Cords Cable Posts 27% Topline Growth in FY25, PAT Soars 46%

Cords Cable Industries Ltd. [NSE: CORDSCABLE, BOM: 532941], a Delhi-headquartered manufacturer of power, instrumentation, control and specialty cables, has posted its financials for the quarter and year ended 31st March 2025.

“Encouraging Year in terms of Market Opportunities” – Cords CMD

While speaking to CableCommunity, Mr. Naveen Sawhney, CMD of Cords Cable Industries said, “Financial year 2024-25 was really very encouraging in respect of market opportunities in both domestic and overseas markets”. Mr. Sawhney highlighted that Cords’ annual topline achieved a growth of approximately 27%, and the company “…was able to reduce financial cost from approximately 4% to 3.1% in the year 2024-25”.

He added that Cords’ outlook for FY26 remains positive, and that the company expects a healthy growth, and substantial order booking from domestic as well as overseas markets during the year.

Analysis of Cords’ FY25 Financial Results

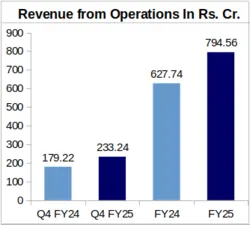

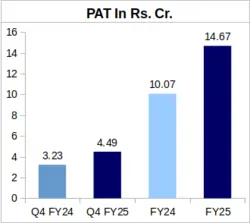

YoY Comparison of Cords’ Financial Numbers: Q4 FY25 vs. Q4 FY24 & FY25 vs. FY24

Cords Cable Industries logged Rs. 233.24 crore as its revenue for Q4 of FY25, representing a stellar 30.14% YoY growth from its Q4 FY24 revenue of Rs. 179.22 crore.

Year-over-Year, Q4 Profit After Tax (PAT) of the company grew remarkably by 39% to Rs. 4.49 crore in FY25 from Rs. 3.23 crore in FY24.

Cords’ annual revenue was Rs. 794.56 crore during FY25, 26.57% higher than its FY24 topline of Rs. 627.74 crore. PAT doubled this upward trend, growing by 45.68% to Rs. 14.67 crore in FY25 from Rs. 10.07 crore reported for FY24.

Earnings Per Share (EPS) of the company were reported as Rs. 3.40 for Q4 FY25, and Rs. 11.25 for the entire FY25.

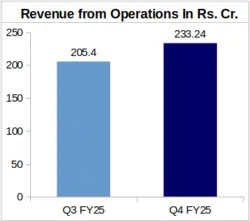

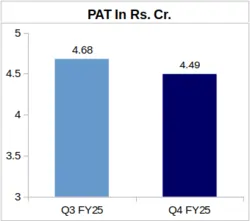

QoQ Trend in Cords’ Financial Figures: Q4 FY25 vs. Q3 FY25

Cords’ Q4 FY25 revenue is 13.55% higher than its Q3 FY25 revenue of Rs. 205.40 crore. It must be noted that the company’s Q3 FY25 revenue had earlier been reported as its ‘highest-ever’ quarterly topline, and therefore Cords’ Q4 FY25 revenue has set a new record for the company.

However, Cords’ quarterly PAT shrunk slightly by 4.06% from Rs. 4.68 crore, posted for Q3 FY25.

“A Record Breaking Year” – Cords CFO

Mr. Sandeep Kumar, CFO of Cords Cable Industries described FY25 as a “record breaking year”. Mr. Kumar further added that during FY25, “The company has further enhanced its efficiency in power cable manufacturing facility by adding new machinery. At marketing front, the company has added some new industries and customers in all the geographies in India“.

Cords’ Board Recommends 10% Final Dividend for FY25

During its meeting held on 27th May 2025, Cords’ Board recommended a final dividend of Re. 1 per share. With each share having a face value of Rs. 10, this translates to 10% dividend. If approved at the subsequent Annual General Meeting (AGM) of the company, this dividend will be paid within 30 days of the conclusion of the AGM.

Cords’ Stock Gains 3% Post Results Announcement

Cords Cable’s shares were trading at Rs. 200.07 apiece the day after its FY25 financial results were made public. This represents a 3.04% increase from its share price of Rs. 194.17 apiece on the day of announcement of results.

About Cords Cable: Cords Cable Industries was established in 1987, and has two manufacturing facilities, one at Chopanki and the other at Kahrani in Rajasthan. The company’s portfolio comprises Instrumentation cables, Thermocouple cables, Power cables, Control cables, and other Special cables to provide solutions for industrial connectivity requirements such as Railway Signalling, SCADA, DCS, and other plant instrumentation requirements.