Paramount’s FY25 Wires & Cables Revenue Soars 49%, Pipes Underperforms

Paramount Communications Limited [NSE: PARACABLES, BOM: 530555], also known as Paramount Cables within the Indian cable industry, has announced its financials for Q4 of FY25 and the entire FY25.

Paramount’s Standalone Financial Figures: Q4 FY25 & FY25

For the quarter ended 31st March 2025 Paramount Communications reported a topline of Rs. 504.85 crore, and corresponding Profit After Tax of Rs. 18.73 crore.

Considering entire FY25, the company reported Rs. 1,556.66 crore as its standalone revenue and Rs. 86.72 crore as PAT.

Paramount Communications’ Consolidated FY25 Financial Performance

YoY Comparison of Paramount’s Financials: Q4 FY25 vs. Q4 FY24 & FY25 vs. FY24

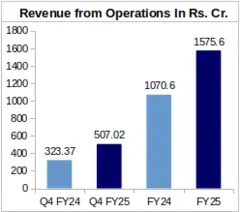

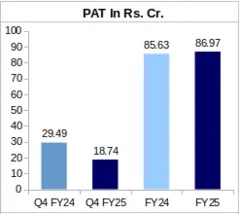

Paramount Communications’ Q4 revenue from operations grew by a staggering 56.79% to Rs. 507.02 crore in FY25 from Rs. 323.37 crore in FY24. This was, however, in stark contrast to the downward trend followed by its Q4 PAT, which shrunk by 36.45% to Rs. 18.74 crore in FY25 from Rs. 29.49 crore in FY24.

For the entire FY25, Paramount reported a revenue of Rs. 1,575.60 crore, which is 47.17% higher than its FY24 revenue of Rs. 1,070.60 crore. As for the company’s annual PAT, Paramount clocked Rs. 86.97 crore in FY25, which represents a marginal increase of 1.56% from its FY24 PAT of Rs. 85.63 crore.

Paramount’s Earnings Per Share (EPS) stood at Rs. 0.62 for Q4 of FY25, and at Rs. 2.85 for the entire FY25.

QoQ Comparison of Paramount Communications’ Financial Figures: Q4 FY25 vs. Q3 FY25

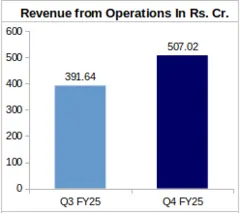

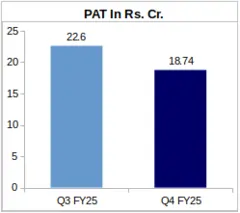

On a Quarter-over-Quarter basis, Paramount’s quarterly revenue jumped by 29.46% from Rs. 391.64 crore earned in Q3 of FY25. However, the company’s Q4 FY25 PAT was 17.08% down from its Rs. 22.60 crore profit which was logged for Q3 of FY25.

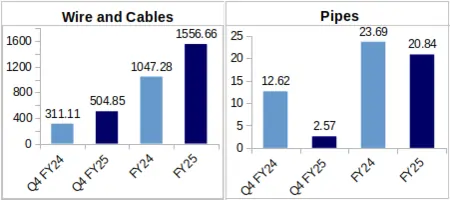

Segment-Wise FY25 Revenue Comparison: Wire & Cables Grow, Pipes Segment Shrinks

Wire and Cables: Paramount Communications is predominantly a manufacturer of cables and wires, and it was only in Q2 of FY24 that the company ventured into the pipes segment. Therefore, revenue from cables and wires make up the bulk of Paramount’s gross revenue. In Q4 FY25 and FY25 this segment accounted for about 99% of Paramount’s gross revenue.

Considering YoY trends, Paramount’s Q4 wire and cable segment revenue was up by a massive 62.27% YoY to Rs. 504.85 crore in FY25 from Rs. 311.11 crore in FY24. For the entire FY25, topline from this segment stood at Rs. 1,556.66 crore, which is 48.64% higher than Rs. 1,047.28 crore in FY24.

Pipes: The company’s pipes segment was the laggard considering its Q4 FY25 and FY25 financial performance.

In Q4 of FY25, Paramount earned a revenue of Rs. 2.57 crore from this vertical, which represents a massive 79.64% slump from Rs. 12.62 crore in Q4 FY24. Annual revenue from this segment shrunk by 12.03% to Rs. 20.84 crore in FY25 from Rs. 23.69 crore in FY24.

Paramount’s Stock Slips 9% After Announcement of FY25 Results

Paramount Communications’ shares were trading at Rs. 61.59 apiece on 21st May 2025, the day when the company announced its FY25 results. However, on the next trading day, the company’s share price dropped by 8.65% to Rs. 56.26 apiece.

Volume of trades of Paramount’s shares grew to 1.8x after the company made its FY25 results public. On 21st May 2025, the volume of trades of Paramount’s shares stood at 38,12,000, whereas on the next day this figure increased to 71,22,000.

Paramount’s FY25 Exports Grow to Rs. 483 Cr., USA Biggest Export Market

In FY25, Paramount’s exports brought in Rs. 483 crore, or about 30.7% of the company’s total revenue. In FY24, exports contributed 25.8% of the company’s total annual revenue. In fact as on 31st March 2025, the company’s order book stands at Rs. 650.7 crore, out of which Rs. 323.2 crore or 49.67% of the total order book comprises export orders. This indicates that the company is actively focused on increasing its presence in foreign markets.

Even among the foreign markets, Paramount Communications views USA as its largest market, where it has 8 distributors as of now. The company also views the EU, South America, Africa and Australia as markets where it can potentially grow.

About Paramount Communications: Paramount Communications is engaged in wire and cable manufacturing. The company has a wide product range, including Railway Cables, High Voltage & Low Voltage Power Cables, Fire Survival Cables, Instrumentation & Data Cables, Specialised Cables, Optical Fiber Cables, and Telecom Cables. The company has two manufacturing facilities one of which is situated in Khushkhera, Rajasthan, while the other is in Dharuhera, Haryana.