HFCL’s Q2 FY26 Financials: Revenue Slides 5%, PAT Slips 2% YoY

Himachal Futuristic Communications Ltd. (HFCL) [NSE: HFCL, BOM: 500183], an Indian manufacturing company of Optical Fibre Cables (OFCs), has announced its financial results for Q2 of FY26.

HFCL’s Q2 FY26 Standalone Financial Numbers

HFCL reported a standalone revenue of Rs. 1,003.13 crore and a Profit After Tax (PAT) of Rs. 61.44 crore during Q2 FY26.

HFCL’s Consolidated Financial Results for Q2 FY26

YoY Comparison of HFCL’s Financials: Q2 FY26 vs. Q2 FY25

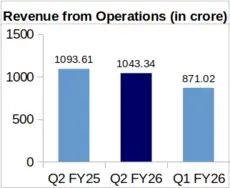

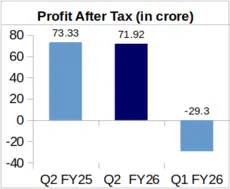

On Year-over-Year (YoY) basis, the company’s consolidated revenue from operations slumped by 4.60% to Rs. 1,043.34 crore during Q2 FY26 from Rs. 1,093.61 crore revenue reported for Q2 FY25. Profit After Tax (PAT) of the company decreased to Rs. 71.92 crore in Q2 FY26 from Rs. 73.33 crore during Q2 FY25. This represents slight YoY decrease of 1.92% in the company’s profit.

Earnings Per Share (EPS) of the company stood at Rs. 0.47 during Q2 FY26 against Rs. 0.51 during Q2 FY25.

Quaterly Comparison of HFCL’s Financial Figures: Q2 FY26 vs. Q1 FY26

On Quarter-over-Quarter (QoQ) basis, the company’s topline was up by 19.78% from its Rs. 871.02 crore revenue clocked during Q1 of FY26. Moreover, During Q1 FY26, HFCL reported a loss of Rs. 29.30 crore.

Analysis of HFCL’s Segment-Wise Revenue

Rs. In Crore

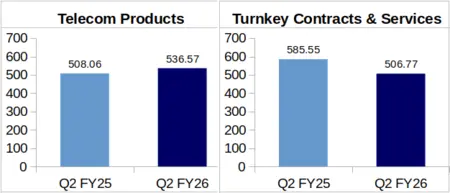

Telecom Products: This segment of the company clocked in a revenue of Rs. 536.57 crore during Q2 FY26 against Rs. 508.06 crore during Q2 FY25, representing a YoY increase of 5.61%.

Turnkey Contracts and Services: HFCL reported a revenue of Rs. 506.77 crore from its Turnkey Contracts and Services business in Q2 of FY26. This reflects a substantial YoY decrease of 13.45% from this vertical’s Rs. 585.55 crore revenue logged during Q2 of FY25.

HFCL’s Order Book at Rs. 9,981 Crore

HFCL mentioned in its investor presentation for Q2 FY26 that the company’s order book has reached Rs. 9,981 crore as on 30th September 2025. This includes Rs. 3,441 crore worth of Network Services orders, Rs. 3,565 crore of Operations & Maintenance orders, and Rs. 2,975 crore worth of orders for HFCL’s products.

Commenting on the company’s financial performance, Mr. Mahendra Nahata, Managing Director of HFCL, said “Our Q2 results reflect the power of strategic execution and our innovation-driven transformation. The strong recovery in margins and profitability, combined with growing international demand and breakthrough achievements in defence, affirm our evolution into a global technology enterprise”.

During the quarter, HFCL received major export orders in its defence electronics portfolio. Key orders are for Thermal Weapon Sights and participation in the upgradation tender for 811 BMP-2 Armoured Fighting Vehicles for the Indian army. HFCL operates a plant in Hosur, Tamil Nadu to manufacture defence equipment, and in September 2025 the company received approval for 1,000 acre of land allotment in Andhra Pradesh for developing a greenfield defence equipment factory.

About HFCL Limited: Established in 1987, HFCL has its headquarters in Delhi. It caters primarily to the communication sector through optical fibre cables and transmission & access equipment manufacturing. HFCL has optical fibre cable manufacturing facilities in Goa and Hyderabad. HTL Limited, the company’s subsidiary, also has an optical fibre cables manufacturing plant in Chennai. The company has a Cable Reinforcement Solutions Plant in Hosur, Tamil Nadu.