Finolex Cables’ Preform Plant to be Live by Q4 FY-25, Q2 PAT Down 23.5% YoY

Finolex Cables Limited [NSE: FINCABLES, BOM: 500144], an Indian manufacturer of cables, copper rods, switchgear, and Fast-Moving Electrical Goods (FMEG), has announced its financials for Q2 of FY-25.

Finolex Cables’ Optical Fibre Plant Progress On Track

In its earnings call for Q2 FY-25, Mr. Mahesh Viswanathan, Deputy Chief Executive Officer and Chief Financial Officer at Finolex Cables, updated on the status of the preform plant which was announced by the company in June 2023. In its first phase, this plant is expected to produce approximately 100 metric tons of glass, which will translate to about 4 million Km of fiber. Mr. Viswanathan said, “…the equipment [for the new preform plant] is here. Commissioning is expected to start in the next 2 weeks or so. We are expecting the engineers from the manufacturer any time now. And we expect that Phase 1 commissioning would be over by quarter 4 [Q4 FY-25], and initial production would start from there”.

He also mentioned that Finolex Cables will be expanding fiber manufacturing capacity at this plant from 4 million Km per annum to 8 million Km per annum in two subsequent phases. In the first phase of the expansion, fibre production will increase to 6 million Km per annum, and in the second phase, it will further rise to 8 million Km per annum. He added “For stage 1, the orders have been placed, and equipment is expected sometime in the second quarter next year”.

Finolex Cables’ Standalone Financial Results for Q2 of FY-25

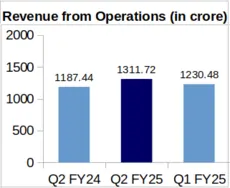

Finolex Cables reported a standalone revenue of Rs. 1,311.72 crore for Q2 of FY-25 and a Profit After Tax (PAT) of Rs. 146.09 crore for the same period.

Finolex Cables’ Q2 FY-25 Consolidated Financial Numbers

YoY Comparison of Finolex Cables’ Financials: Q2 FY-25 vs. Q2 FY-24

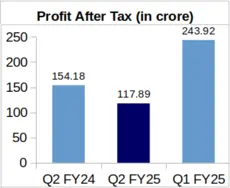

On an Year-over-Year (YoY) basis, the company’s top line jumped by 10.47% to Rs. 1,311.72 crore during Q2 FY-25 from its Rs. 1,187.44 crore revenue for Q2 of FY-24. On the other hand, Finolex Cables’ Q2 PAT plummeted by 23.54% to Rs. 117.89 crore in FY-25 from Rs. 154.18 crore in FY-24.

In accordance with the company’s YoY profit trend, the company’s Earnings Per Share (EPS) fell to Rs. 7.71 during Q2 of FY-25 from Rs. 10.08 during Q2 of FY-24.

QoQ Results Analysis for Finolex Cables: Q2 FY-25 vs. Q1 FY-25

Quarter-over-Quarter (QoQ), Finolex Cables’ revenue from operations grew by 6.60% from Rs. 1,230.48 crore, which was logged during Q1 of FY-25. However, the company’s PAT tumbled by 51.67% from Rs. 243.92 crore, which was earned during Q1 of FY-25.

YoY Comparison of Finolex Cables’ Q2 Segmental Revenue: Q2 FY-25 vs. Q2 FY-24

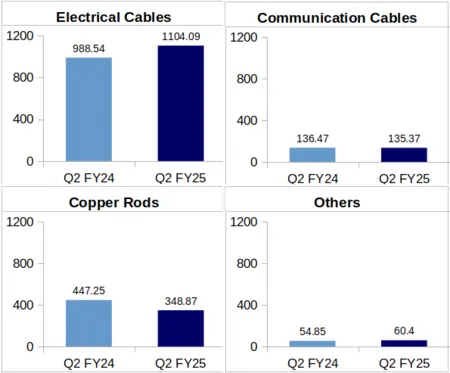

Electrical Cables: The company’s revenue from this segment jumped to Rs. 1,104.09 crore during Q2 of FY-25 against Rs. 988.54 crore in Q2 of FY-24. This showed a YoY growth of 11.69% in the company’s quarterly Electrical Cables revenue.

The company mentioned that the sharp decline in Copper prices from mid-May [avg. USD 10,130 per tonne] to August 2024 [avg. USD 8,963 per tonne] prompted the company to liquidate it’s stock. Mr. Viswanathan, elaborated, “We had to take a few price cuts during the quarter because while we were trying to do the liquidation, Copper also was consistently falling”. Consequently, selling prices were reduced, which impacted the company’s margins. However, Mr. Viswanathan expressed hope with regard to Finolex Cables’ margins from Copper-based products. He added that the company expects the margins to be more stable during the following period.

As for the volume of sales in this segment, Finolex Cables’ presentation added that its network expansion propelled sales of flexible and power cables. However demand for wires from the agriculture sector was subdued in Q2 due to favorable monsoon conditions and sufficient water availability.

Communication Cables: The Communication Cables segment of the company contributed Rs. 135.37 crore to the company’s total revenue during Q2 of FY-25 against Rs. 136.47 crore in Q2 of FY-24. This shows a minor decrease of 0.81% in the company’s Communication Cables segment revenue on YoY basis.

Fall in Copper prices which started in mid-May also impacted Finolex Cables’ margins in the metal-based Communication Cables segment during Q2 FY-25. Contrastingly, Finolex Cables’ Optical Fibre Cable (OFC) sales were strong during Q2 FY-25 owing to demand from existing customers. This led to healthy volume growth in the company’s OFC sales during the quarter.

Copper Rods: Finolex Cables clocked a revenue of Rs. 348.87 crore from this segment in Q2 FY-25 against Rs. 447.25 crore earned during Q2 of FY-24, representing a decrease of 22% on YoY basis.

Others: This segment comprises Finolex Cables’ switchgear, conduit pipes and Fast Moving Electrical Goods (FMEG). Revenue from ‘Others’ segment of the company grew by 10.12% YoY to Rs. 60.40 crore in first quarter of FY-25 from Rs. 54.85 crore during Q1 of FY-24.

Finolex Cables added that while the volume of sales in their lighting sub-segment was strong during Q2 of FY-25, potential profit gains suffered due to ongoing price deflation. The company attributed this growth in sales to expansion of its distributor network. The electric fans sub-segment performed well during the quarter, owing to a favourable summer season. Conduit pipes also recorded an increase in sales volume during Q2 of FY-25.

Finolex Cables Limited: Pune-based Finolex Cables is a major Indian cable manufacturer and the flagship company of the Finolex Group. Finolex offers a wide range of Electrical and Communication cables. The company has manufacturing facilities at Pimpri and Urse in Pune, Goa, and Roorkee, Uttarakhand.