HFCL Impressive Q3 FY26 Performance: Revenue Jumps 20%, PAT up 41%

Himachal Futuristic Communications Ltd. (HFCL) [NSE: HFCL, BOM: 500183], an Indian manufacturing company of Optical Fibre Cables (OFCs), has posted its financial results for Q3 of FY26.

HFCL Standalone Financial Results of Q3 FY26

For Q3 FY26, the company reported a standalone revenue of Rs. 1,223.89 crore and Profit After Tax (PAT) of Rs. 56.19 crore.

Consolidated Financial Performance of HFCL for Q3 FY26

YoY Analysis of HFCL’s Financials: Q3 FY26 vs Q3 FY25

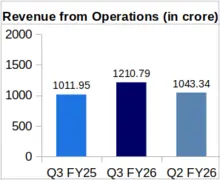

On consolidated basis, HFCL clocked a revenue of Rs. 1,210.79 crore in Q3 FY26, reflecting an increase of 19.65% from Rs. 1,011.95 crore revenue earned during Q3 of FY25. According to the company’s official press release dated 3rd February 2026, exports accounted for 27% of the company’s total revenue during the quarter, a significant rise from 14% in Q3 FY25, underscoring HFCL’s strengthening global presence.

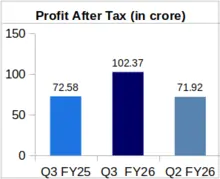

Following this increasing trend, the company’s Q3 FY26 PAT also jumped to Rs. 102.37 crore from Rs. 72.58 crore during Q3 FY25. This shows a jump of 41.04% YoY.

The company’s Earning Per Share (EPS) increased by 31.37% to Rs. 0.67 in Q3 FY26 against Rs. 0.51 in Q3 FY25.

QoQ Comparison of HFCL Financial Results: Q3 FY26 vs. Q2 FY26

On Quarter-over-Quarter (QoQ) basis, HFCL’s revenue increased by 16.05% from Rs. 1,043.34 crore in second quarter of FY26. The company’s PAT also rose by 42.34% QoQ from Rs. 71.92 crore during Q2 FY26.

HFCL’s Segment-Wise Revenue Comparison During Q3 FY26

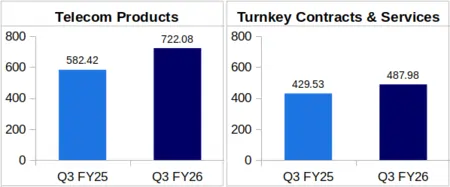

Telecom Products: HFCL reported a revenue of Rs. 722.08 crore from its Telecom Products business in third quarter of FY26. This reflects a YoY increase of 23.98% from Rs. 582.42 crore, earned by the company from this vertical during Q3 of FY25.

Turnkey Contracts and Services: HFCL’s Turnkey Contracts and Services segment quarterly revenue increased by 13.61% YoY to Rs. 487.98 crore during Q3 of FY26 from Rs. 429.53 crore in Q3 of FY25.

Robust Order Book Growth in Q3 FY26

According to the company’s press release dated 3rd February 2026, HFCL’s order book stood at Rs. 11,125 crore as on 31st December 2025, marking an increase from Rs. 10,410 crore in Q3 FY25. Of the total order book in Q3 FY26, the company secured Network Services orders worth Rs. 3,035 crore, Operations & Maintenance (O&M) orders amounting to Rs. 3,522 crore, and product orders valued at Rs. 4,568 crore.

Commenting on the performance, Mr. Mahendra Nahata, Managing Director, HFCL, said,“Q3 FY26 was a quarter of focused execution for HFCL. We expanded our export footprint, continued capacity build-up, and advanced our defence portfolio, while consciously improving the quality and sustainability of our revenue mix”.

HFCL’s Capacity Expansion Plans in Optical Fibre and Cables

HFCL has outlined plans to expand its manufacturing capacities across Optical Fibre and Optical Fibre Cables (OFCs). The company’s current Optical Fibre manufacturing capacity stands at approximately 28 million fibre-kilometres, which is projected to increase to 33.9 million fibre-kilometres by December 2026.

In addition, HFCL plans to expand its Optical Fibre Cable manufacturing capacity to 42.3 million fibre-kilometres by June 2026, up from the existing capacity of 30.5 million fibre-kilometres.

About HFCL Limited: Established in 1987, HFCL has its headquarters in Delhi. It caters primarily to the communication sector through optical fibre cables and transmission & access equipment manufacturing. HFCL has optical fibre cable manufacturing facilities in Goa and Hyderabad. HTL Limited, the company’s subsidiary, also has an optical fibre cable manufacturing plant in Chennai. The company has a Cable Reinforcement Solutions Plant in Hosur, Tamil Nadu.