Diamond Power Q3 FY25 Revenue Jumps 5 Times, Posts 6 Cr Profit

Diamond Power Infrastructure Limited branded as DICABS [NSE: INE989C01038, BOM: 522163], an Indian manufacturer of power transmission equipment that includes Conductors, Power Cables (HV, LV & EHV) and Towers., has announced its financial results for Q3 of FY-25.

Diamond Power’s Q3 FY-25 Standalone Financials

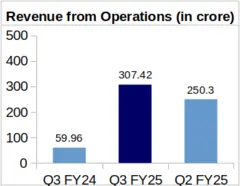

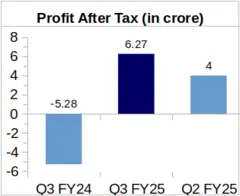

Diamond Power reported a standalone revenue of Rs. 307.42 crore for Q3 of FY-25 and a Profit After Tax (PAT) of Rs. 6.42 crore for the same period.

Diamond Power’s Consolidated Q3 FY-25 Financial Numbers

YoY Comparison of Diamond Power’s Financials: Q3 FY-25 vs. Q3 FY-24

Diamond Power’s Q3 FY-25 revenue of Rs. 307.42 crore was 5.12 times of the company’s Q3 FY-24 revenue of Rs. 59.96 crore. Diamond Power’s PAT jumped to Rs. 6.27 crore during Q3 of FY-25, from loss of Rs. 5.28 crore reported for Q3 of FY-24.

Earnings Per Share (EPS) of the company stood at Rs. 0.12 during Q3 of FY-25 against a loss per share of Rs. 0.10 for Q3 FY-24.

QoQ Analysis of Diamond Power’s Financial Results: Q3 FY-25 vs. Q2 FY-25

Diamond Power’s revenue increased QoQ by 22.82% from Rs. 250.30 crore reported during Q2 of FY-25. Also, the company’s PAT jumped by 56.75% from Rs. 4 crore profit earned by Diamond Power’s during Q2 of FY-25.

Major Reason For Revenue and Profit Turnaround Recovering from Insolvency 2 Years Ago

Diamond Power had turned insolvent and was admitted on the Corporate Insolvency Resolution Process (CIRP) of National Company Law Tribunal (NCLT) in August 2018. NCLT, in an order delivered on June 20, 2022, approved the resolution plan submitted by “GSEC Ltd in consortium with one Mr Rakesh Shah“.

Notably, Mr. Rakesh Raman Lal Shah is brother-in-Law of industrialist and Adani Group Chairman Mr. Gautam Adani.

As of July 9, 2024, Diamond Power’s unexecuted order book position stood at Rs.1,505 crore, as informed in a stock exchange filing by the company. The order book is attributed to two major order wins, Rs.899.75 crore order for the supply of AL-59 conductors and other order for the supply of LV/MV cables valued at Rs.409 crore.

The AL-59 conductor mandate was placed by Adani Energy Solutions Ltd for deployment at transmission projects of its various TBCB subsidiaries, while the Rs. 409 Crore cables were ordered by Adani Green Energy Ltd.

About Diamond Power Infrastructure Ltd: Diamond Power Infrastructure Ltd. founded in 1970 owns a cable and conductor plant, spread over 110 acres, at Savli in Gujarat. The plant is equipped with five CCV (catenary continuous vulcanization) lines for producing cables. The Savli plant has annual conductor manufacturing capacity of around 2.5 lakh tonnes.