Bansal Wire Revenue Jumps 53% YoY in Q3 FY-25, PAT Grows to Rs. 41.68 Cr.

Bansal Wire Industries Ltd. [NSE: BANSALWIRE, BSE: 544209], a major manufacturer of Stainless Steel (SS), has announced its financial results for Q3 of FY-25.

Bansal Wire Industries, established in 1985, is a major manufacturer of steel wire and Stainless Steel (SS) wire. The company has five manufacturing facilities in India, three of which are situated in Ghaziabad, one is in Dadri and one is in Bahadurgarh, Haryana.

Brief Background of Bansal Wire’s Performance

Bansal Wire rolled out its Initial Public Offering (IPO) in Q2 of FY-25. The company’s stock got listed at a share price of Rs. 350.35 apiece on 10th July 2024. Currently, Bansal Wire’s share price stands at Rs. 398.45 apiece, signifying that the company’s stock has gained 13.73% over the past 8 months.

Bansal Wire has been reporting consistently strong financials even before getting listed. During FY-24, the company reported a revenue of Rs. 2,466.03 crore from operations.

Considering the first 9 months of FY-25, the company reported consolidated revenue of 2,566.97 crore from operations.

Bansal Wire’s Standalone Financials for Q3 of FY-25

For Q3 of FY-25, Bansal Wire Ind. reported a standalone revenue of Rs. 929.26 crore from operations. The company’s Profit After Tax (PAT) for this period stood at Rs. 35.77 crore.

Bansal Wire’s Robust Performance: Comparison of Consolidated Quarterly Results

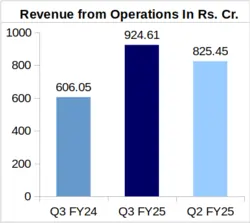

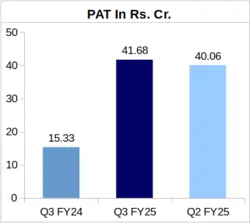

YoY Comparison of Bansal Wire’s Financials: Q3 FY-25 vs. Q3 FY-24

Bansal Wire’s consolidated Q3 revenue during FY-25 stood at Rs. 924.61 crore, which represents a remarkable 52.56% jump YoY from its Q3 revenue of Rs. 606.05 crore in FY-24.

Correspondingly, PAT of the company during Q3 of FY-25 was Rs. 41.68 crore, which is 2.71 times its Q3 FY-24 PAT of Rs. 15.33 crore.

Bansal Wire’s Earnings Per Share (EPS) echoed this upward trend, growing to Rs. 2.66 during Q3 of FY-25 as compared to Rs. 1.20 reported for Q3 of FY-24.

QoQ Comparison of Bansal Wire’s Figures: Q3 FY-25 vs. Q2 FY-25

Bansal Wire exhibited growth in revenue and PAT on a Quarter-over-Quarter (QoQ) basis as well.

The company’s quarterly top line was up by 12.01% from Rs. 825.45 crore which was logged for Q2 of FY-25. Growth in PAT was not as pronounced, and the company’s Q3 FY-25 PAT was 4.04% higher than its Q2 FY-25 PAT of Rs. 40.06 crore.

Bansal Wire’s Stock Gains 6% After Announcement of Financials

On the day of announcement of its Q3 financial results, Bansal Wire Ind.’s share price stood at Rs. 397.65 apiece. This figure increased to Rs. 421.45 apiece on the next trading day, representing a 5.99% jump.

Volume of share trades also grew massively to 3,55,000 trades on the trading day after announcement of Bansal Wire’s results, against 72,000 trades on the day of announcement.

About Bansal Wire Industries: Bansal Wire Industries was incorporated in 1985, and as per the company is the largest producer of SS wire in India. The company holds about 20% of SS wire market share in the country.