Apar Industries’ Top Line Grows 15%, Cables Revenue Up 28%

Apar Industries Limited [NSE: APARINDS, BOM: 532259], has posted its financial results for Q4 of FY-25 and the entire FY-25.

The company has reported its all-time high quarterly and annual consolidated revenue during Q4 FY-25 and FY-25, respectively.

Apar Industries’ Standalone Financials for Q4 FY-25 & FY-25

Apar’s standalone topline for Q4 of FY-25 was reported as Rs. 4,959.59 crore. During this period, the company earned a Profit After Tax (PAT) of Rs. 244.27 crore.

Considering entire FY-25, Apar logged a revenue of Rs. 17,463.53 crore, and a corresponding PAT of Rs. 793.67 crore.

The company’s Earnings Per Share (EPS) were reported as Rs. 60.81 for Q4 of FY-25 and as Rs. 197.59 for the entire FY-25.

Analysis of Apar’s Consolidated Financial Results for Q4 FY-25 & FY-25

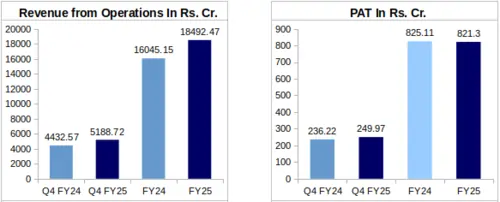

YoY Comparison of Apar’s Financial Figures: Q4 FY-25 vs. Q4 FY-24 & FY-25 vs. FY-24

Apar’s Q4 consolidated topline saw a 17.06% growth to Rs. 5,188.72 crore in FY-25 from Rs. 4,432.57 crore in FY-24. However, Apar’s Q4 PAT increased by 5.82% to Rs. 249.97 crore in FY-25 from Rs. 236.22 during FY-24.

As for the entire year, Apar’s topline exhibited 15.25% growth to Rs. 18,492.47 crore in FY-25 from Rs. 16,045.15 crore in FY-24. The company’s annual PAT remained almost flat, shrinking by a meagre 0.46% to Rs. 821.30 crore during FY-25 from Rs. 825.11 crore in FY-24.

Apar Industries reported EPS of Rs. 62.23 for Q4 of FY-25, and Rs. 204.47 for the entire 2024-25 fiscal.

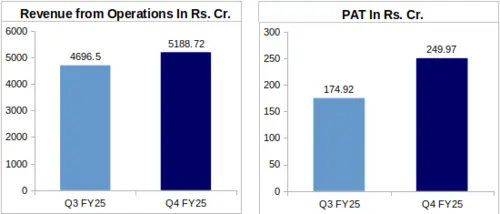

QoQ Analysis of Apar’s Financials: Q4 FY-25 vs. Q3 FY-25

Apar’s Q4 FY-25 revenue was up by 10.48% from its Q3 FY-25 revenue of Rs. 4,696.50 crore. On a Quarter-over-Quarter (QoQ) basis, the company’s PAT recorded a notable increase of 42.91% from Rs. 174.92 crore earned in Q3 of FY-25.

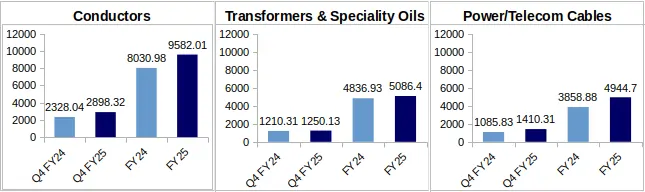

Apar’s Segment-Wise Consolidated Revenue Comparison: Q4 FY-25 vs. Q4 FY-24 & FY-25 vs. FY-24

Conductors: Apar usually earns most of its revenue on account of its conductors business vertical. In Q4 FY-25 and entire FY-25, this segment brought in about half of the gross revenue*.

In Q4 of FY-25, Apar’s conductors business segment earned Rs. 2,898.32 crore as revenue, which is 24.50% higher YoY than its Q4 FY-24 revenue of Rs. 2,328.04 crore from this business segment.

During the entire FY-25, Apar’s topline from this segment was Rs. 9,582.01 crore, showing 19.31% growth from the company’s conductor vertical revenue of Rs. 8,030.98 crore.

*Gross revenue refers to the sum of segmental revenues without the deduction of any inter-segmental revenue.

Speaking in terms of volume, quarterly sales grew by 5.9% YoY in Q4 of FY-25, and annual sales volume was up by 7.8% during FY-25. Further, in Q4 of FY-25, conductor exports contributed 24.5% of the company’s quarterly revenue from this segment, whereas annual conductor exports brought in 24.2% of Apar’s annual conductor segment revenue during FY-25.

Transformers and Speciality Oils: Apar’s Transformers and Speciality Oils segment recorded a lukewarm YoY growth during Q4 FY-25 and FY-25. The company’s Q4 revenue from this segment was up slightly by 3.29% to Rs. 1,250.13 crore in FY-25 from Rs. 1,210.31 crore in FY-24. As for the entire year, revenue from this segment recorded a 5.16% increase to Rs. 5,086.40 crore in FY-25 from Rs. 4,836.93 crore in FY-24.

Export contribution in segmental revenue remained almost unchanged, considering this business vertical. In Q4 of FY-25, exports in this segment earned 41.7% of the segmental revenue, which is almost the same as Q4 of FY-24, when exports brought in 43.4% of Apar’s transformers and speciality oils segment revenue. In the entire FY-25, 44% of the revenue in this segment was from exports, as compared to 45.8% in FY-24.

Power/Telecom Cables: This segment showed the highest YoY revenue growth, considering both Q4 FY-25 and FY-25.

Apar’s Q4 FY-25 power/telecom cable segment revenue was Rs. 1,410.31 crore, YoY 29.88% higher than its Q4 FY-24 segmental revenue of Rs. 1,085.83 crore. Considering the entire fiscal, revenue from this segment grew remarkably by 28.14% to Rs. 4,944.70 crore in FY-25 from Rs. 3,858.88 crore in FY-24.

Apar Industries’ Stock Gains Over 14% After Results Announcement

Apar Industries’ shares were trading at Rs. 6,927.50 apiece on the day of announcement of its results. On the very next trading day, Apar’s stock gained 14.63%, with its share price increasing to Rs. 7,941 apiece.

Exports’ Share in Revenue Mix Drops, Domestic Demand Remains Strong

In Q4 of FY-25, exports brought in 31.3% of the company’s quarterly revenue. This figure is lower than the share of exports in Apar’s Q4 FY-24 revenue, which was 38.9%. This trend can also be observed in case of the company’s annual revenue. In FY-25, exports accounted for 32.8% of the company’s revenue as compared to 45.2% in FY-24.

Apar mentioned in its investor presentation for FY-25 that domestic demand “…continues to demonstrate resilient performance”, increasing by 31.4% YoY (quarterly) in Q4 of FY-25 and 40.9% YoY (annual) during the full FY-25.

About Apar Industries Limited: Established in 1958, Apar Industries Ltd. has its presence in over 125 countries. Apar’s portfolio comprises manufacture and supply of conductors, transmission cables, specialty oils, polymers, and lubricants.