Dynamic Cables Healthy FY-25 Financials: Revenue Jumps 33%, PAT Grows 71%

Dynamic Cables Ltd. [BOM: 540795, NSE: DYCL], an Indian manufacturer of cables has announced its financial results for Q4 of FY-25 and the financial year ended 31st March 2025.

Dynamic Cables’ Financial Performance: Q4 of FY-25 & FY-25

YoY Comparison of Dynamic Cables Financials: Q4 FY-25 vs. Q4 FY-24 & FY-25 vs. FY-24

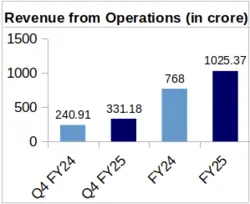

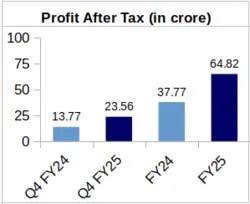

Dynamic Cables reported a consolidated topline of Rs. 331.18 crore during Q4 FY-25, marking an increase of 37.47% YoY from Rs. 240.91 crore recorded as revenue during Q4 of FY-24. Correspondingly, PAT during Q4 of FY-25 increased to Rs. 23.56 crore, which is up by 71.09% from the company’s Q4 FY-24 profit of Rs. 13.77 crore.

Considering the full financial year, In FY-25 Dynamic Cables recorded a top line of Rs. 1,025.37 crore , thus exhibiting growth of 33.51% from Rs. 768 crore in FY-24. Echoing the same upward trend, the company’s FY-25 PAT of Rs. 64.82 crore was 71.62% higher than its FY-24 PAT of Rs. 37.77 crore.

Moreover, the company’s Q4 FY25 Earning Per Share (EPS) stood at Rs. 9.73. For the entire 2024-25 fiscal, Dynamic Cables’ EPS was reported as Rs. 27.31.

Commenting on the company’s FY-25 financials, Mr. Ashish Mangal, Managing Director of Dynamic Cables, said “FY ‘25 has been a milestone year in the journey of Dynamic Cables…..These achievements have been driven by robust demand across sectors, our commitment to on-time delivery and disciplined financial management”. He added that the company’s order book stood at Rs. 726 crore as of 31st March 2025.

QoQ Comparison of Dynamic’s Financials: Q4 FY-25 vs. Q3 FY-25

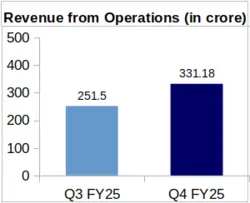

Dynamic Cables’ revenue from operations saw a notable QoQ increase of 31.68% from Rs. 251.50 crore reported in Q3 FY-25.

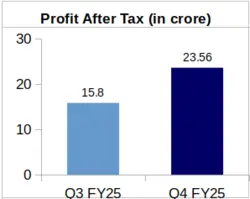

Further, Dynamic Cables’ PAT displayed a remarkable growth QoQ, with Q4 profit increasing by 49.11% from the company’s Q3 PAT in FY-25, which stood at Rs. 15.80 crore.

Decrease in Promoters’ Shareholding Pattern of Dynamic Cables

It is interesting to note that there has been a substantial change in Dynamic Cables’ shareholding pattern from FY-24 to FY-25. Promoter shareholding has decreased to 68.18% during March 2025 from 74.47% in March 2024.

Dynamic Cable to Set up New Cable Manufacturing Plant

Dynamic Cables is setting up a new cable manufacturing plant with a capital expenditure of Rs. 35 crore. This plant is expected to be operational in second half of FY-26. However, the company did not specify location of this plant during its FY-25 earnings call.

This plant will manufacture High Voltage (HV) and Low Voltage (LV) cables. The company will also manufacture solar cables at this upcoming plant.

About Dynamic Cables Limited: Dynamic Cables was incorporated in the year 2007 and is headquartered in Jaipur, Rajasthan. The company is a manufacturer of power infra cables that includes LT, HT, EHV, Power control & instrumentation cables, flexible & industrial cables, solar cables and railway signaling cables. Dynamic Cables has 3 manufacturing plants situated at Jaipur and Reengus. Business operations are managed through corporate office in Jaipur and 5 regional sales offices across India.