Polycab India’s Q3 FY26 Revenue Growth at 46%, PAT Zooms 36% YoY

Polycab India Ltd. (PIL) [NSE: POLYCAB, BOM: 542652], a leading Indian manufacturer of cables and wires, has announced its financial results for Q3 FY26.

Polycab India’s Q3 FY26 Standalone Financials

Polycab’s standalone revenue for Q3 of FY26 was reported as Rs. 7,517.25 crore. The corresponding Profit After Tax (PAT) for the quarter was Rs. 617.90 crore.

Polycab’s Consolidated Financial Performance During Q3 FY26

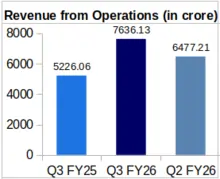

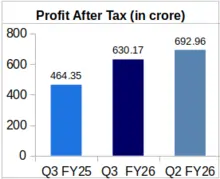

YoY Comparison of Polycab’s Financials: Q3 FY26 vs. Q3 FY25

Considering Year-over-Year (YoY) financial performance, Polycab’s Q3 revenue from operations grew by 46.12% to Rs. 7,636.13 crore in FY26, from Rs. 5,226.06 crore in FY25. The company’s PAT echoed this upward trend, soaring by 35.71% to Rs. 630.17 crore during Q3 of FY26 from Rs. 464.35 crore logged for Q3 of FY25.

Moreover, Polycab India’s Earnings Per Share (EPS) were Rs. 41.30 during Q3 of FY26 against Rs. 30.42 in Q2 of FY25. This represents a growth of 35.77% YoY.

QoQ Comparison of Polycab India’s Financial Results: Q3 FY26 vs. Q2 FY26

As compared to Q2 FY26, Polycab’s Q3 FY26 revenue was up by 17.89%. In the second quarter of FY26, the company had logged a revenue of Rs. 6,477.21 crore. The company’s Q3 FY26 PAT also decreased Quarter-over-Quarter (QoQ) by 9.06% from Rs. 692.96 crore in Q2 FY26.

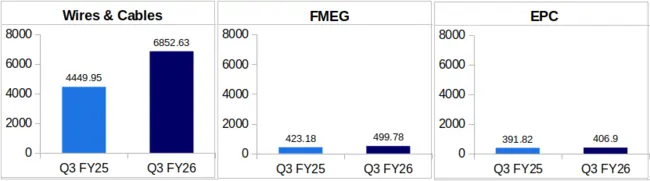

Polycab’s Segment-Wise Revenue Comparison for Q3 FY26

INR in Cr.

Wires and Cables: Polycab India’s Wires and Cables business vertical exhibited a 54% YoY growth, with quarterly revenue from this segment reported as Rs. 6,852.63 crore for Q3 FY26 against Rs. 4,449.95 crore in Q3 FY25.

This segment typically makes up for the bulk of Polycab’s revenue, and in Q3 of FY26, revenue from wires and cables sales constituted 88.32% of its gross revenue*.

*Gross revenue refers to the sum of segmental revenues before the deduction of inter-segmental revenue.

As per the company’s Q3 FY26 investor presentation, growth in the Wires and Cables segment was driven by ‘robust demand and sustained commodity price inflation’.

FMEG: Polycab’s FMEG vertical brought in a segmental revenue of Rs. 499.78 crore during Q3 FY26, which is YoY 18.10% higher than the company’s Q3 FY25 FMEG revenue of Rs. 423.18 crore.

Mentioning the reasons behind growth in the FMEG segment, the company stated that this segment’s growth was led by the solar category.

EPC: In Q3 of FY26, this business segment brought in Rs. 406.90 crore to Polycab’s gross revenue, which is 3.85% higher YoY as compared to this vertical’s Rs. 391.82 crore revenue for Q3 FY25.

Management Commentary on Polycab’s Q3 FY26 Financial Performance

Commenting on the company’s Q3 FY26 financial performance, Mr. Inder T. Jaisinghani, Chairman and Managing Director, Polycab India Limited, said, “Q3 marked a record-breaking quarter for the Company, with revenues at an all-time high, driven by strong execution in the W&C business and sustained momentum in the FMEG segment”.

He further added that the domestic business delivered a good performance, reflecting robust demand conditions and continued market share gains.

About Polycab India Limited: Polycab India Limited was established in 1996. The company’s wire and cable portfolio includes power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, communication cables, and others, including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables, and green wires.