Havells India Q1 FY-25 Financials: Revenue up 20%, PAT Grows 42%

Havells India Limited [NSE: HAVELLS, BOM: 517354], a major Indian cable & Fast Manufacturing Electrical Goods (FMEG) manufacturer, has announced its financial results for Q1 of FY-25.

Havells India’s Q1 FY-25 Standalone Financial Results

During Q1 of FY-25, Havells India clocked a standalone revenue of Rs. 5,798.11 crore from its operations and a corresponding Profit after Tax (PAT) of Rs. 411.18 crore.

Earnings Per Equity Share (EPS) of the company stood at Rs. 6.56 for Q1 of FY-25.

Consolidated Financial Figures of Havells India for Q1 FY-25

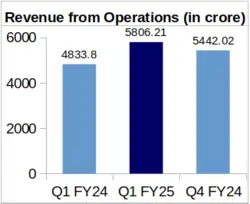

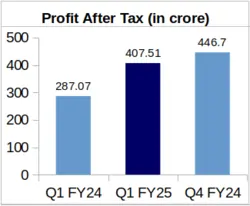

YoY Comparison of Havells India’s Financials: Q1 FY-25 vs. Q1 FY-24

On a Year-over-Year (YoY) basis, Havells India’s revenue from operations jumped by 20.12% to Rs. 5,806.21 crore during Q1 of FY-25 from Rs. 4,833.80 crore earned during Q1 of FY-24.

The company’s PAT for the quarter ended 30th June 2024 stood at Rs. 407.51 crore, which showed a YoY exceptional increase of 41.95% YoY from Havells’ Rs. 287.07 crore PAT reported for Q1 of FY-24.

EPS of the company during Q1 of FY-25 was Rs. 6.49 against Rs. 4.58 for Q1 of FY-24.

QoQ Comparison of Havells India’s Financial Numbers: Q1 FY-25 vs. Q4 FY-24

Havells India’s revenue for Q1 of FY-25 revenue was 6.69% higher than the company’s Rs. 5,442.02 crore revenue clocked during Q4 of FY-24.

The company’s Q1 FY-25 PAT showed a decrease of 8.77% from Rs. 446.70 crore which was earned during last quarter of FY-24.

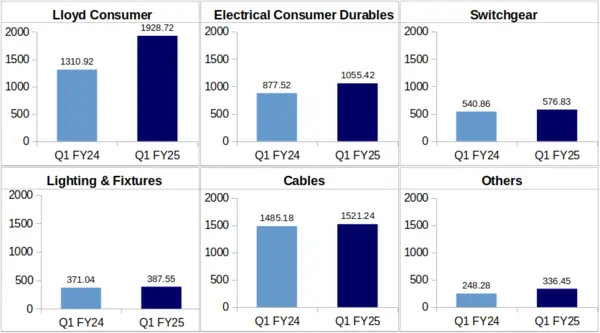

Havells India’s Segment-Wise Revenue Comparison

Rs. in Cr.

Lloyd Consumer: Havells India’s Q1 revenue from its Lloyd Consumer segment portrayed a significant YoY increase of 47.13% to Rs. 1,928.72 crore in FY-25 from Rs. 1,310.92 crore in FY-24.

Havells India mentioned in its investor presentation for Q1 of FY-25 financials that the company witnessed a strong start to FY-25 for its AC products. There was a high demand for AC products in the market which was captured to a good extend by Lloyd owing to its ‘large manufacturing capacity’. Havells also mentioned that sales of Lloyd non-AC products grew in tandem with those of its AC products during Q1 of FY-25.

Electrical Consumer Durables (ECD): This segment brought in Rs. 1,055.42 crore to Havells India’s Q1 FY-25 revenue against Rs. 877.52 crore during Q1 of FY-24. Therefore, the company’s Q1 Electrical Consumer Durables segment has grown YoY by 20.27%. The company’s ECD segment showed a healthy growth attributed to favourable summer season and launch of premium products in this segment.

Switchgear: Revenue from Havells India’s Switchgear segment grew by 6.65% to Rs. 576.83 crore in Q1 of FY-25 from Rs. 540.86 crore in Q1 of FY-24. The company’s Q1 FY-25 revenue from its Switchgear business was impacted due to ‘cost increase’ in this segment.

Lighting & Fixtures: The company’s revenue from its Lighting & Fixtures segment stood at Rs. 387.55 crore in Q1 of FY-25 as compared to Rs. 371.04 crore in Q1 of FY-24. Therefore, there has been an increase of 4.45% in segmental revenue. Even though there was strong volume growth in Lighting & Fixtures segment during Q1 of FY-25, it has suffered a setback on account of price deflation.

Cables: Revenue from this segment rose by 2.43% to Rs. 1,521.24 crore during Q1 of FY-25 from Rs. 1,485.18 crore clocked during Q1 of FY-24.

The company mentioned that despite capacity constraints, power cables showed healthy growth during Q1 of FY-25.

Others: This segment takes into account some of Havells’ other products such as water pumps, motors, and purifiers.

On a YoY basis, the company’s quarterly revenue from this segment increased by 35.51% to Rs. 336.45 crore in Q1 of FY-25, from Rs. 248.28 crore clocked during Q1 of FY-24.

Havells India’s Stock Suffers by 5% After Announcing Q1 FY-25 Financials

Havells India’s stock price tumbled by 5.25% one day after the company announced its financial results for Q1 of FY-25. On the day of announcement of results, the company’s share price was Rs. 1,862.65 apiece as compared to Rs. 1,768.50 apiece on the next trading day. Further, the company’s volume of share trades peaked at 34,42,000 trades on the day Havells India announced its financials against 19,00,000 trades on the next trading day.

About Havells India Limited: Havells India Limited is a Noida-based company, which is one of the biggest players in the Indian FMEG market. Its product range includes Industrial and domestic Circuit Protection Switchgear, Modular Switches, Cables and wires, Fans, Power Capacitors, and Luminaires for Domestic, Commercial, and industrial applications, Water Heaters, Motors, and Domestic Appliances.