Aksh Optifibre FY25 Revenue Down 41% YoY, Loss of Rs. 26 Cr.

Aksh Optifibre Limited [NSE: AKSHOPTFBR, BOM: 532351], an Indian Optical Fibre Cable (OFC) manufacturer, has published its financial results for Q4 FY25 and the entire financial year ended 31st March 2025.

Aksh Optifibre’s Standalone Financial Numbers: Q4 FY25 & FY25

During Q4 of FY25, Aksh Optifibre logged a standalone revenue of Rs. 31.79 crore. The company reported a loss of Rs. 17.61 crore during Q4 of FY25.

For the entire FY25, Aksh’s standalone topline was Rs. 127.12 crore. The company’s loss stood at Rs. 20.11 crore considering the entire fiscal.

Aksh Optifibre’s Consolidated Financial Performance: Q4 FY25 & FY25

YoY Comparison of Aksh’s Financials: Q4 FY25 vs. Q4 FY24 & FY25 vs. FY24

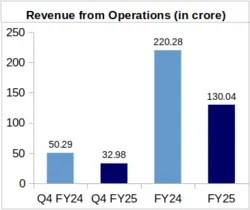

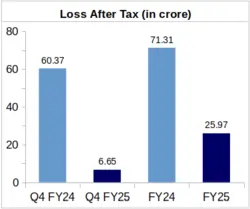

Year-over-Year (YoY) comparison of Aksh Optifibre’s financial figures shows a 34.42% decrease in the company’s Q4 topline to Rs. 32.98 crore in FY25 from Rs. 50.29 crore in FY24. The company reported a loss of Rs. 6.65 crore during Q4 of FY25, which is down by 88.98% from the company’s loss of Rs. 60.37 crore during Q4 of FY24.

During the entire financial year 2024-25, the company’s revenue from operations decreased by 40.97% to Rs. 130.04 crore from Aksh’s Rs. 220.28 crore revenue which was reported for FY24. Aksh Optifibre loss stood at Rs. 25.97 crore for FY25, which is down by 63.58% from Rs. 71.31 crore loss reported for FY24.

Aksh Optifibre’s loss per share stood at Rs. 0.41 during Q4 of FY25 against loss per share of Rs. 1.60 during entire FY25.

QoQ Results Analysis of Aksh Financial Numbers: Q3 FY-25 vs. Q4 FY-25

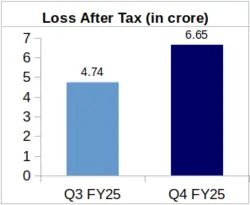

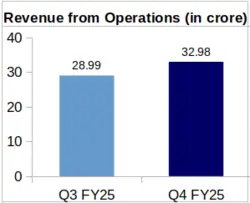

On a Quarter-over-Quarter (QoQ) basis, the company’s revenue increased by 13.76% from Rs. 28.99 crore revenue clocked during Q3 of FY-25. Aksh Optifibre’s net loss increased by 40.30% QoQ from Rs. 4.74 crore reported for Q3 of FY-25.

Aksh Optifibre’s Segment-Wise FY25 Results Comparison

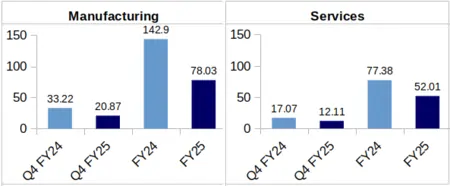

Manufacturing: During Q4 of FY25, this segment of the company brought in a revenue of Rs. 20.87 crore as compared to Rs. 33.22 crore during Q4 of FY24. This shows a YoY decrease of 37.18%.

Considering the entire financial year 2024-25, Aksh’s revenue from manufacturing business segment stood at Rs. 78.03 crore, exhibiting a decrease of 45.40% from Rs. 142.90 crore logged during FY-24.

Aksh’s product portfolio under this segment include OFCs, Aramid Reinforcement Plastic (ARP) rods, Fibre Reinforcement Plastic (FRP) rods, LEDs, and Ophthalmic lenses.

Services: This segment of the company earned a revenue of Rs. 12.11 crore during Q4 of FY25 against Rs. 17.07 crore earned during Q4 of FY24, representing a YoY decrease of 29.06%.

For the entire fiscal year 2024-25, the company’s revenue from this segment saw a decrease of 32.79% to Rs. 52.01 crore, from Rs. 77.38 crore clocked during FY24.

This segment comprises services offered by Aksh Optifibre in the areas of e-governance, Voice Over Internet Protocol (VoIP), Fibre-To-The-Home (FTTH), and Internet Protocol Television (IPTV).

About Aksh Optifibre Limited: Aksh Optifibre Ltd. was established in 1986, and in 2000, the company diversified into FRP manufacturing. Aksh has two plants at Bhiwadi for Optical Fibre Cable manufacturing and one plant at Reengus, Rajasthan for Fibre Reinforced Plastic Rods (FRP) manufacturing.