TARIL’s FY-25 Financials: Topline Up 56%, PAT 4.6x YoY

Transformers & Rectifiers (India) Ltd. (TARIL) [NSE: TARIL, BOM: 532928], a company based in Gujarat specializing in transformer manufacturing, has announced its financial results for the quarter and financial year ended 31st March 2025.

TARIL’s Standalone Financial Figures: Q4 FY-25 & FY-25

Transformers and Rectifiers clocked a standalone revenue of Rs. 647.31 crore from operations during Q4 of FY-25. The company’s Profit After Tax (PAT) during this period stood at Rs. 76.59 crore.

For the entire financial year, TARIL reported a standalone topline of Rs. 1,950.14 crore and a PAT of Rs. 187.57 crore.

Transformers & Rectifiers’ (India) Earning Per Share (EPS) for Q4 of FY-25 stood at Rs. 2.58, and at Rs. 6.31 for entire FY-25.

TARIL’s Consolidated Financial Figures: Q4 FY-25 & FY-25

YoY Comparison of TARIL’s Financial Numbers: Q4 FY-25 vs. Q4 FY-24 & FY-25 vs. FY-24

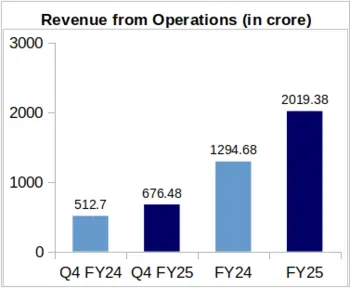

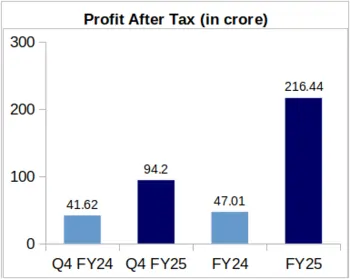

TARIL reported a consolidated revenue of Rs. 676.48 crore during Q4 of FY-25, exhibiting an increase of 31.94% YoY from Rs. 512.70 crore in Q4 of FY-24. TARIL reported a Profit After Tax (PAT) of Rs. 94.20 crore for Q4 of FY-25, which is 2.26 times the company’s profit of Rs. 41.62 crore during Q4 of FY-24.

Considering the full financial year, in FY-25, TARIL’s revenue exhibited a massive increase of 55.98% to Rs. 2,019.38 crore from its Rs. 1,294.68 crore revenue during FY-24. The company recorded a PAT of Rs. 216.44 crore during FY-25 as compared to a PAT of Rs. 47.01 crore during FY-24. Therefore, the company’s FY-25 PAT is 4.60 times of its FY-24 PAT.

TARIL’s Earning Per Share (EPS) was Rs. 3.17 for Q4 of FY-25 and Rs. 7.21 for entire FY-25.

QoQ Comparison of TARIL’s Financials: Q3 of FY-25 vs. Q4 of FY-25

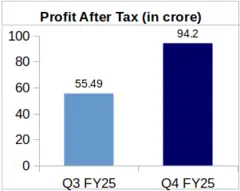

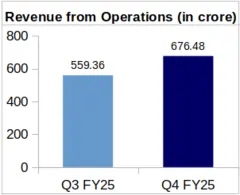

On a Quarter-over-Quarter (QoQ) basis, TARIL’s Q4 FY-25 revenue from operations was up by 20.94% from Rs. 559.36 crore logged during Q3 of FY-25. The company’s Q4 FY-25 profit increased by 69.76% QoQ from Rs. 55.49 crore clocked during Q3 of FY-25.

“Highest-Ever Unexecuted Order Book as of March 2025” – TARIL’s MD

For the entire FY-25, TARIL reported an order inflow of Rs. 4,504 crore. For Q4 of FY-25, the company received new orders worth Rs. 2,144 crore. Further, TARIL’s order book stood at Rs. 5,132 crore as on 31st March 2025. According to Mr. Satyen Mamtora, Managing Director of Transformers and Rectifiers (India), the company “…achieved record order inflow, leading to highest-ever unexecuted order book as of March 2025”. He added that other than this, TARIL has over Rs. 22,000 crore worth of inquiries under negotiation.

TARIL’s Stock 5% Up Post Announcement of FY-25 Financials

TARIL’s share price jumped 5% one day after the company announced its FY-25 financial results. The company published its results on 8th April 2025. TARIL’s share price stood at Rs. 494 apiece on the day of announcement of its financials against Rs. 518.70 apiece on the next trading day.

About Transformers & Rectifiers (India) Ltd.: TARIL was incorporated in 1994 and has its headquarters in Ahmedabad, India. It manufactures power transformers, distribution transformers, furnaces, and rectifier transformers. The company has three manufacturing facilities in Western India, namely, Moraiya, Changodar, and Odhav in Ahmedabad.