Apar Industries’ Q2 FY26 financials: Revenue up 23%, PAT Jumps 30%

Apar Industries Ltd. [NSE: APARINDS, BOM: 532259], one of India’s major conductors, cables & lubricants manufacturers, has published its financial results for Q2 of FY26.

Apar Industries Q2 FY26 Standalone Financials

Apar Industries reported a standalone revenue of Rs. 5,462.93 crore and Profit After Tax (PAT) of Rs. 253.87 crore during Q2 of FY26.

Apar’s Consolidated Q2 FY26 Financials

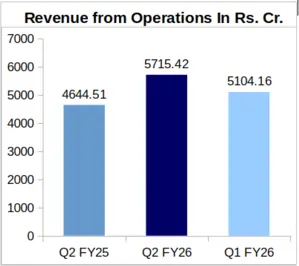

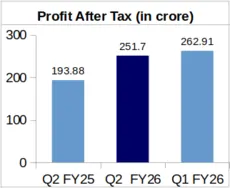

YoY Comparison of Apar’s Numbers: Q2 FY26 vs. Q2 FY25

Apar’s consolidated revenue during Q2 FY26 was up by 23.06% to Rs. 5,715.42 crore from its Rs. 4,644.51 crore revenue reported for Q2 FY25. Apar’s PAT jumped to Rs. 251.70 crore during Q2 FY26 from Rs. 193.88 crore in Q2 FY25. This represents a significant Year-over-Year (YoY) increase of 29.82% in the company’s PAT.

The company’s Earnings Per Share (EPS) stood at Rs. 62.66 during Q2 FY26 against Rs. 48.27 during Q2 FY25.

QoQ Analysis of Apar’s Financial Performance: Q2 FY26 vs. Q1 FY26

On Quarter-over-Quarter basis (QoQ), the company’s revenue was up by 11.98% from Rs. 5,104.16 crore earned for Q1 FY26. However, Apar’s PAT followed a downward QoQ trend, decreasing by 4.26% from Rs. 262.91 crore clocked during Q1 FY26.

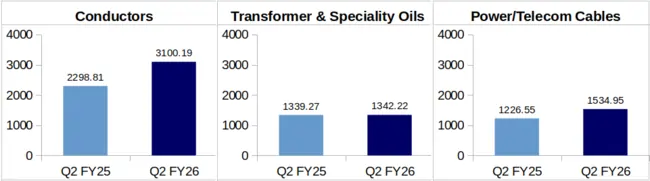

Apar’s Segment Wise Revenue Comparison

Rs. in Cr.

Conductors: During Q2 of FY26, the company reported Rs. 3,100.19 crore as revenue from its Conductors segment against Rs. 2,298.81 crore earned during Q2 of FY25. This shows a jump by 34.86% YoY.

The company in its investor presentation for Q2 FY26 financials mentioned that exports grew 74.6% YoY in Q2 FY26, contributing 24.2% to conductor division’s revenue in Q2 FY26. The company mentioned a pending order book of Rs. 7,168 crore in this segment. Further, there was an increase in volume of 16.2% YoY in this segment during Q2 of FY26.

Commenting on the profitability of this segment, Mr. Kushal Desai, CMD of Apar Industries, remarked, “EBITDA post forex also grew 21.4% to reach a value of Rs. 248 crores. On the margin front, [Q2 FY26] EBITDA…stands at Rs. 39,636 per metric ton as against Rs.37,702 per metric ton for the same period last year”. He attributed this increase in profitability to the increased sale of premium products in this category, and growth of Apar’s conductor business in the U.S.

Transformer and Speciality Oils: Apar’s Transformer and Speciality Oils vertical brought in a segmental revenue of Rs. 1,342.22 crore during Q2 FY26, which is YoY only 0.22% higher than the company’s Q2 FY25 Transformer and Speciality Oils revenue of Rs. 1,339.27 crore.

While speaking of the nearly flat YoY trend in revenue from this segment, Mr. Desai said that this was because of lower crude prices in H1 FY26 as compared to H1 FY25. “Transformer oil volume was a bit lower at 4.6% at a global level on account of some execution delays in the supply chain, especially from our plant in the Middle East as well as in some of the export locations”, he added. Mr. Desai highlighted that despite this, on the domestic front, Apar’s Q2 transformer oil revenue grew by 13.6% YoY in FY26.

In terms of volume, this segment reported a slight overall YoY growth of 3.7% during Q2 of FY26.

Power/Telecom Cables: The company reported a revenue of Rs. 1,534.95 crore from this segment in Q2 FY26. This reflects a YoY increase of 25.14% from Rs. 1,226.55 crore, earned by the company from this vertical during Q2 of FY25.

The company reported a pending order book of Rs. 1,836 crore in this segment.

About Apar Industries Limited: Established in 1958, Apar Industries Ltd. has its presence in over 125 countries. Apar’s portfolio comprises manufacture and supply of conductors, transmission cables, specialty oils, polymers, and lubricants.