Copper, Aluminium Rally Reshapes Electrical Buying; EPC Margins Tested

Copper and Aluminium are not “just commodities” for the electrical industry — they sit inside almost every product that moves electricity: cables and wires, transformers, motors and generators, bus bars, heat exchangers, earthing systems, switchgear and transmission & distribution hardware. When these metals move sharply, the impact shows up immediately in quotations, tender pricing, working capital and project economics.

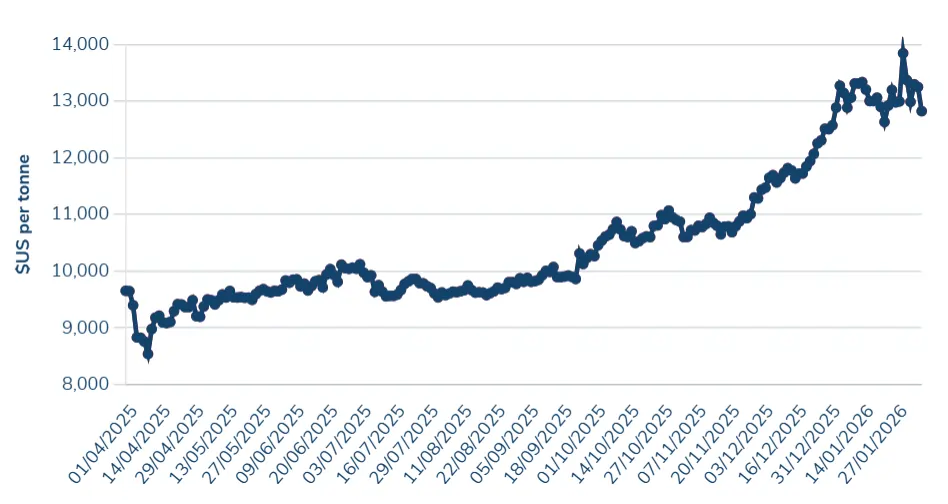

Since mid-2025, both metals have repeatedly tested fresh highs on global exchanges. Copper on the London Metal Exchange (LME) surged to a record intraday $14,527.50/tonne on 29 January 2026 before cooling off — a move Reuters noted was driven heavily by speculative buying and short-covering, with analysts warning of correction risk at those peak prices.

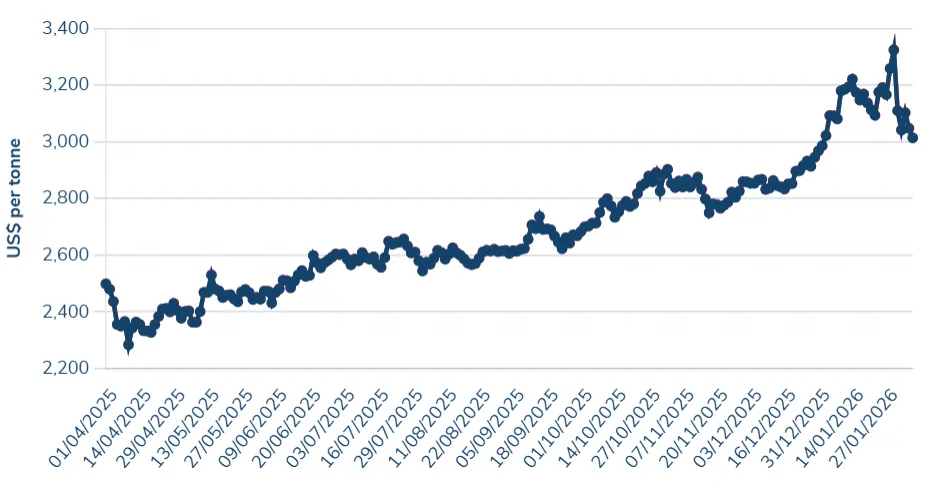

Aluminium has also rallied strongly; LME Aluminium cash settlement on 29 January 2026 was around $3,325/tonne (Westmetall’s LME data table).

For Indian manufacturers and project businesses, the real story is not the “record high” headline — it’s the sustained period of elevated prices and the volatility that has disrupted procurement decisions across the value chain.

A cable manufacturer official said, “This is not a normal cycle anymore. Quote validity that used to be 10-15 days has effectively become 3-5 days in many products. If you hold price, you hold risk.”

India lens: LME isn’t the Only Price That Matters

Domestic benchmarks have reflected the same heat. Economic Times reported the most-active MCX copper contract at about ₹1,330.45/kg in early January 2026.

On Aluminium, Economic Times reported MCX Aluminium futures pushing above ₹320/kg in early January 2026, tracking the rally on LME above $3,000/tonne.

What this has meant on the shopfloor is straightforward: replacement cost moved up rapidly, and“firm pricing” became harder to give without protection.

A large proportion of domestic electrical supply contracts, especially in private industrial and mid-sized infrastructure projects, continue to be firm-price by default, with limited or no metal-escalation provisions. While larger manufacturers may selectively hedge or secure forward purchase agreements, smaller and mid-sized players often lack formal hedging access or balance-sheet flexibility. As a result, volatility tends to affect Indian manufacturers and EPCs more sharply than peers in markets where metal-linked pricing clauses are more common.

Why Prices Have Stayed Hot: The Practical Version

The rally has not come from one single trigger. It has come from a combination.

Structural demand growth: Demand has been steadily increasing from areas such as grid expansion, Renewables, Electric Vehicles (EVs) and Data Centres – this has increased the baseline copper/aluminium demand. These are long-term infrastructure trends, not seasonal spikes.

Supply that can’t respond quickly: Opening a new copper mine or expanding smelting capacity takes many years due to environmental approvals, land acquisition, financing and logistics. Even when prices rise, new supply does not come into the market immediately.

Volatility amplifiers: Speculative flows and short-covering have exaggerated spikes; Reuters’ reporting on the late-January surge captured both the intensity of the move and the caution about sustainability.

A “tight-but-not-breathless” outlook — Reuters’ early-February analyst poll captured a market view that 2026 averages may stay elevated even if January peaks were extreme.

The Pain Points: Manufacturers, EPCs, Package Suppliers, Project Owners

Manufacturers: Margins First, Working Capital Next

In cables, transformers and many electrical categories, raw material is the biggest component. When copper and Aluminium stay elevated for months, the pressure shows up in three places:

Old orders become margin traps: Orders booked at earlier metal rates have been executed at compressed or negative contribution unless contracts allowed pass-through.

Tender pricing turns risky: A bid is no longer just about conversion cost and competition; it’s about whether the metal assumption holds.

Working capital swells: Even if volumes don’t change, the same inventory costs more.

A simple illustration helps: if a manufacturer holds 50 tonnes of copper as running inventory, a move from $9,000/tonne to $13,500/tonne increases inventory value by $225,000. That is not a market comment – it is a bank limit and interest cost in real terms. (Copper’s record print was $14,527.50/tonne on 29 Jan.)

An official of a Transformer Manufacturing company said, “Copper is not just cost — it decides whether you can even quote competitively. If you price aggressively, you risk bleeding. If you price safely, you risk losing the order.”

EPCs / Package Suppliers: The “Booked at Old Rates” Squeeze

Over the last 6–9 months, many EPCs and package suppliers have tried to hold or delay equipment buying because project orders were booked at older, lower metal assumptions. Placing large POs today — for cables, transformers, bus-duct, panels, earthing and associated items — has often meant one of two outcomes:

- Either an outright loss on the package, or

- A massive compression of expected margins.

The squeeze has been particularly severe in packages where rising copper and Aluminium prices have coincided with elevated steel and freight costs, compounding overall equipment and installation budgets.

This is not a “demand collapse”. It is risk control. Projects may still be alive, but procurement decisions have been slowed down to avoid converting paper margins into real losses.

Project Owners: When Financial Closure Meets a New CapEx Reality

Project owners have faced a different stress: CapEx budgets and financial closure numbers were locked in earlier. When core electrical packages reprice upward:

- Loan coverage can become insufficient

- Promoters may need to inject additional equity

- Timelines have been pushed as financing and approvals are revisited

In project businesses, schedule overruns don’t stay limited to time — they multiply costs, and they harden stakeholder behavior across the ecosystem.

What Buyers Are Doing Right Now

Indian buyers have largely shifted into “controlled buying” mode:

- Procurement limited to immediate needs.

- Split orders and staggered deliveries.

- Shorter validity acceptance, but stiff resistance to escalation clauses.

- Heavier and longer negotiation cycles around metal escalation pass-through and payment milestones.

- Many EPCs are revisiting contracts with project owners for upward price revision.

What looks like hesitation has often been a commercial calculation: buying too early at a perceived peak vs buying too late and risking a higher replacement cost.

Several projects are facing execution delays because project owners (buying directly) don’t want to incur cost increases, EPCs are approaching project authorities for price escalation, or manufacturers have stuck to their ground in orders that have become loss-making.

A major EPC service supplier mentioned, “We’re not stopping projects — we’re trying to stop margin leakage. The decision is not ‘buy or don’t buy’. The decision is ‘how to buy without breaking the package economics’.”

The Urgency of March Billing – Inevitable Year-end Sales Targets

While many EPCs and project owners postponed procurement for months, EPC firms in particular face the added pressure of meeting billing milestones, RA certifications and revenue-recognition targets. This has triggered a sudden surge in orders for cables, transformers and other electrical equipment in recent weeks, even at these elevated metal prices.

Several project owners have also stretched themselves beyond the limit, and project execution has become urgent in such cases. This has further led to a spike in orders received by manufacturers.

Many manufacturers have accepted tighter conversion and absorbed part of the increase to fulfill urgent dispatch timelines.

What to do Next: Practical Moves

For Manufacturers (Cables/Transformers/Electrical Equipment)

- Quote metal + conversion separately wherever possible; it has reduced disputes and shortened negotiation cycles.

- Reduce quote validity and make it explicit; protecting the business has mattered more than chasing volumes.

- Tie sales, purchase and finance daily; metal volatility has turned into a cross-functional risk.

- Use partial hedging if full hedging isn’t feasible; even limited protection has reduced “surprise” losses.

For EPCs / Package Suppliers

- Audit contracts for escalation language and triggers; many teams have discovered “assumptions” that were never enforceable.

- Lock long-lead items early; delay has often increased exposure more than it reduced it

- Rebuild package pricing logic using current metal bands, not last year’s averages

For Project Owners

- Revalidate the electrical scope capex early; it has reduced rework and tender resets later

- Plan phased procurement rather than “wait for perfect correction” – because delay penalties and financing costs can exceed metal savings

The Bigger Thought to Leave With

Copper and Aluminium prices are no longer behaving like background inputs. In this cycle, they have behaved like project execution variables — deciding who can quote, who can buy, who can finance, and who can deliver on time.

Even if prices correct from peak levels, the lesson remains: volatility has become structural risk. Companies that treat metal movement as a business system problem — not a daily price irritation — have been the ones that protected margins, preserved liquidity and continued executing while others froze.

This phase of elevated metal prices, combined with volatility, is likely to persist through 2026.