24.

Additionally, for FY-25 Havells registered Rs. 1,378.93 crore as consolidated revenue from this segment, representing a healthy growth of 26.09% from the Rs. 1,093.60 crore earned in FY-24.

About Havells India Limited: Havells India Limited is a Noida-based company, which is one of the biggest players in the Indian FMEG market. Its product range includes Industrial and domestic Circuit Protection Switchgear, Modular Switches, Cables and wires, Fans, Power Capacitors, and Luminaires for Domestic, Commercial, and industrial applications, Water Heaters, Motors, and Domestic Appliances.