Finolex Industries Q1 FY-25 Financials: Revenue Shrinks 3%, PAT Grows 4.34 Times

Finolex Industries Limited [NSE: FINPIPE, BOM: 500940], an Indian manufacturer of PVC pipes and fittings, has announced its financial results for Q1 of FY-25.

Finolex Industries’ Standalone Financials for Q1 FY-25

During Q1 of FY-25, Finolex Industries reported a standalone revenue of Rs. 1,140.49 crore and a Profit After Tax (PAT) of Rs. 505.20 crore.

Finolex Industries’ Q1 FY-25 Consolidated Financials

YoY Comparison of Finolex Industries’ Financials: Q1 FY-25 vs. Q1 FY-24

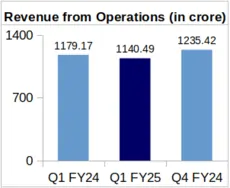

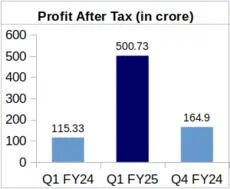

On a Year-over-Year (YoY) basis, the company’s revenue decreased by 3.28% to Rs. 1,140.49 crore during Q1 of FY-25 from Rs. 1,179.17 crore in Q1 of FY-24. Consolidated PAT of the company jumped to Rs. 500.73 crore which is 4.34 times the company’s Q1 FY-24 PAT of Rs. 115.33 crore.

Proportionally, Finolex Industries’ Earnings Per Share (EPS) increased drastically to Rs. 8.10 during Q1 of FY-25 from Rs. 1.86 during Q1 of FY-24.

QoQ Comparison of Finolex Industries’ Financial Performance: Q1 FY-25 vs. Q4 FY-24

Finolex Industries’ revenue decreased QoQ by 7.68% from Rs. 1,235.42 crore clocked for Q4 of FY-24. Further, the company’s Q1 FY-25 PAT grew to 3.04 times of its Q4 FY-24 PAT, which stood at Rs. 164.90 crore.

Segment-Wise Revenue Analysis of Finolex Industries

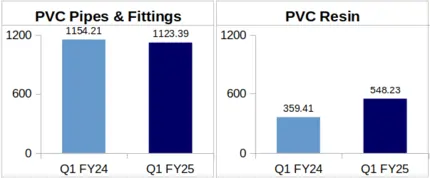

PVC Resin: The company’s revenue from this business segment jumped to Rs. 548.23 crore during Q1 of FY-25 from Rs. 359.41 crore during Q1 of FY-24. This represents a YoY increase of 52.54% in the company’s segmental revenue.

The company mentioned in its investor presentation that Q1 volume of sales pertaining to its PVC Resin business jumped by 51.11% YoY during FY-25.

PVC Pipes and Fittings: Finolex Industries earned a revenue of Rs. 1,123.39 crore from its PVC Pipes and Fittings business during Q1 of FY-25, representing a YoY decrease of 2.67% from Rs. 1,154.21 crore logged from this segment for Q1 of FY-24.

PVC Pipes and Fittings segment contributed 67.20% to the company’s gross revenue* during Q1 of FY-25.

*Gross revenue refers to the sum of segmental revenues before the deduction of inter-segmental revenue.

The company’s volume of sales from its PVC Pipes and Fittings business decreased by 2% during Q1 of FY-25 on YoY basis. During the company’s earnings call for its Q1 FY-25 financials, Mr. Ajit Venkataraman, MD of Finolex Industries, said “We had a good growth in Pipes and Plumbing & Sanitation segment, but we were faced with certain supply constraints in the first 2 months of the quarter, which resulted in the lower volumes”. He further added that the company’s expects a volume growth of about 10% to 15% for FY-25.

Finolex Industries’ Stock Jumps Over 3% After Announcing Q1 FY-25 Financials

Post announcement of Q1 FY-25 financial results, Finolex Industries’ share price jumped by 3.30% as compared to the share price on previous trading day. The company’s share price stood at Rs. 328.40 apiece on the trading day after the announcement of its Q1 FY-25 financials against Rs. 317.90 apiece on previous trading day.

Further, volume of share trades of the company peaked at 38,40,000 trades on the trading day after the announcement of company’s financials as compared to 4,16,000 trades on the trading day before the announcement of results.

Management Insights on Finolex Industries’ Q1 FY-25 Financials

Commenting on the company’s quarterly financial results, Mr. Prakash P. Chhabria, Executive Chairman, Finolex Industries Limited said “Operating performance of the Company improved due to growth in the plumbing and sanitation segment and increase in PVC pricing. Demand remained stable during the quarter with higher growth seen from the non-agri (urban) segment compared to agri segment. The company’s continuous efforts to penetrate into the non-agri segment will reflect in improved earnings performance going forward”.

About Finolex Industries Limited: Finolex Industries Ltd. is a part of the Finolex Group, which was founded in 1958 by Mr. Pralhad P. Chhabria. The company has three manufacturing facilities, which are located at Ratnagiri and Urse in Maharashtra, and at Masar in Gujarat. Finolex Industries has a network of about 900 dealers across India.